The accounting industry faces its most formidable challenge yet: navigating the accounting talent shortage amid the lingering effects of the COVID-19 crisis and “The Great Resignation.”

Accountants and bookkeepers are among the most in-demand professions today. However, there are currently more available jobs than qualified accountants ready to take on the work. Although the shortage of accountants has been a problem since before the pandemic began, “The Great Resignation” accelerated the industry’s labor crisis.

Accounting professionals are quitting in record numbers, with some seeking higher salaries and more flexible schedules while others are leaving the profession entirely. Much like other essential industries like healthcare and retail, the accounting sector struggles to meet rising client demands as fewer workers are hired to replace those who left.

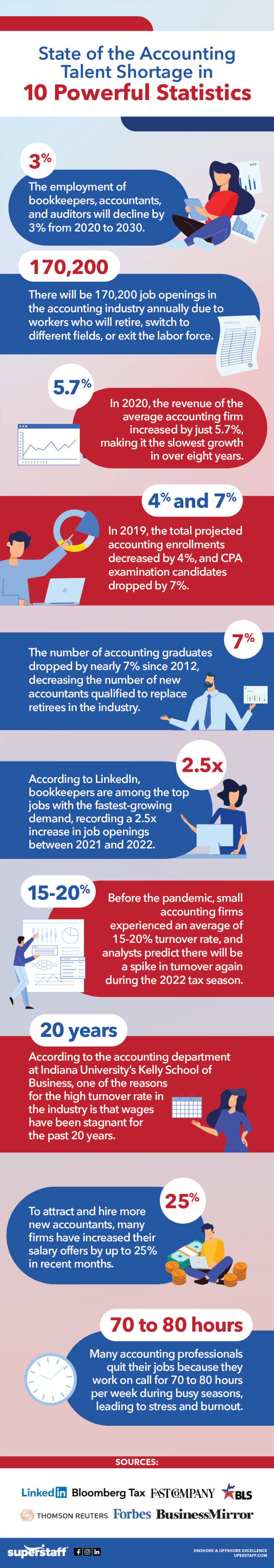

You may wonder, “How significant is the current accounting talent shortage? What is causing accountants to quit their jobs? How can corporations and accounting firms address these challenges?” In this infographic, we’ll delve into all of these questions and more.

Read More: Find Out the Top 7 Sectors Suffering Labor Shortage Due to ‘The Great Resignation’

State of the Accounting Talent Shortage in 10 Powerful Statistics

Top 3 Operational Strategies Companies Can Implement To Address the Accountant Shortage in 2022

The U.S. Bureau of Labor Statistics predicts that there will be a 3% decline in the employment of accountants, bookkeepers, and auditors. However, despite declining employment, there will continue to be, on average, 170,200 job openings every year due to accounting professionals who exit the labor force or switch careers.

Knowing what we now know about the state of the accounting talent shortage, what can corporations and firms do to address these challenges? The answer is to adapt to the changing market conditions and implement new operational strategies. Here are a few valuable tips to utilize:

1. Automate tasks where you can and embrace recent technological advancements.

One of the reasons for the accounting talent shortage is that the profession often involves high-stress environments and time-sensitive workloads. The average accountant works on call for 70 to 80 hours a week during busy seasons, such as tax season.

To help reduce an accounting professional’s workload, more and more corporations and accounting firms are embracing technological solutions. The accounting sector was once known for being averse to adopting new technologies and advancements. However, the shortage of accountants may be pushing the industry to find ways to ease the burden of their existing employees.

Artificial intelligence (AI) and machine learning technologies can automate and streamline tasks that pull CPAs away from their core duties. For instance, accountants used to handle repetitive tasks such as manually reconciling bank statements, producing financial reports in a spreadsheet, or manually inputting data onto a computer.

Through automation, accountants can save time, improve accuracy and efficiency, and focus on what they do best. In addition, the growing adoption of remote work in the industry allows accountants and bookkeepers to enjoy more flexibility in their schedules and greater work-life balance, significantly reducing stress and burnout that may lead to attrition.

2. Consider outsourcing accountants and bookkeepers.

In addition to adopting new technologies to reduce the workload of your existing employees, outsourcing is another way to address the accounting talent shortage. Hiring qualified workers can be challenging in a specialized field like accounting. Thankfully, partnering with an outsourcing provider can help firms find skilled and knowledgeable accountants quickly and efficiently.

Outsourcing also allows corporations and accounting firms to scale or downsize operations quickly. For instance, smaller firms may not have a heavy workload during off-seasons but need extra help during tax season. By outsourcing, these firms can meet rising seasonal demand without going through the trouble of hiring in-house accountants and bookkeepers.

3. Access talents from the Philippines.

With today’s technology, geography and location are no longer barriers to finding and working with qualified talents. Corporations and firms struggling with accountant shortages can adopt outsourcing solutions to expand their talent pool and partner with skilled and reliable workers from across the globe. And one of the best countries to outsource accounting and bookkeeping services to is the Philippines.

The Philippines has the largest number of accounting schools in Asia, with over 466 schools across the nation. Every year, an average of 7,250 new CPAs join the labor force by working for local and international firms.

U.S. firms that decide to offshore to the Philippines don’t have to worry about training Filipino accountants to meet Western standards and practices. The presence of major accounting firms in the country, including Deloitte Touche Tohmatsu and Ernst & Young Philippines, have also helped local accountants become familiar with and well-versed in international taxation and accounting procedures and regulations.

Trust SuperStaff To Help Your Firm Navigate the Accounting Talent Shortage

If you need help addressing the accountant shortage, reach out to the professionals at SuperStaff. We offer various outsourcing solutions, including accounting and bookkeeping services. Our CPAs are proficient in the latest bookkeeping software and keep themselves updated on U.S. accounting standards and regulations.

At SuperStaff, we employ the best practices of Fortune 500 companies to ensure that our accounting and financial outsourcing solutions are accurate and sound. Trust our experienced accountants and bookkeepers to keep your company’s best interests in mind.

Contact us today, and learn more about how our outsourcing solutions can empower your firm’s financial success and growth!