Fast, reliable, and empathetic service is no longer a luxury in insurance; it’s the baseline expectation. Today’s policyholders demand immediate answers when filing claims, adjusting coverage, or seeking guidance in stressful situations. A single delayed response or mishandled interaction can quickly erode trust, leading customers to switch providers in search of better service.

At the same time, insurance companies are under mounting pressure. Claims surges from natural disasters, increasingly complex regulations, and rising expectations for personalized service are stretching internal teams to their limits. Balancing compliance, efficiency, and customer satisfaction has become more challenging than ever.

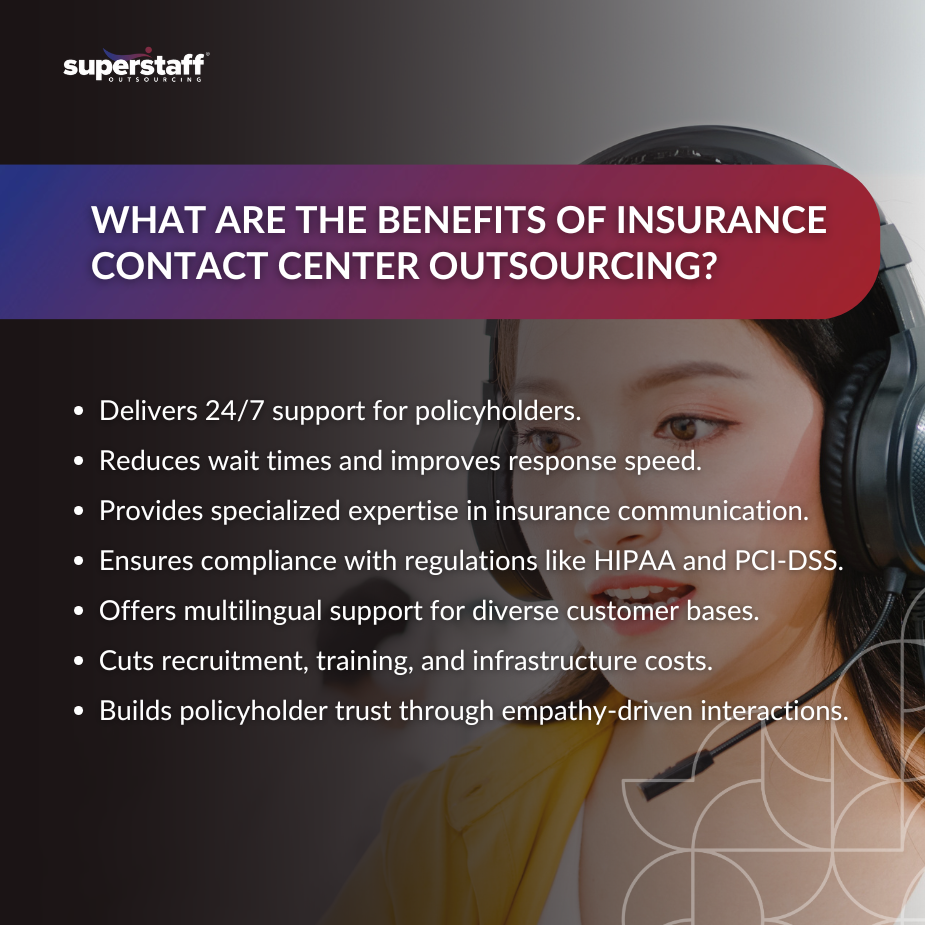

This is where insurance contact center outsourcing comes in. By leveraging specialized partners, insurers gain access to scalable support models, industry-trained agents, and technology-driven service delivery that blends efficiency with empathy.

The purpose of this blog is to explore why outsourcing has become one of the smartest strategies for insurers to improve the policyholder experience. From reducing wait times to ensuring compliance, we’ll unpack how outsourcing can transform customer service from a cost center into a competitive advantage.

Policyholder expectations are rapidly evolving in today’s insurance landscape

Insurance has traditionally been viewed as a transactional business. Policyholders signed up, paid their premiums, and only interacted with their providers during claims. But the digital age has changed this dynamic forever. Today, customers expect ongoing engagement, proactive communication, and service that feels both immediate and personal.

Policyholders increasingly demand real-time answers. Whether through phone, live chat, or social media, they want instant solutions and updates on their claims. Any delay risks frustration, which can quickly translate into a negative review or lost business.

Equally important is empathetic communication. Insurance is often associated with high-stress moments: car accidents, health emergencies, natural disasters. Policyholders don’t just need information; they need reassurance and understanding. A warm, compassionate interaction can make all the difference in customer experience.

Another expectation is seamless multichannel support. Customers may begin an inquiry via email, continue through chat, and finalize through a phone call. They expect each interaction to be consistent and connected.

- Rise in demand for 24/7 assistance: Emergencies don’t happen on a schedule. Policyholders expect round-the-clock access to their insurance providers.

- Growing importance of trust and empathy: Customers reward companies that show genuine care, not just efficiency.

- Balancing compliance with customer-centricity: Insurers must meet stringent regulations while maintaining friendly, approachable service.

These growing expectations create significant pressure on in-house contact center teams, often pushing them beyond their capacity.

In-house contact centers struggle with scalability and cost efficiency

Running an in-house contact center is increasingly unsustainable for many insurance companies. The operational burden is immense, and scaling to meet demand often comes at a steep price. This is why insurance contact center outsourcing is becoming a more widespread strategy.

Staffing shortages are one of the biggest hurdles. Recruiting, training, and retaining skilled agents takes time and money: resources that insurers could otherwise invest in product innovation or risk management. High attrition rates in customer service roles only add to the problem, creating a cycle of constant rehiring.

Training is another costly factor. Insurance agents require more than basic call-handling skills; they need specialized knowledge of products, claims processes, and regulatory frameworks. This lengthens onboarding and inflates costs.

Maintaining a large internal team also means high overhead costs, from salaries and benefits to office space, technology infrastructure, and management layers.

- Difficulty managing seasonal claim spikes: Natural disasters or market disruptions can lead to sudden surges in inquiries, overwhelming in-house teams.

- Increasing costs of maintaining large teams: Operational expenses rise as insurers try to keep service levels high.

- Risk of inconsistent delivery: Stretched teams often lead to errors, delays, and poor customer experiences.

To overcome these hurdles, many insurers turn to outsourcing as a flexible and scalable alternative.

Insurance contact center outsourcing delivers specialized expertise and compliance

When insurers outsource insurance customer service, they gain more than just additional staff—they tap into a workforce with specialized expertise and compliance training tailored for the industry.

Insurance contact center outsourcing partners train agents to navigate sensitive customer interactions with professionalism and empathy. More importantly, they ensure strict adherence to industry regulations, reducing compliance risks.

Key areas of compliance include:

- HIPAA: Protecting health-related data in insurance communication.

- PCI-DSS: Securing payment data during transactions.

- Local insurance regulations: Ensuring that operations adhere to jurisdiction-specific requirements.

Beyond compliance, outsourcing also enables access to multilingual support. In diverse markets, having agents who speak multiple languages ensures inclusivity and builds stronger relationships with policyholders.

Outsourcing teams also excel in multiple insurance functions, including:

- Sales support: Helping policyholders with quotes, renewals, and upselling opportunities.

- Claims resolution: Guiding customers through often complex claims processes.

By combining compliance expertise with multilingual and specialized services, outsourcing firms enhance both operational efficiency and customer satisfaction.

Outsourcing improves policyholder experience through faster, more personalized service

At its core, outsourcing isn’t just about cutting costs; it’s about improving the policyholder experience. By leveraging insurance contact center outsourcing for policyholder satisfaction, insurers can transform customer service into a value driver.

Faster response times are one of the most obvious benefits. Outsourced teams provide 24/7 coverage, reducing hold times and ensuring no inquiry goes unanswered.

Personalization is another major advantage. With access to advanced CRM integrations and customer analytics, outsourced agents can tailor their responses based on policyholder history, preferences, and context. This creates a smoother, more meaningful interaction.

Empathy is also enhanced. Outsourcing providers train agents specifically in insurance communication, emphasizing compassionate, supportive service that builds trust.

- Reduced wait times with 24/7 availability.

- Personalized support using CRM and data insights.

- Empathy-driven communication to strengthen relationships.

These customer-centric improvements also deliver significant business outcomes for insurers.

Insurance companies benefit from outsourcing through cost savings and increased retention

While the main driver for many insurers is improving customer experience, outsourcing also yields substantial cost efficiencies.

By working with insurance contact center outsourcing providers, insurers can significantly reduce recruitment, training, and management expenses. They no longer need to invest heavily in infrastructure, as outsourcing partners handle these responsibilities.

Retention also improves when customers feel valued and supported. Satisfied policyholders are more likely to renew, recommend their insurer, and purchase additional products.

Scalability is another key advantage. During peak demand periods—such as hurricane season, economic disruptions, or health crises—outsourced teams can quickly expand to handle increased volumes without sacrificing quality.

Here are some of the benefits of working with an insurance BPO:

- Reduced recruitment and training costs.

- Stronger customer retention through improved satisfaction.

- Scalability during peak demand, including natural disasters.

To maximize these benefits, insurers need to carefully select outsourcing partners that align with their customer-first values.

SuperStaff’s insurance outsourcing solutions empower companies to deliver exceptional policyholder experiences

SuperStaff stands out as a partner that not only understands customer service but also appreciates the unique complexities of the insurance industry. With deep experience in Philippines customer service outsourcing, SuperStaff offers global insurers access to a highly skilled, culturally adaptable workforce.

Our agents are extensively trained in sensitive insurance communication, ensuring policyholders receive both accurate information and empathetic support.

SuperStaff also has a proven track record in compliance-heavy industries, meaning insurers can rest assured that all regulatory standards will be met.

We offer customized support models tailored to each client’s needs, including:

- Voice services: Traditional call handling with empathetic, human-centered communication.

- Non-voice support: Email, chat, and digital support channels for convenience and speed.

- Omnichannel solutions: Seamless integration across all platforms for a consistent customer experience.

By partnering with SuperStaff, insurers can transform their contact centers into hubs of policyholder engagement, trust, and loyalty.

Partner With SuperStaff for Reliable Insurance Contact Center Outsourcing

Insurance contact center outsourcing is more than a cost-cutting measure—it’s a strategic solution to improve policyholder experience while ensuring scalability, compliance, and operational efficiency.

We’ve explored how outsourcing addresses rising customer expectations, alleviates in-house inefficiencies, ensures compliance, enhances personalization, and delivers measurable cost and retention benefits.

Insurers ready to strengthen customer relationships and achieve long-term success should consider partnering with SuperStaff. With our expertise in insurance communication, compliance, and scalable support models, we help insurers deliver service that not only meets but exceeds policyholder expectations.