Hospitals are waiting. Patients are frustrated. And health insurers? They’re buckling under the weight of claims they can’t process fast enough. Across the U.S., insurance backlogs are mounting, forcing patients to wait weeks or even months for reimbursements and coverage decisions. For healthcare providers, delayed payments jeopardize operations. For insurers, rising complaints and compliance risks are becoming the norm. That’s why more businesses are turning to insurance claims business process outsourcing to stay responsive, reduce costs, and ensure compliance.

The truth is, the U.S. health insurance sector is approaching a breaking point. Burdened by labor shortages, outdated systems, and an avalanche of post-pandemic demand, internal claims departments are struggling to keep up. Add in ever-evolving compliance requirements, and the need for insurance claims business process outsourcing becomes even more critical.

In this high-stakes environment, insurance claims business process outsourcing is no longer just a cost-saving measure—it’s a strategic necessity. By delegating time-consuming claims processing to specialized offshore teams through insurance claims business process outsourcing, insurers and healthcare providers can regain control, reduce errors, and deliver faster service.

This blog explores how insurance claims business process outsourcing offers a practical path forward—helping restore efficiency, ensure accuracy, and ultimately protect the integrity of patient care.

The U.S. Health Insurance System Is Drowning in Administrative Overload

Across the healthcare landscape, insurers are overwhelmed by rising workloads and shrinking internal capacity. Claims processing times are increasing as overworked teams attempt to keep up with mounting volumes. Additionally, U.S. businesses are navigating sharp 6% increases in health insurance costs, adding financial pressure to the mix.

Outdated legacy systems and understaffed departments can’t handle today’s demands, much less tomorrow’s. According to industry reports, administrative costs in U.S. healthcare remain among the highest globally, and the bottlenecks are only worsening.

- Claims errors are causing delays and denials. Simple data entry mistakes or mismatched codes can hold up reimbursements for weeks.

- Regulatory compliance demands add pressure. HIPAA, CMS, and state-level mandates require meticulous documentation and up-to-date processes.

- Backlogged systems are hurting customer satisfaction. When patients don’t get answers or reimbursements promptly, trust breaks down.

This growing chaos is pushing insurers and providers to reconsider their internal workflows.

How Insurance Claims Business Process Outsourcing Supports Faster Claims Resolution

When implemented effectively, insurance claims business process outsourcing allows organizations to resolve claims faster by removing bottlenecks caused by manual processing, staffing gaps, or outdated systems.

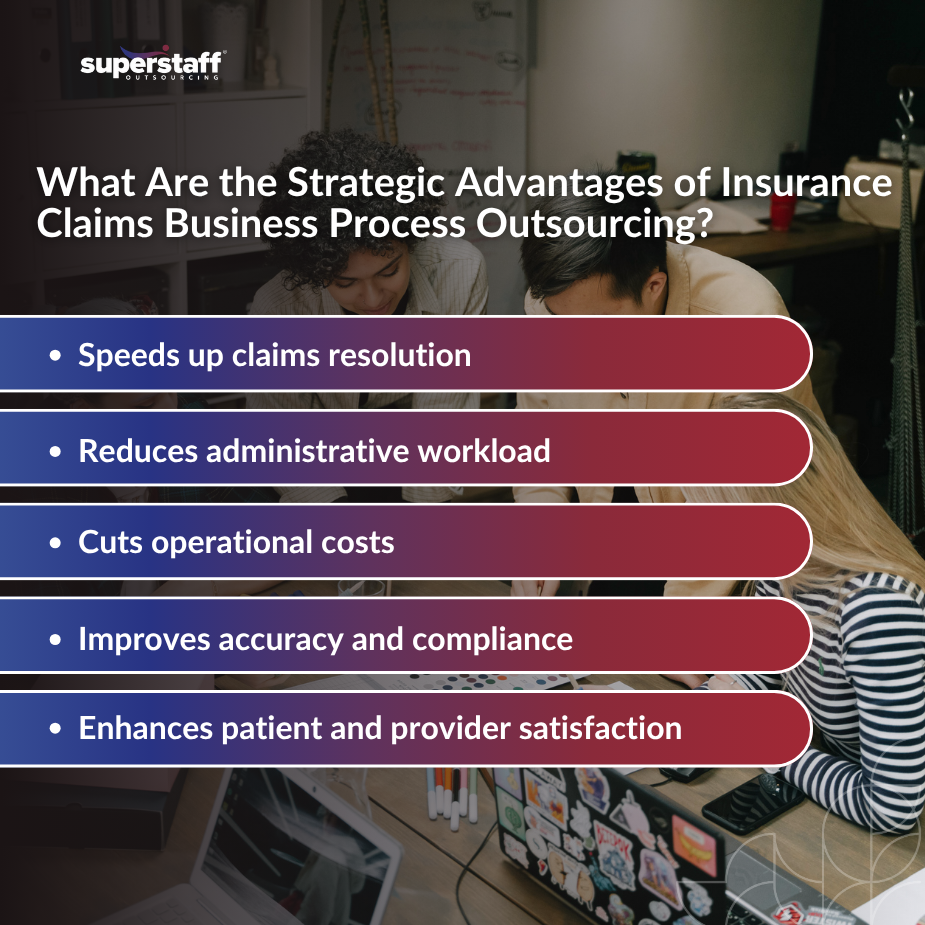

Benefits of Insurance Claims Business Process Outsourcing for U.S. Healthcare Insurers

BPO services for healthcare provide access to a global talent pool with niche expertise. These professionals are not only trained in claims workflows but are also well-versed in insurance codes, payer policies, and regulatory requirements.

Teams at outsourcing firms are equipped to work with:

- ICD-10 and CPT coding standards

- Explanation of Benefits (EOBs)

- Pre-authorizations and eligibility checks

The impact is immediate:

- Faster turnaround times reduce customer frustration. Claims are processed swiftly, improving member experience and payer-provider relationships.

- Standardized processes eliminate rework. Outsourced teams follow documented SOPs to ensure consistency and accuracy.

- Offshore teams can operate during extended hours. With teams in different time zones, work continues even after U.S. offices close.

Beyond efficiency, outsourcing also reduces financial risk for insurance providers.

Claims Backlogs Are Costing Payers and Providers Money—and Trust

Every delayed claim is more than just a number. It’s a delayed payment, a strained provider relationship, and a frustrated patient.

Insurance backlogs interrupt the flow of revenue for healthcare providers, many of whom rely on timely reimbursements to maintain operations. Payers, in turn, face penalties, reputational harm, and a rise in customer churn.

- Delays affect provider reimbursement timelines. Hospitals waiting for payments are forced to cut costs elsewhere.

- Denials due to processing errors lead to appeals and disputes. This adds layers of cost and complexity to the system.

- Dissatisfied patients switch providers or file complaints. Member retention suffers as service levels drop.

A proactive solution, such as outsourcing insurance claims processing, is needed before reputational and financial damage escalates.

Offshore Claims Processing Teams Can Scale Rapidly and Stay Current With Ever-Changing Regulations

One of the most significant advantages of insurance claims business process outsourcing is its built-in adaptability. Outsourcing providers invest heavily in training, compliance, and QA to meet evolving industry requirements.

- Built-in training and compliance monitoring. Teams receive continuous updates on regulatory changes.

- Dedicated QA teams ensure accuracy. Errors are caught early, protecting revenue and reducing rework.

- Multilingual capabilities help with diverse policyholders. BPO teams can service English, Spanish, and other languages to better handle member queries.

The adaptability of insurance claims business process outsourcing providers allows organizations to stay compliant without overloading internal resources. Reducing claims backlog through insurance claims business process outsourcing partners becomes not only possible but also sustainable at scale.

Still, successful outsourcing requires more than just handing off tasks.

Choosing the Right Outsourcing Partner Makes All the Difference

Not all outsourcing is created equal. Choosing a provider with a track record in insurance claims business process outsourcing ensures better alignment with industry-specific workflows and KPIs. When evaluating insurance back office support partners, quality matters as much as cost. The ideal healthcare BPO partner should function as a valid extension of your team, not just a vendor.

Key considerations include:

- Look for HIPAA-certified BPOs. Compliance and data security are non-negotiables.

- Assess their claims volume capacity and industry specialization. Can they scale with your needs?

- Demand real-time reporting and SLAs. Transparency and accountability are critical for managing performance.

The right partner doesn’t just process claims—they help future-proof operations.

Outsourcing Can Also Ease the Administrative Burden on Internal Teams and Reduce Burnout

Behind every insurance backlog is a team of people pushed to their limits. Claims processing is repetitive, high-pressure, and time-sensitive—a perfect recipe for burnout, which is why many companies turn to insurance claims business process outsourcing to improve efficiency and reduce internal strain.

By outsourcing these tasks, internal teams can redirect their energy toward complex issues, compliance strategy, and service innovation.

- Reduces overtime and improves retention. Employees are less likely to quit when workloads are manageable.

- Enhances work-life balance for claims analysts. A sustainable work environment improves focus and accuracy.

- Empowers better use of in-house talent. Staff can concentrate on high-value activities like audits, fraud detection, or policy development.

Ultimately, outsourcing claims processing supports a more responsive, sustainable healthcare system.

Ready to Reclaim Control? Insurance Claims Business Process Outsourcing Is the Way Forward

Contact SuperStaff today to explore how insurance claims business process outsourcing can help you build a more efficient and resilient claims operation. With the U.S. health insurance industry under increasing stress, insurance claims business process outsourcing has become not just helpful, but essential.

Outsourcing offers more than just temporary relief—it delivers long-term operational advantages. With specialized teams focused solely on claims processing, insurers gain the speed needed to keep up with growing demands. Continuous training ensures these teams remain compliant with the latest regulations, minimizing risk and improving accuracy.

The scalability of outsourcing also brings cost efficiency, as providers can adjust support levels without overinvesting in internal resources. Just as important, outsourcing eases the burden on in-house staff, helping reduce burnout and enabling a more sustainable approach to healthcare administration.

The U.S. health system cannot afford to continue relying on overburdened internal processes. It’s time to turn to trusted outsourcing solutions.

Explore how SuperStaff’s specialized healthcare outsourcing teams can help your organization eliminate backlogs, improve accuracy, and restore trust, without sacrificing compliance or care quality.