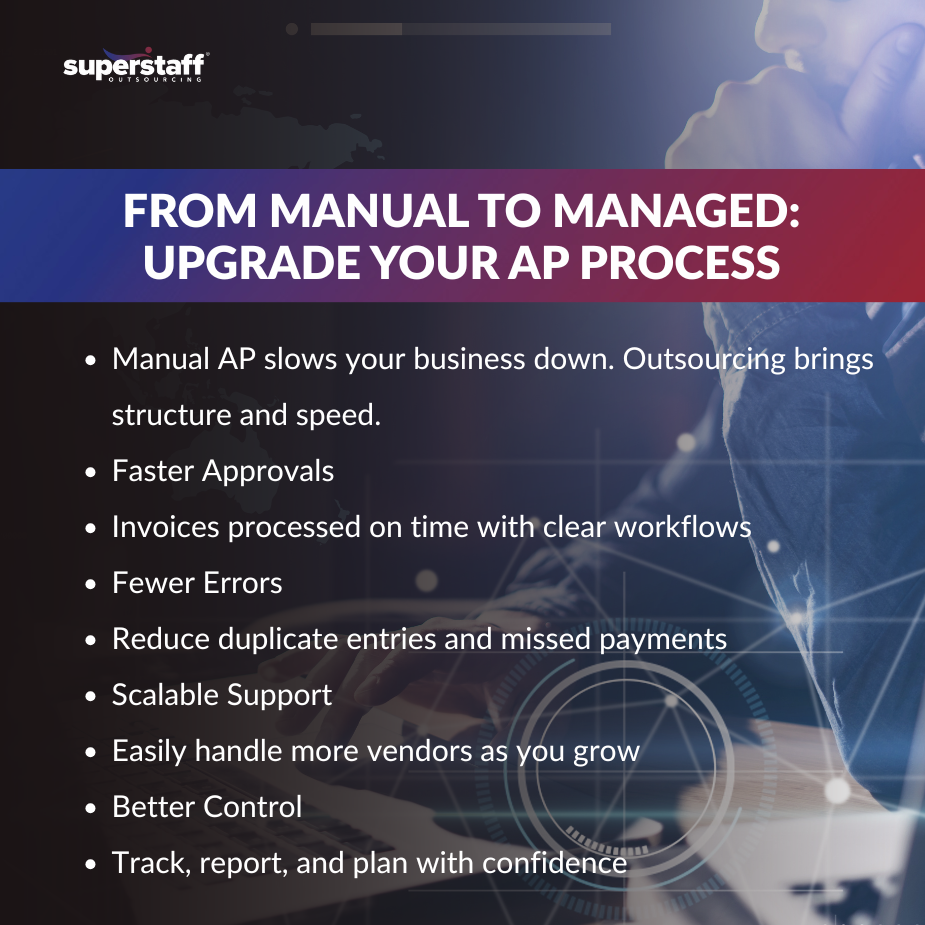

Many businesses still rely on spreadsheets, email approvals, and printed invoices to manage their payables. These outdated systems slow down payments, increase the risk of errors, and make it difficult to scale operations. As businesses grow, this manual setup becomes harder to manage, especially when dealing with multiple vendors and invoices each month.

This is where accounts payable outsourcing services come in. By shifting routine tasks to a specialized partner, businesses can replace inefficient systems with organized, error-reducing workflows. The result is better visibility, faster processing, and more time to focus on core financial goals.

What’s Wrong With Manual AP?

Manual accounts payable (AP) processes may seem manageable at first. But over time, they often create more problems than they solve.

Common challenges include:

- Invoices piling up in email inboxes

- Delays due to missing approvals

- Duplicate or incorrect payments

- No clear record of past transactions

- Hard-to-track vendor disputes

These issues not only waste time but also affect vendor relationships and cash flow. Many of these problems stem from legacy systems that haven’t kept up with how modern finance teams work.

What Are Accounts Payable Outsourcing Services?

Accounts payable outsourcing services involve handing over AP tasks, such as invoice entry, approvals, and payment coordination, to a third-party provider. These providers use structured workflows and automation tools to manage payables efficiently and accurately.

The process typically includes:

- Receiving and digitizing invoices

- Matching invoices to purchase orders

- Routing documents for approval

- Preparing payment schedules

- Maintaining records and generating reports

For growing companies, this model offers a fast way to upgrade without needing to invest in expensive software or hire extra staff. Some providers also offer automated accounts payable solutions that reduce manual work and increase processing speed.

Moving From Manual to Managed: 5 Practical Steps

Transitioning from an outdated AP system to a managed solution doesn’t have to be difficult. Here’s how many businesses approach the change:

1. Assess the Current AP Workflow

Look at where delays and errors are happening. Are invoices getting lost? Are approvals too slow? This step helps identify gaps that outsourcing can fill.

2. Choose a Trusted Outsourcing Provider

Find a partner that offers proven accounts payable outsourcing services. Look for experience, secure systems, and the ability to integrate with your existing finance tools.

3. Set Clear Goals and Metrics

Before starting, agree on key outcomes such as processing time, accuracy, and reporting standards. These benchmarks will guide the rollout.

4. Migrate Data Securely

Move past records, vendor lists, and invoice templates to the provider’s system. Security is important here—use encrypted transfers and clear documentation.

5. Launch, Review, and Adjust

Once live, monitor how the new system is performing. Make small changes as needed to fine-tune the workflow.

What Happens When You Outsource?

Once your AP tasks are outsourced, many routine problems disappear. Invoices are handled on time, errors drop, and your team spends less time on paperwork.

Let’s look at the typical changes:

- Faster processing time due to automation

- Standardized approval flows

- Clear digital records for audit and reporting

- More control over payment scheduling

- Less pressure on internal staff

These outcomes are also part of the benefits of outsourcing accounts payable for small businesses, which often lack the time or staff to manage payables manually.

Why Automation Matters in AP

When businesses use automated accounts payable solutions, they remove many of the steps that usually cause problems. Instead of emailing invoices and chasing approvals, everything flows through one connected system.

Features of automation include:

- Optical character recognition (OCR) to scan paper invoices

- Auto-matching of invoices with purchase orders

- Rule-based routing for approvals

- Alerts for missing or overdue tasks

- Real-time dashboards and reporting tools

This setup improves accuracy and gives your finance team more visibility. It also helps explain how outsourcing AP reduces errors and manual entry, which is one of the main reasons businesses make the switch.

What to Look for in a Partner

Not all outsourcing providers are the same. The best ones do more than just handle tasks, they improve your overall process. When reviewing options for accounts payable outsourcing services, check for:

- Industry experience and client references

- Strong data security and compliance standards

- Flexible service packages for scaling needs

- Integration with your current ERP or accounting tools

- Clear communication and reporting structure

You’ll want a partner who can grow with your business and provide both structure and flexibility.

The Case for Outsourcing Accounts Payable and Receivable Together

While many businesses start with accounts payable, some also consider outsourcing accounts payable and receivable at the same time. This creates a full-service finance workflow, where incoming and outgoing transactions are both managed efficiently.

Doing so can:

- Improve cash flow tracking

- Create one source of truth for finance data

- Reduce reconciliation work at month-end

- Improve forecasting and reporting

It’s especially helpful for small and mid-sized businesses looking to organize finance without building a large in-house team.

SuperStaff’s Approach to Managed AP

SuperStaff offers a practical way to shift from outdated processes to modern AP workflows. With trained specialists and secure systems, SuperStaff delivers accounts payable outsourcing services that are scalable, accurate, and easy to implement.

Services include:

- Invoice digitization and matching

- Approval management and escalation

- Vendor communication and records

- Payment scheduling and status tracking

- Customized reports and insights

Whether you’re managing a handful of vendors or processing hundreds of invoices each week, SuperStaff’s team can help you gain control of your AP function.

Smarter Payables Start With Expert AP Support

Manual AP systems may seem manageable at first, but they often cause delays, errors, and stress as your business grows. Moving to managed solutions with accounts payable outsourcing services is a smart step toward speed, accuracy, and better vendor relationships.

From automation to secure processing, outsourcing helps you modernize without taking on more overhead. It supports small businesses, growing teams, and large enterprises alike.

Let SuperStaff help you take control of your accounts payable, so you can focus on what matters next.