Accounts receivable outsourcing has become more than just a cost-cutting strategy in today’s unpredictable global economy; it’s a safeguard for stability and growth. With inflation, trade disruptions, and shifting consumer behavior challenging cash flow, businesses are realizing that effective AR management is critical to survival. Outsourcing these functions ensures faster collections, reduced risk, and healthier balance sheets, making it a priority in boardrooms across industries.

Around the world, finance BPO is evolving at a rapid pace. Traditional outsourcing hubs are now sharing the stage with new, strategically positioned markets, and Colombia is quickly rising as a standout leader. Backed by a strong financial services sector, a bilingual workforce, and nearshore accessibility to the U.S., Colombia has positioned itself at the forefront of delivering specialized AR solutions.

This shift is transforming how global businesses think about receivables. Colombia’s finance BPO sector is not only providing operational efficiency but also reshaping strategies around customer experience, compliance, and long-term financial resilience.

This blog explores why Colombia is emerging as the go-to destination for accounts receivable outsourcing and what its rise means for the future of finance operations worldwide.

Colombia is rapidly emerging as a finance BPO powerhouse

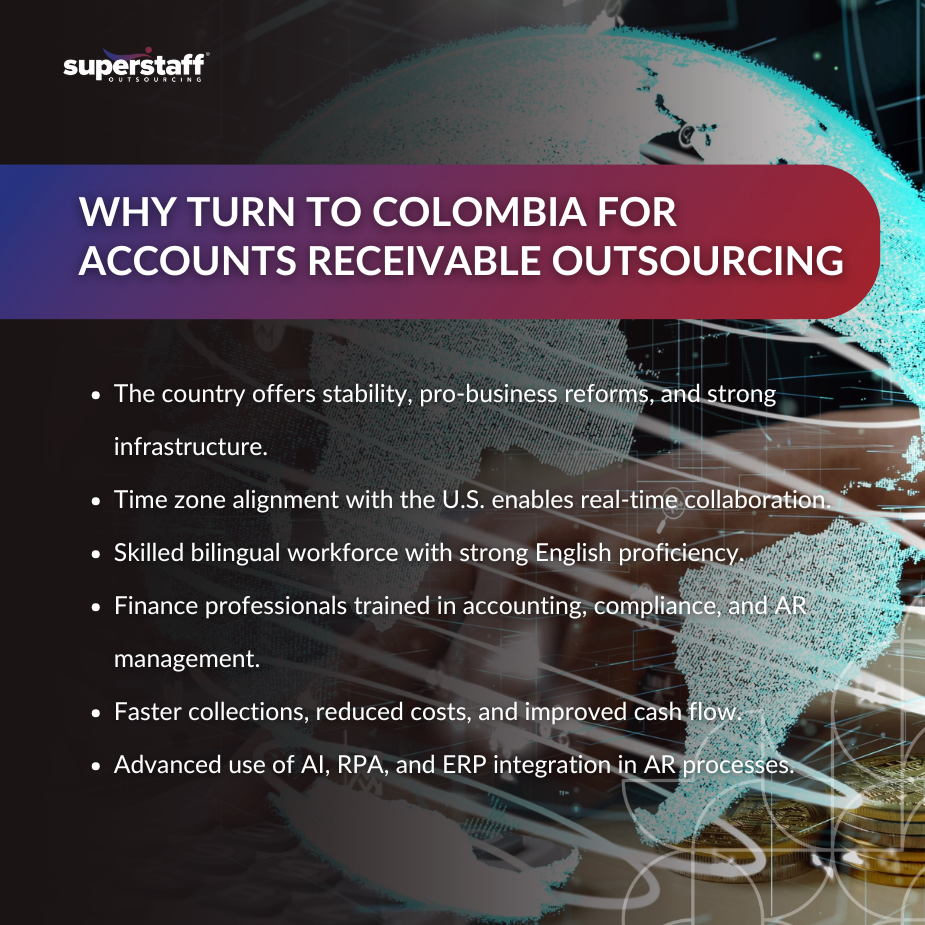

Colombia’s transformation over the past two decades has positioned it as a reliable and attractive hub for finance outsourcing. Once overshadowed by its regional peers, Colombia is now gaining recognition as a nearshore destination that blends economic stability, government support, and a thriving business climate.

The country’s economic reforms have strengthened its position in the global services market. Tax incentives for foreign investors, free trade agreements with North America and Europe, and a pro-business environment have fueled foreign direct investment into Colombia’s BPO and finance sectors. This stability is particularly valuable for companies seeking consistent, long-term accounts receivable outsourcing partnerships.

Infrastructure is another key factor driving the rise of outsourcing to a Colombia call center. Major cities like Bogotá, Medellín, and Cali have invested heavily in business parks, IT hubs, and digital infrastructure to support outsourcing operations. These developments allow finance BPO providers to offer seamless AR services across multiple industries.

Geography further enhances Colombia’s appeal. With a time zone that closely aligns with the U.S., Colombia enables real-time collaboration between American companies and Colombian finance teams. For businesses managing sensitive AR functions, such as collections, invoicing, and cash application, this alignment ensures responsiveness and agility that offshore destinations in Asia cannot always match.

With this strong foundation, Colombia is uniquely positioned to support specialized finance functions like accounts receivable outsourcing.

Accounts receivable outsourcing is vital for modern business continuity and growth

Accounts receivable management sits at the heart of financial health. Late payments, inaccurate invoicing, and inefficient collections can destabilize even the most promising businesses. In an environment of economic uncertainty, companies can no longer afford to leave AR processes vulnerable.

For SMEs and midmarket firms, AR challenges are particularly acute. Limited internal staff often juggle multiple responsibilities, leading to delays in collections and errors in reconciliation. As a result, cash flow disruptions occur, straining business continuity and growth potential.

This is where accounts receivable outsourcing proves indispensable. By transferring AR processes to specialized providers, businesses can:

- Minimize collection delays through proactive follow-ups and automated reminders.

- Reduce risks of bad debt by improving customer segmentation and prioritizing collections.

- Enhance cash flow visibility through accurate reporting and analytics.

Most importantly, outsourcing AR allows executives to focus on core business growth while experts handle the complexities of financial management.

Businesses increasingly turn to Colombia for these solutions due to its skilled workforce.

Colombia offers a highly skilled, bilingual finance workforce

At the core of Colombia’s rise in finance BPO is its people. Their massive talent pool is among the strongest benefits of Colombia accounts receivable outsourcing for US firms. The country boasts a workforce that is not only educated and adaptable but also equipped with the bilingual capabilities essential for global finance operations.

Colombia consistently ranks among the top Latin American nations in English proficiency, with professionals trained to serve North American clients seamlessly. This is critical in accounts receivable outsourcing, where clear communication with customers ensures timely payments and positive client relationships.

Education further strengthens Colombia’s position. Universities in Bogotá, Medellín, and Cali offer specialized programs in accounting, finance, and compliance, producing a steady pipeline of skilled professionals ready to enter the BPO industry. Many Colombian workers are also certified in international financial reporting standards (IFRS), making them valuable assets for global businesses.

Another advantage lies in attrition rates. Compared to other outsourcing hubs, Colombia experiences lower employee turnover, ensuring greater stability and consistency in AR operations. This stability translates to reduced training costs and stronger long-term relationships between providers and clients.

Beyond talent, Colombia provides key operational advantages that make outsourcing AR there highly efficient.

Nearshore advantages make Colombia ideal for accounts receivable outsourcing

For U.S. businesses, nearshoring to Colombia offers a unique blend of accessibility, cultural affinity, and cost efficiency. Unlike offshore destinations that operate on opposite time zones, Colombian teams can collaborate in real time with U.S. finance departments, ensuring faster decision-making and issue resolution.

Cost efficiency is another major advantage. While operating closer to the U.S. than Asian hubs, Colombia still offers significant labor cost savings compared to domestic operations. For companies managing large AR portfolios, these savings can translate into substantial improvements in profit margins.

Cultural compatibility further enhances Colombia’s position in providing finance and accounting BPO services. Colombian professionals are well-versed in U.S. business practices, making them particularly effective in customer-facing AR roles. Their strong service orientation helps build trust with clients and customers alike, which is vital in collections and receivables management.

These advantages allow Colombia to offer accounts receivable outsourcing that is both cost-effective and customer-centric.

Technology adoption strengthens Colombia’s finance BPO offerings

While talent and geography play critical roles, technology has become the real differentiator in finance BPO. Colombian providers have embraced digital transformation, integrating advanced tools to streamline AR processes.

Automation through AI and robotic process automation (RPA) is reshaping accounts receivable outsourcing in Colombia. Tasks such as invoice processing, payment reminders, and dispute resolution are now faster and more accurate, reducing human error and improving efficiency.

Data security is another cornerstone. Colombian BPO firms comply with international standards such as ISO and GDPR, ensuring that sensitive financial information is protected. This commitment to compliance makes Colombia a trusted partner for businesses in highly regulated industries like healthcare and finance.

Integration with global ERP systems further enhances service quality. By connecting seamlessly with platforms like SAP, Oracle, and NetSuite, Colombian AR teams can deliver real-time reporting and analytics that empower businesses with actionable financial insights.

Technology combined with human expertise positions Colombia as a forward-looking AR outsourcing hub.

The future of accounts receivable outsourcing in Colombia looks promising

Looking ahead, Colombia’s role in global finance BPO will only expand. Analysts predict that the demand for accounts receivable outsourcing will rise significantly among U.S. midmarket and SME companies seeking cost-effective yet high-quality solutions.

The Colombian government continues to support nearshoring growth by investing in workforce training and promoting policies that encourage foreign partnerships. Cities like Medellín and Bogotá are expected to see rapid expansion in bilingual finance roles, further strengthening the country’s capacity to serve global clients.

As digital tools become more sophisticated, Colombia’s AR outsourcing sector will also evolve toward predictive analytics, proactive cash flow management, and personalized customer engagement strategies. These innovations will not only streamline receivables management but also help businesses gain a competitive edge.

As AR outsourcing grows, businesses should consider strategic partnerships in Colombia.

Ensure Financial Health Through Accounts Receivable Outsourcing in Colombia

Colombia is establishing itself as a leading destination for finance BPO, especially in accounts receivable outsourcing. With its stable business climate, highly skilled bilingual workforce, nearshore advantages, and strong technology adoption, the country offers a compelling alternative for companies seeking reliable and scalable AR solutions.

From healthcare to logistics, businesses that have partnered with Colombian providers have already seen improvements in collections, cash flow, and customer relationships. The future promises even greater opportunities as Colombia continues to expand its finance BPO capabilities.

SuperStaff partners with businesses seeking scalable, reliable, and future-ready finance outsourcing in Colombia. Now is the time to strengthen your cash flow strategies with Colombian AR solutions.