During the Trump administration, the way the government handled student loan in collections went through major changes. As more borrowers struggled to repay their debts, the government turned to private companies to manage overdue accounts.

At the same time, some rules that protected borrowers were removed, making the collection process stricter. Private agencies were given more power to handle delinquent loans, leading to faster recoveries but also more challenges for borrowers.

In this article, we explain how student loan in collections changed during this time, how third-party services became more involved, and what these changes meant for both borrowers and lenders.

How Student Loan in Collections Policies Changed Under the Trump Administration

The Trump administration introduced several important changes to student loan in collections. The main focus was to make loan servicing more efficient and to involve private companies more closely in debt collection.

Here are the key changes during this period:

-

Streamlining Federal Loan Servicing

The government aimed to simplify the management of federal student loans by centralizing services. This meant fewer points of contact for borrowers but tighter control over loan handling.

-

Involving Private Collection Agencies

Officials believed that private companies could handle defaulted loans faster. As a result, more third-party contracts were awarded.

-

Ending Obama-Era Protections

Borrowers lost some protections against aggressive collection practices. Private agencies were allowed to be more persistent when trying to recover debts.

-

Focus on Recovering Government Debt

The priority was to collect as much overdue money as possible through outsourcing.

With these shifts, third-party services became a bigger part of handling student loan in collections.

The Growing Role of Third-Party Collection Agencies

As the number of overdue student loans increased, third-party collection agencies were given more work. They brought their expertise in managing large amounts of debt. This shift also led to more private companies seeking opportunities to become third-party debt collection agency partners for the government, expanding the overall collection network.

The Department of Education signed more contracts with private firms specializing in student debt recovery.

How Third-Party Agencies Worked

Private agencies followed a clear process to collect loans, including:

- Reaching out to borrowers through calls, letters, and emails

- Negotiating new payment plans

- Offering different repayment options

- Meeting strict performance targets to keep their contracts

Using third-party services helped the government manage more accounts. However, it also created new problems for borrowers trying to pay off their loans.

How Third-Party Involvement Affected Borrowers

The shift to private debt collectors significantly impacted borrowers, often making the experience more stressful. According to the Consumer Financial Protection Bureau (CFPB), over 70 million Americans were contacted by debt collectors last year. Of those, 27% reported feeling threatened by the collector’s behavior.

The frequency of calls and the aggressive tactics used by third-party debt collectors contributed to a heightened sense of pressure, creating additional challenges for borrowers already struggling with their loans.

Challenges for Borrowers

Working with private agencies brought these issues:

- Negotiating Repayment Plans: Borrowers had to deal directly with collectors to set up new payment terms.

- Proving Financial Hardship: It was harder for borrowers to show they could not afford payments.

- Lack of Transparency: Private agencies sometimes made it difficult for borrowers to get clear information about their loans or dispute incorrect charges.

Borrowers had to be more careful and active when dealing with third-party agencies to protect their rights.

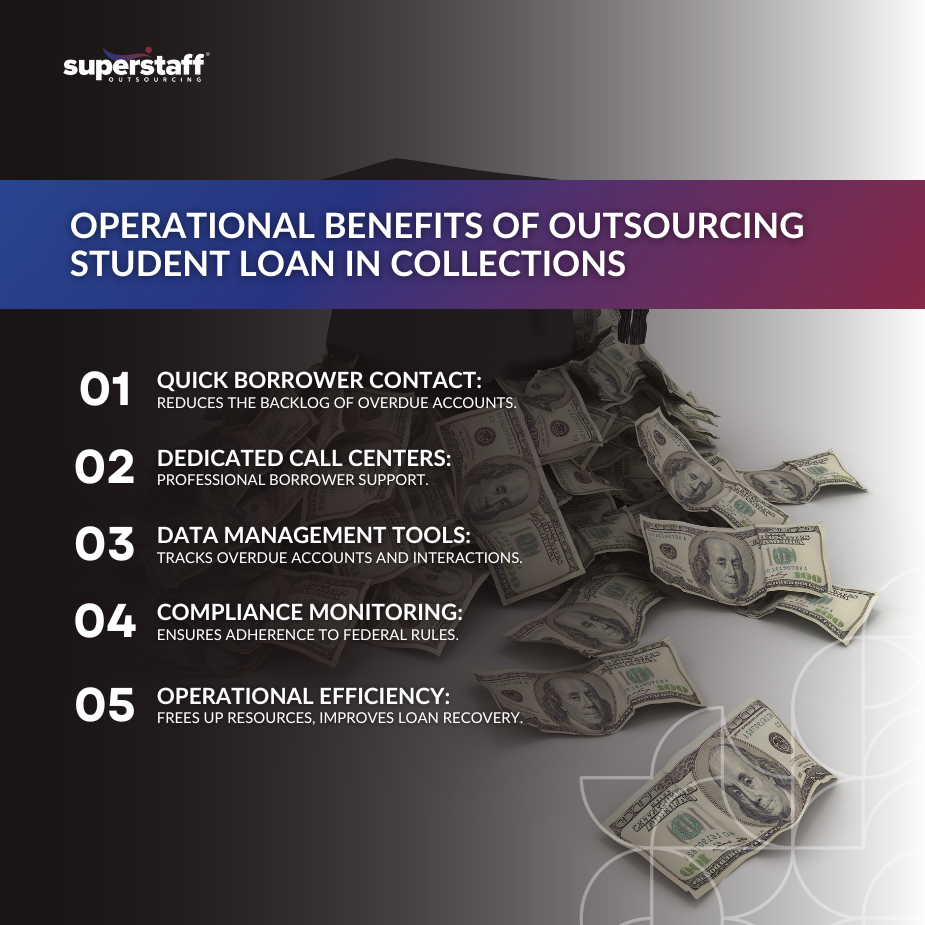

Operational Benefits of Outsourcing Student Loan Collection

Even though borrowers faced challenges, the government gained some operational advantages by outsourcing collection work.

Private collection firms had teams ready to contact borrowers quickly after a loan became delinquent. This helped reduce the backlog of overdue accounts.

Third-party agencies offered:

- Dedicated Call Centers: Staff trained to handle borrower communications professionally

- Data Management Tools: Systems to track overdue accounts and borrower interactions

- Compliance Monitoring: Detailed reporting to federal agencies to ensure rules were followed

By outsourcing, the Department of Education could manage large amounts of delinquent loans more efficiently.

Lasting Impacts of Trump-Era Student Loan in Collections Policies

Starting May 5, 2025, the U.S. Department of Education will restart automatic collections on defaulted federal student loan in collections, ending a five-year suspension that began during the COVID-19 pandemic. This shift marks a return to stricter collection practices, placing additional financial pressure on borrowers.

There is still strong discussion about:

- How much power private collectors should have

- What protections do borrowers need to avoid unfair treatment

- How to improve transparency and communication between borrowers and collectors

Many people are pushing for better balance, making sure that loans are collected fairly while protecting borrowers from aggressive tactics.

These lasting impacts show that the decisions made during the Trump era continue to shape student loan management today.

The Impact of Outsourcing on Student Loan in Collections

Student loan in collections during the Trump era highlighted the expanding role of third-party services, influencing both borrower experiences and debt recovery systems.

Key points to remember:

- Policy changes opened the door for more private-sector involvement.

- Third-party agencies helped handle a growing number of delinquent loans.

- Borrowers faced new challenges, including tougher collection practices and less transparency.

Struggling to navigate student loan in collections in today’s volatile climate?

With shifting regulations and rising borrower concerns, third-party support is more critical than ever. SuperStaff delivers trusted, compliant solutions that strengthen your servicing operations and protect customer relationships.

Our experienced teams provide flexible support, transparent communication, and professional care. Let’s streamline your loan recovery process—partner with SuperStaff today.