With markets more volatile and fast-moving than ever, financial decision-making has become more complex than ever. From navigating inflationary pressures to planning for international expansion, companies must make high-stakes decisions with speed, precision, and confidence. But maintaining an in-house finance team capable of delivering deep insights across all fronts—cash flow forecasting, budgeting, investment planning, and fundraising support—isn’t always realistic, especially for startups and midmarket firms.

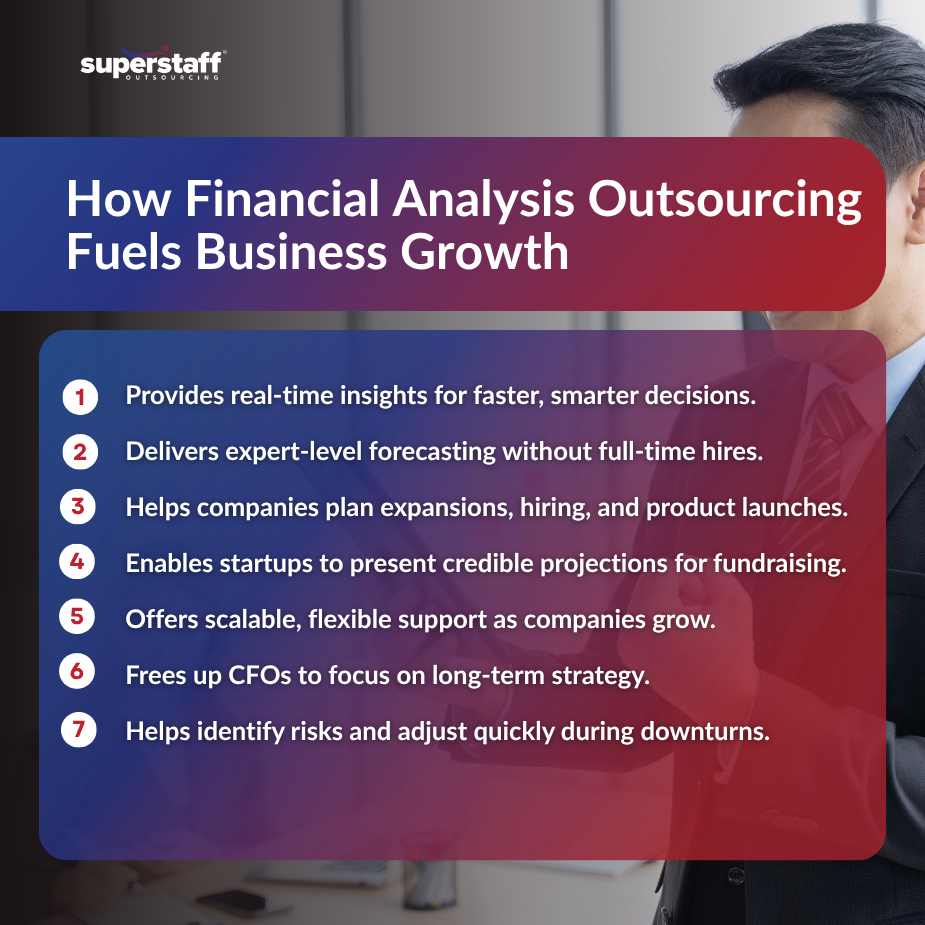

That’s where financial analysis outsourcing steps in. No longer viewed as just a cost-saving tactic, outsourcing this function has evolved into a strategic growth lever. By tapping into experienced financial analysts who specialize in modeling, forecasting, and investor reporting, companies gain access to the tools and expertise they need to move from reactive bookkeeping to forward-looking strategy. From building detailed financial forecasts to preparing data-backed pitch decks for capital raises, outsourced financial teams are helping businesses scale smarter and grow faster.

Financial Analysis Has Become Central to Business Strategy

The finance function has undergone a dramatic transformation in recent years. Once confined to ledger books and monthly reports, finance leaders now sit at the core of every strategic decision. Whether it’s determining product pricing, evaluating new market opportunities, or managing liquidity during a downturn, accurate financial insights are the foundation of success.

Today’s businesses operate in a hypercompetitive, data-driven landscape where agility is everything. Gone are the days when quarterly reports were enough. Companies must now respond to changes in real time—adjusting forecasts, reallocating budgets, and managing resources on the fly. This demand for speed, clarity, and precision is why financial analysis has moved from the back office to the boardroom.

Key reasons financial analysis is now mission-critical:

- Data is the new currency. Executives expect financial models that incorporate multiple scenarios and what-if projections.

- Agility is a competitive advantage. Businesses that adapt their financial strategy quickly outperform those stuck in static planning cycles.

To keep up with this shift, many companies are rethinking how they access financial expertise—and outsourcing is emerging as a smart and scalable solution.

What Financial Analysis Outsourcing Covers (and Why It Matters)

Financial analysis outsourcing gives companies access to a full suite of expert services without the burden of building a large internal finance team. These services go far beyond basic accounting—they support critical business functions that impact growth, profitability, and investor confidence.

Here’s what outsourced financial planning and analysis typically includes:

- Financial forecasting and scenario modeling

- Budget creation and monitoring

- Variance and trend analysis

- KPI development and tracking

- Dashboards for executive decision-making

These services are particularly beneficial for startups and midmarket companies that need high-level financial support but lack the headcount or budget to hire an entire FP&A team.

Why it matters:

- Access to expert-level modeling without full-time headcount: Outsourced teams bring deep industry expertise and best-in-class tools to your table.

- Cost-effective financial clarity: Instead of investing heavily in recruitment, software, and training, companies can plug into an experienced team that delivers immediate value.

Among these services, financial forecasting plays an especially critical role in driving sustainable growth.

Better Forecasting, Smarter Decisions

Forecasting isn’t just about predicting revenue—it’s about preparing for the unknown. Whether it’s a supply chain disruption, a new product launch, or a global economic shift, companies that forecast well respond faster and smarter.

If you’re wondering how outsourced financial analysis services accelerate business growth, here’s your answer: These offshore professionals produce scenario-based forecasts that go beyond linear projections. These forecasts help companies understand the financial impact of key decisions before they’re made.

What that looks like in practice:

- Proactive risk management: Outsourced analysts can simulate economic downturns, price changes, or shifts in demand to help you prepare before problems hit.

- Strategic growth planning: Accurate forecasts support decisions about new hires, capital expenditures, product development, and geographic expansion.

And when it’s time to fund those plans, outsourced finance teams become even more vital.

Fundraising Support: Financial Storytelling That Wins Investors

Raising capital isn’t just about big ideas—it’s about numbers that make sense. Investors want proof that your business model is sound, your growth plan is realistic, and your team understands its runway.

That’s where outsourced financial experts shine. They help transform raw financial data into compelling narratives that align with investor expectations.

Here’s how outsourced financial planning and analysis supports fundraising:

- Building investor-ready financial models

- Creating clear and credible pitch decks

- Preparing for due diligence with clean, well-documented statements

- Communicating critical metrics like burn rate, ROI, and breakeven point

These insights not only improve your chances of securing funding—they build long-term credibility with stakeholders.

These fundraising-ready insights are especially impactful for startups and growth-stage companies navigating complex funding rounds with limited in-house finance talent.

Startups and Midmarket Firms: The Biggest Winners

While large corporations often have in-house FP&A departments, smaller firms must do more with less. Startups and midmarket businesses, in particular, benefit tremendously from financial analysis outsourcing.

Here’s why:

- Limited in-house resources: Startups may have a bookkeeper or generalist CFO but lack the modeling and forecasting skills needed for investor discussions.

- High need for clarity and credibility: Investors, partners, and internal stakeholders expect detailed projections—even when the team is still small.

- Flexible support: Outsourced teams can scale their involvement as your business grows, providing just the right level of service at every stage.

By outsourcing, these firms gain access to enterprise-grade insights without hiring a full internal team, allowing them to focus their resources on innovation and market expansion.

Beyond capital raising, outsourced financial analysis provides long-term ROI by enabling better decisions, faster pivots, and scalable operations.

Long-Term Value: Outsourcing as a Strategic Growth Partner

Great financial analysis isn’t just about the next quarter—it’s about building systems that support sustainable growth.

Outsourced financial planning and analysis teams don’t stop at producing forecasts and reports. They offer ongoing support in monitoring performance, adjusting projections, and preparing reports for stakeholders and boards.

Long-term benefits include:

- Freeing up CFOs for strategy: Instead of being buried in spreadsheets, CFOs can focus on market trends, capital strategy, and partnerships.

- Faster course correction: When performance veers off-track, outsourced teams provide the insights needed to realign quickly.

- Continuous improvement: Dashboards and analytics drive data-informed decision-making across departments.

Choosing the right outsourcing partner can make or break this strategic advantage—especially as finance becomes increasingly intertwined with digital transformation and business innovation.

What to Look for in a Financial Analysis Outsourcing Provider

Not all outsourcing providers are created equal. The best partners go beyond crunching numbers—they understand your industry, your growth goals, and your stakeholders’ expectations.

Here are the top criteria to evaluate:

- Industry experience: Look for providers with experience supporting businesses at your size, stage, or sector.

- Scalability: Your outsourcing partner should grow with you—from Series A to IPO, or from regional to global expansion.

- Data security and compliance: Your financial data is sensitive. Confirm your partner’s security protocols and regulatory alignment.

- Cultural fit: Especially if your outsourced team is overseas, strong communication skills and cultural alignment are essential.

For instance, companies that tap into Philippine call center outsourcing networks often find high-quality financial services talent with strong English proficiency and Western business acumen. The country’s well-established BPO industry isn’t just for customer service anymore—it’s becoming a hub for specialized support roles, including FP&A professionals and financial modelers.

With the right provider, the finance function becomes a proactive driver of growth—not just a reporter of the past.

Financial Analysis Outsourcing Isn’t a Cost Move—It’s a Growth Strategy

Financial analysis outsourcing has shifted from being a tactical solution to a strategic necessity. Whether you’re planning your next funding round, evaluating a new market, or preparing for uncertain economic conditions, outsourced support gives you clarity and confidence.

Key takeaways:

- Strategic forecasting improves financial decision-making

- Outsourced support prepares businesses for investor scrutiny and growth

- Smaller firms gain access to enterprise-level insights without the overhead

If you’re ready to future-proof your finances, SuperStaff’s outsourced financial analysis services can help you unlock funding, scale faster, and build a stronger foundation for growth. Let’s talk.