Nearshore technology outsourcing has gained significant momentum in today’s globalized business landscape. As companies seek out strategic and cost-effective solutions to navigate economic uncertainties and labor shortages, Latin America has emerged as an ideal outsourcing destination.

However, two countries, in particular, stand out in this region. In this infographic, Colombia vs Costa Rica for Nearshore Tech Outsourcing, we will delve into an in-depth comparison of the two countries, exploring their strengths, their outsourcing services, and other critical considerations to ultimately reveal which country will be most compatible in addressing needs of today’s businesses.

Colombia vs. Costa for Nearshore Tech Outsourcing

Tech Nearshore Outsourcing: Costa Rica vs Colombia

With their rich pool of tech talent, supportive business environments, and vast interconnectivity, both Colombia and Costa Rica stand as strong contenders in the LatAm nearshore outsourcing arena.

However, since both countries showcase unique competitive advantages, choosing the ideal nearshore outsourcing partner requires a comprehensive grasp of how each country fosters and cultivates the tech and BPO industries.

Let’s delve into the key similarities and contrasts between nearshore outsourcing companies in Colombia and Costa Rica for an informed decision.

Workforce Profile

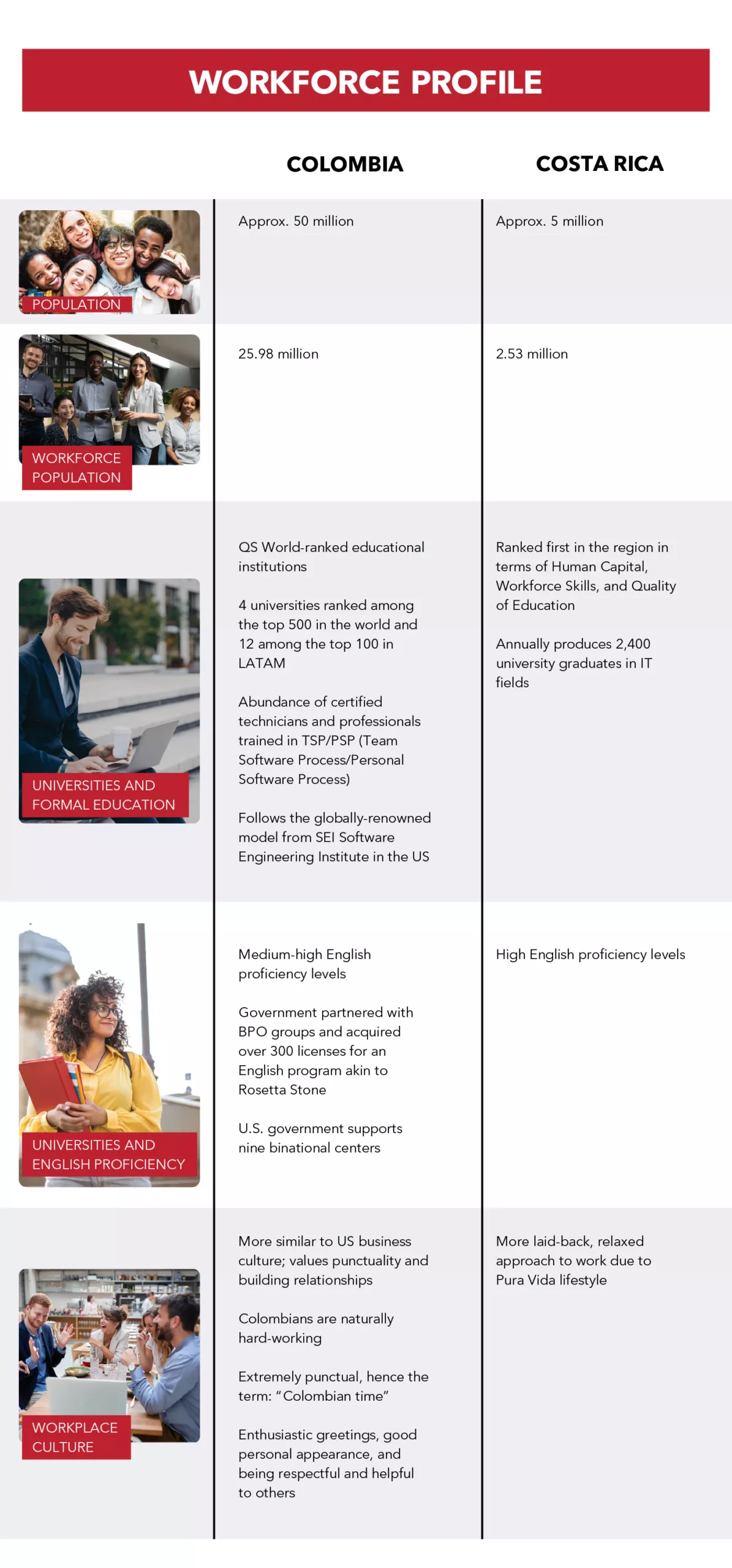

Understanding each country’s workforce profile can help us determine their viability as nearshoring destinations. By evaluating the depth of their talent pool, language proficiency, and other local workforce characteristics, businesses can strategize their operations.

Workforce Population

In terms of its workforce population, Colombia (25.98 million) far exceeds Costa Rica (2.53 million), providing the former with a distinct advantage when it comes to nearshore IT outsourcing and nearshore software outsourcing.

The larger workforce in Colombia offers greater flexibility and scalability for businesses seeking to outsource their technology needs. Companies can tap into a wider range of skilled professionals, find suitable resources to meet their specific project requirements, and effectively scale their operations.

Universities and Formal Education

With both prioritizing their education sectors, Colombia and Costa Rica have made significant strides in their respective systems.

As a matter of fact, 53 of Colombia’s universities made it to the QS Latin America University Rankings Top 400, showcasing the country’s commitment to higher education and research excellence. Meanwhile, the World Economic Forum (WEF) ranked Costa Rica first in the region for human capital, workforce skills, and quality of education.

English Proficiency

Recognizing the importance of English proficiency in the global market, Colombia acquired over 300 licenses for an English program akin to Rosetta Stone that aims to improve the language skills of employees in the contact center industry.

Moreover, the partnership between Colombia and the US has played a significant role in promoting English language education in the country. With the support of the U.S., Colombia has established nine binational centers that offer high-quality English-language teaching and free educational and cultural events.

For its part, Costa Ricans also showcase an exceptional command of the English language. It has achieved record-high results in English language proficiency tests like TOEIC and TOEFL due to their strong focus on English language education.

Work Culture

The work cultures of Costa Ricans and Colombians have distinct differences, reflecting their unique societal values and lifestyles.

Personal relationships and family networks play a significant role in Colombian business culture.

Colombians are also known for their hard-working nature and strong emphasis on punctuality. Similar to the U.S., arriving on time is essential in their work culture, as it conveys respect for the person’s time and attention. Being punctual is seen as a sign of professionalism and courtesy.

On the other hand, Costa Ricans embrace a more laid-back approach to work, influenced by their “pura vida” lifestyle which represents a relaxed and peaceful society. Punctuality is also not particularly with his strong suit. While some businessmen may adhere to the established meeting time, others may be more relaxed about time.

Understanding and respecting these cultural nuances that shape their business practices will drive the success of outsourcing partnerships with each country.

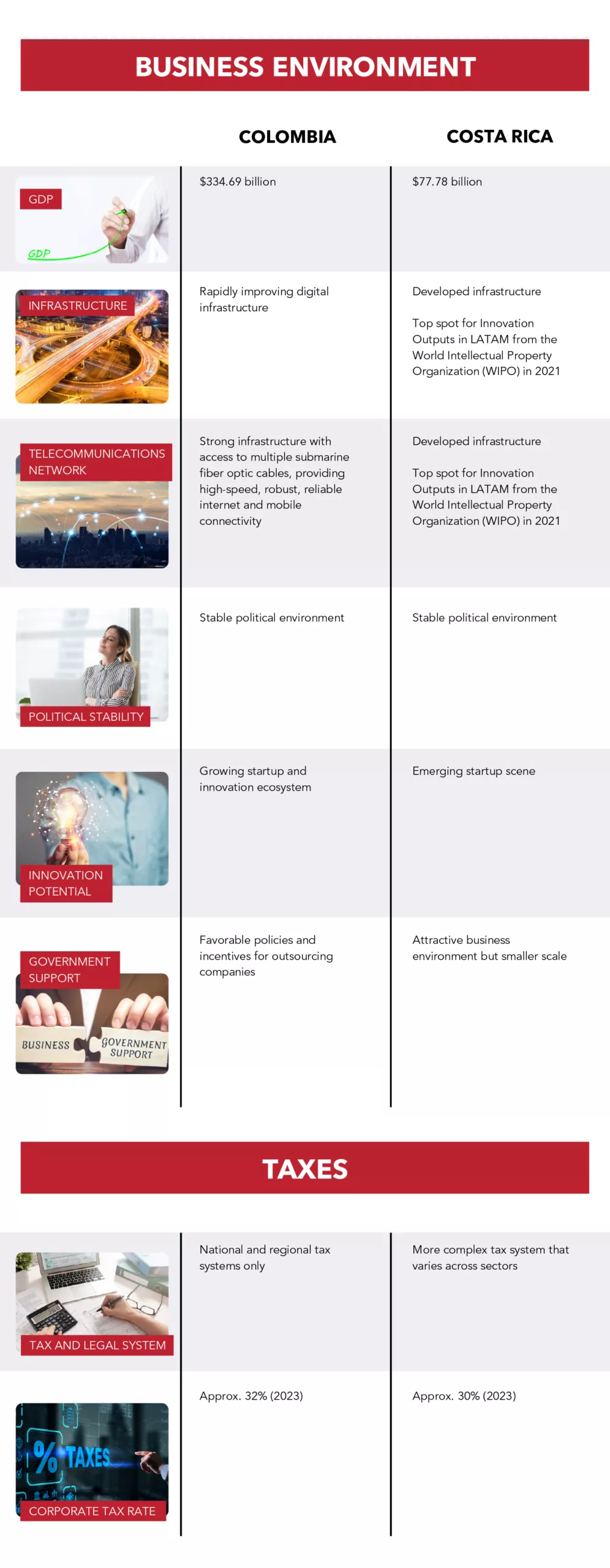

Business Environment

A country’s business environment heavily impacts perceptions of why it’s the perfect BPO destination. It provides stability, legal protection, and infrastructure, all of which contribute to a positive and productive outsourcing experience.

GDP

Colombia ($334.69 billion) has a much larger GDP compared to Costa Rica ($77.78 billion).

This goes to show that Colombia’s economy is more diversified, with a larger population and a broader range of industries such as services, agriculture, and manufacturing. Costa Rica, on the other hand, has a smaller economy, but it has been steadily growing and has a reputation for stability and sustainability. Its economy is more focused on services, particularly tourism and tech.

Infrastructure and Telecommunications Network

The latest BPO Offshore Index reveals that a significant majority (89%) of business leaders and stakeholders have complete confidence in Colombia’s internet connectivity, fixed telephone lines, and mobile coverage for voice – indicating that Colombia has made substantial strides in developing a reliable and efficient communication infrastructure that’s crucial for outsourcing.

The robust communication services in the country enables BPO firms to deliver high-quality customer service, technical support, and other outsourced services without major disruptions.

Additionally, the index highlights that hotels, restaurants, and airport facilities catering to international travelers share the same level of confidence in communication infrastructure. This is crucial in attracting foreign businesses.

Government Support

Colombia offers favorable policies and incentives for outsourcing companies operating within its borders. The government recognizes the significance of the BPO sector in boosting the economy and creating employment opportunities. As a result, they have implemented various measures to attract and support outsourcing companies.

These incentives may include tax benefits, subsidies, grants, and other financial support to encourage outsourcing companies to establish their operations in Colombia. By providing such incentives, the government aims to make the country an attractive destination for BPO firms seeking to outsource their business processes.

While Costa Rica also offers government support for the BPO sector, it is on a smaller scale compared to Colombia. Their government focuses on maintaining an attractive business environment with reliable infrastructure, and a well-educated workforce.

Political Stability

Colombia first-ever leftist president, Gustavo Petro, assumed office in 2022, marking a historic moment for the country. With this significant political change, expectations are high among the public, including the BPO community. Executives have already engaged with the new government to discuss crucial issues, potential reforms, and its future direction.

Understandably, a new presidency often comes with promises of policy shifts and reforms that can significantly shape the business and economic landscape. However, it is natural for businesses, including those in the BPO sector, to exercise prudence in assessing the long-term effects of these changes.

Costa Rica is also considered one of the most politically stable countries in Latin America. It has a strong democratic system of government and a history of peaceful transitions of power.

Innovation Potential

Colombia and Costa Rica both exhibit promising potential for innovation, each with its distinct traits. With a thriving startup ecosystem and surge in entrepreneurial ventures across various sectors, Colombia’s landscape is already well-established but still promises continuous growth.

The government’s proactive approach in supporting innovation through favorable policies, funding programs, and streamlined regulations further reinforces its commitment to fostering a vibrant innovation ecosystem. Moreover, Colombia benefits from a large and diverse workforce, comprising skilled professionals in STEM fields – a strong foundation for driving forward innovative solutions.

On the other hand, Costa Rica’s innovation potential is emerging but promising. The country is gradually making its mark in the global innovation landscape, witnessing a rising number of startups and innovative projects.

The government in Costa Rica recognizes the importance of innovation and entrepreneurship in driving economic development, and it has taken steps to support startups through creating a conducive business environment and offering incentives for research and development activities. The presence of a highly educated and skilled workforce, particularly in technology, engineering, and sciences, adds to Costa Rica’s potential for growth in the innovation sector.

Taxes

Considering tax laws in outsourcing destinations is critical for making well-informed decisions and optimizing the benefits of outsourcing. By understanding the tax implications, incentives, compliance requirements, and legal risks, businesses can strategically choose the most suitable outsourcing location and ensure smooth and compliant operations. Proper tax planning can lead to cost savings, improved profitability, and a positive outsourcing experience.

Tax and Legal System

The labor laws in Costa Rica can be complex and vary across industries, posing challenges for companies seeking to outsource to the country. These laws are generally designed to protect employees, but they can create difficulties for businesses navigating the outsourcing landscape.

One crucial aspect to consider is the classification of employees under different contract types. Foreign companies outsourcing to Costa Rica must have a clear understanding of the distinctions between various employee contracts to avoid misclassification. Failing to correctly classify employees can result in significant fines and legal repercussions.

Fortunately, in Colombia, the tax system only consists of national and regional taxes. National taxes, such as income tax, value-added tax (VAT), and excise tax, are applicable to all individuals or legal entities that have fiscal residency within the country. On the other hand, regional taxes, including industry and commerce tax and property tax, are determined by each department or municipality within the boundaries established by law.

Moreover, the Colombian government has consistently showcased its dedication to supporting the BPO sector by including it as one of the 20 sectors covered by a customized business plan under the Productive Transformation Program (PTP).

Corporate Tax Rate

The difference in corporate tax rates between Colombia and Costa Rica can have significant implications for their respective BPO markets. Colombia’s corporate tax rate of approximately 32% represents a relatively higher tax burden for businesses compared to Costa Rica’s rate of approximately 30%. The higher tax liability could impact the net income and overall profitability of BPO operations in the country, potentially influencing financial decision-making and tax planning.

Costa Rica’s slightly lower corporate tax rate of around 30% can be a more attractive feature for BPO companies.

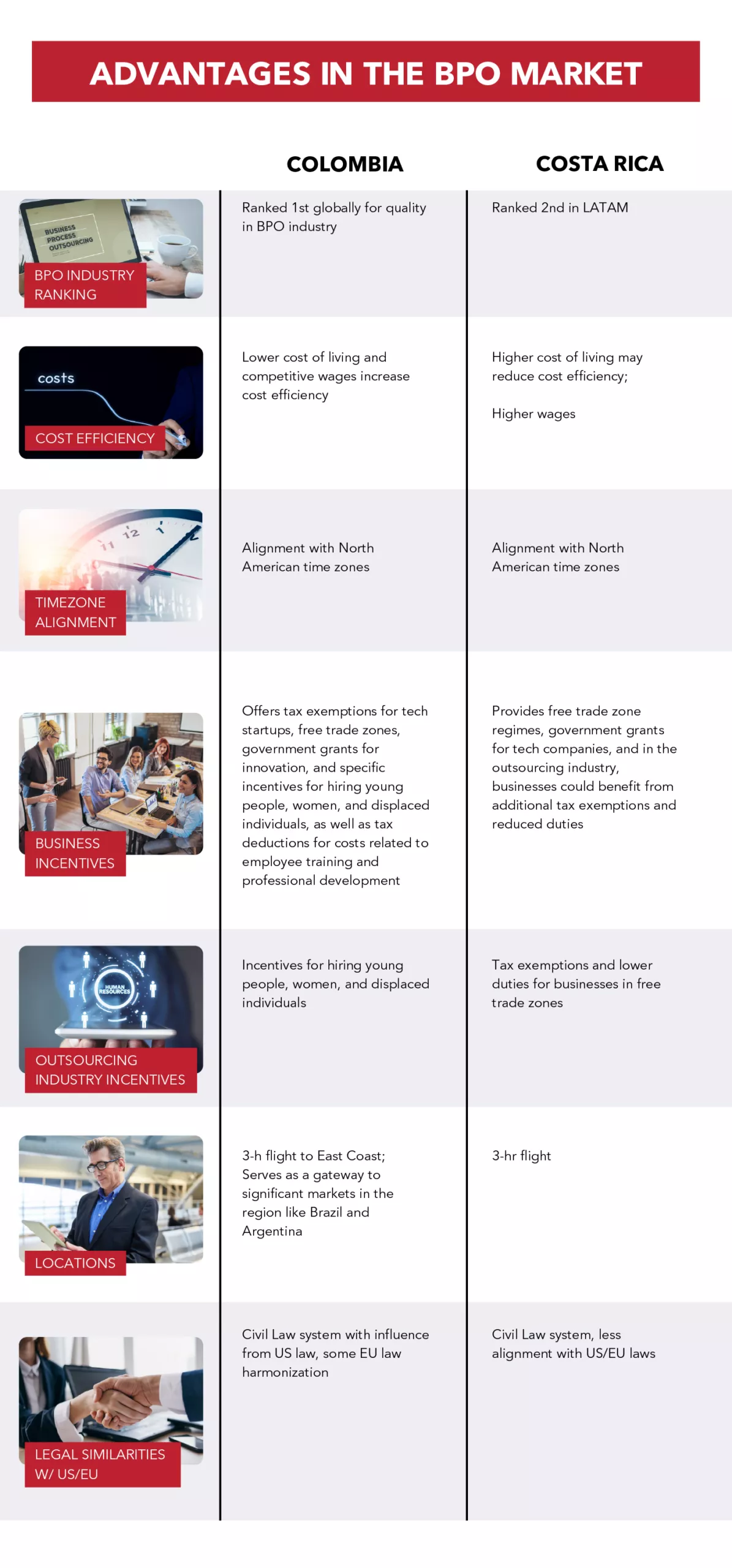

Advantages in the BPO Market

BPO Industry Ranking

Throughout the years, Colombia has confidently emerged as a prominent figure in the Latin America nearshoring market. Thanks to its advantageous geographical location and a thriving tech sector that continues to grow rapidly, the country has become an irresistible hub for companies seeking to outsource their technological requirements.

Colombia’s business-friendly environment and ever-expanding IT sector further bolster its appeal, making it an ideal destination for outsourcing technology needs and software development. The nation’s prowess in this field has earned it the distinguished top position in the Offshore BPO Confidence Index for two consecutive years, solidifying its status as a pioneering force in the realm of tech outsourcing. With unwavering dedication and continuous innovation, Colombia remains at the forefront of the global tech outsourcing landscape, offering unmatched opportunities for companies to thrive and succeed.

Meanwhile, despite its smaller economy, Costa Rica has successfully positioned itself as the second leading outsourcing destination in Latin America. The country’s stable political environment, skilled workforce, and investment-friendly policies have attracted many international companies to establish operations in the country.

Cost Efficiency

Compared to Colombia’s living cost ($546) and minimum wage ($314.16), Costa Rica’s higher living cost ($1000) and minimum wage ($649.55) diminishes the comparative cost advantage for BPO clients. Higher costs of living often translate to higher operational expenses, including salaries and overhead costs for businesses.

On the other hand, the reduced expenses in Colombia’s BPO market can be passed on to clients, making it a more cost-effective option for outsourcing operations. While Costa Rica may have other advantages, the higher living cost can offset these benefits when it comes to cost considerations.

Time Zone

Colombia, which shares a similar time with US Eastern Standard Time (EST), allows for easier coordination and communication between outsourced teams in Colombia and your in-house team in the eastern regions of the US.

Meanwhile, Washington time is two hours ahead of Costa Rica’s, which can potentially lead to delays in communication and coordination. Although a two-hour time difference may not seem substantial, it can still impact real-time decision-making and work synchronization, especially in time-sensitive projects.

Business Incentives

Both Colombia and Costa Rica offer enticing business incentives for outsourcing companies, aiming to attract foreign investment and foster the growth of their technology sectors. In Colombia, startups in the tech industry receive tax exemptions, encouraging innovation and entrepreneurship. Additionally, Free Trade Zones (FTZs) provide outsourcing firms with attractive tax benefits and exemptions, making these zones alluring locations for outsourcing operations.

The Colombian government further supports technological advancements through grants and funding for innovation and research projects. Moreover, specific incentives target social inclusion by providing benefits to companies that hire young people, women, and individuals from displaced communities. Furthermore, tax deductions for employee training and professional development incentivize investments in a skilled and knowledgeable workforce.

Costa Rica’s business incentives in the outsourcing sector are just as compelling. Their government grants contribute to the growth of the technology industry, supporting tech companies with financial assistance for expansion and research initiatives. Moreover, additional tax exemptions and reduced duties create a favorable financial environment for outsourcing companies, promoting Costa Rica as a cost-effective and advantageous outsourcing option.

Outsourcing Industry Incentives

Colombia offers incentives such as tax benefits, subsidies, and grants to outsourcing companies that hire young people, women, and displaced individuals. By encouraging the employment of these marginalized sectors, the government aims to address socio-economic challenges and promote inclusivity.

Meanwhile, one of the primary incentives Costa Rica provides to the outsourcing industry is tax exemptions. Companies operating within designated free trade zones can benefit from significant tax reductions or even complete exemptions from income tax, sales tax, and import duties, resulting in substantial savings for outsourcing businesses.

Costa Rica also has established free trade zones that offer businesses certain advantages, such as streamlined administrative processes, simplified regulations, and infrastructure support. This creates a conducive environment for outsourcing companies to operate and expand their operations.

Location

While Costa Rica has the advantage of geographic proximity to the United States, Colombia’s strategic position offers unique benefits as a nearshoring destination. Situated in the northern tip of South America, Colombia serves as a gateway to significant markets in the region like Brazil and Argentina.

Its key location allows businesses to expand their reach beyond North America and tap into the vast opportunities presented by the South American market. By choosing Colombia as a nearshoring destination, companies can establish a strong presence in Latin American markets, unlocking long-term growth prospects and diversifying their customer base.

Legal Similarities with US/EU

Colombia and Costa Rica both have legal systems rooted in the Civil Law tradition, setting them apart from the common law systems prevalent in the US and the European Union. In Colombia, the legal framework has been influenced by the US legal system, owing to historical ties and trade relations between the two countries.

Additionally, Colombia has also undertaken efforts to harmonize some of its laws with those of the EU, likely driven by trade agreements and cooperation initiatives. However, it’s important to note that the Civil Law system forms the foundation of Colombia’s legal structure, resulting in some differences when compared to the common law systems of the US and the EU.

In contrast, Costa Rica’s legal system also operates under the Civil Law tradition but exhibits less alignment with US and EU laws. The country’s legal framework is more self-contained and has limited direct influence from the legal systems of the US and the EU. Instead, Costa Rica’s legal codes and regulations are primarily shaped by its internal legal traditions and local needs.

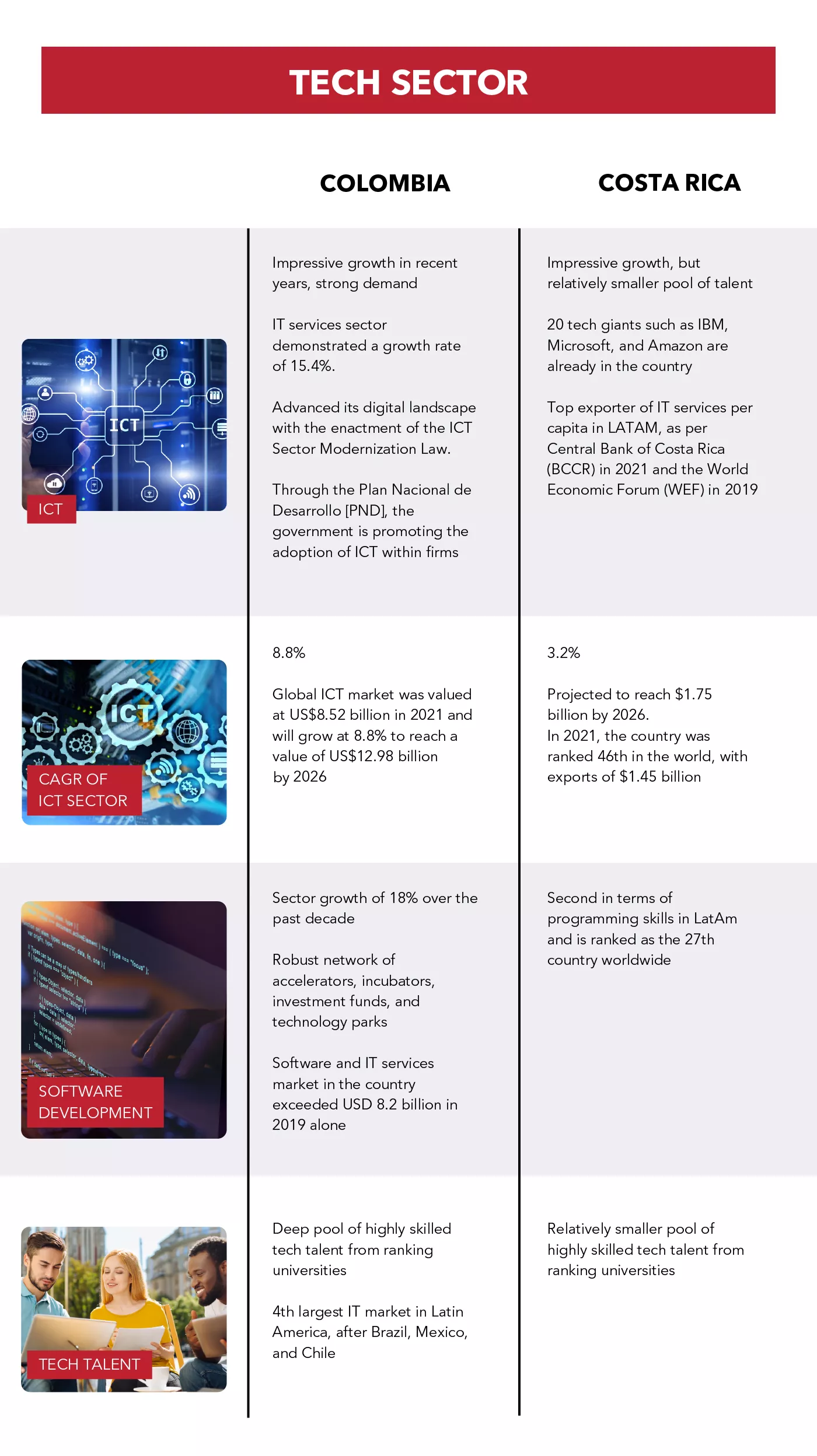

Tech Sector

ICT

Colombia’s global ICT market, valued at $8.52 billion in 2021, is expected to grow further at a CAGR of 8.8% and reach a value of $12.98 billion by 2026. The government’s active promotion of ICT adoption and utilization within firms, as part of the National Development Plan, further enhances the sector’s growth potential.

Meanwhile, Costa Rica’s ICT industry has also demonstrated impressive growth and it is expected to reach $1.75 billion by 2026.

Software Development

Colombia’s robust innovation ecosystem of accelerators, incubators, investment funds, and technology parks fosters the development of cutting-edge technologies and encourages startups and entrepreneurs to thrive in the tech industry.

Additionally, Colombia’s software development industry takes pride in its abundance of certified technicians and professionals trained in TSP/PSP (Team Software Process/Personal Software Process) that highlights the country’s commitment to maintaining high quality standards in software development.

Costa Rica’s software development market has also showcased commendable achievements, with the sector attracting major tech giants like IBM, Microsoft, and Amazon. The country ranks second in terms of programming skills in Latin America and is globally ranked as the 27th country for its expertise in software development.

Tech Talent

Both Colombia and Costa Rica demonstrate a commitment to developing tech talent and have their unique strengths in the IT industry. Colombia’s larger population has resulted in a deeper pool of tech talent, and the country’s software development sector’s benefits from that.

On the other hand, Costa Rica excels in programming skills, attracting global tech companies, and receiving recognition for its innovation outputs. Despite its smaller population, Costa Rica has established itself as an attractive destination for technology investments and developments.

Each country’s emphasis on tech education, innovation, and developing a skilled workforce enhances their potential for continued growth and success in the tech industry.

Between 2001 and 2018, Colombia produced an impressive 690,491 graduates in Software & IT programs, highlighting the country’s focus on developing a skilled workforce for the technology industry. Costa Rica also recognizes the importance of IT education and annually produces 2,400 university graduates in IT fields, which is fairly sizable for a relatively small country.

Why Outsource With Colombia: Colombia vs Costa Rica for Nearshore Technology Outsourcing

Colombia and Costa Rica are leading tech hubs in LatAm. But in terms of nearshore technology outsourcing, Colombia emerges as the ultimate choice between the two tech powerhouses.

The country excels in areas such as cost-effectiveness, strategic location, and a highly skilled workforce. Opting to outsource from Colombia’s renowned outsourcing firms can yield greater profitability and foster entrepreneurial growth.

Don’t miss out on the opportunity to leverage Colombia’s competitive IT and tech solution packages.

Contact us today and unlock the full potential of Colombia’s thriving tech industry!