When most business leaders hear the phrase “finance outsourcing,” they immediately think of one thing: bookkeeping. Maybe some data entry. Perhaps a little payroll support. But that’s just the tip of the iceberg.

In today’s fast-paced, data-driven world, finance and accounting services have evolved into something far more comprehensive. Full-scope outsourcing no longer just handles the day-to-day ledgers—it encompasses everything from tax compliance and financial reporting to strategic forecasting, risk management, and even CFO-level insights. Whether you’re a startup scaling quickly or a midmarket company aiming to streamline operations, these services can offer the structure, visibility, and flexibility you need to grow confidently.

This blog breaks down what “full-scope” finance and accounting services really include and how they can dramatically reshape how companies operate financially. If you’ve been thinking about outsourcing as a tactical fix, it’s time to rethink the possibilities.

Bookkeeping is Just the Beginning: What Most Businesses Get Wrong

When people think of outsourcing finance tasks, their minds often jump to data entry or basic bookkeeping. Many small to mid-sized enterprises (SMEs) assume that finance and accounting outsourcing is limited to tasks like managing ledgers or reconciling accounts. While those transactional tasks are part of the picture, they barely scratch the surface.

The myth that outsourcing equals nothing more than invoice tracking or payroll processing keeps many companies from exploring its full potential. In truth, businesses that outsource financial services gain access to a much broader and more strategic set of solutions—including CFO-level guidance, audit readiness, compliance monitoring, and long-term forecasting.

Let’s explore the layers that go beyond the basics to reveal what full-scope finance and accounting outsourcing services really include.

Core Transactional Services: What’s Typically Included

Are you wondering what’s included in outsourced finance services? At its foundation, finance and accounting services begin with core transactional functions. These are essential, day-to-day financial operations that keep a business running smoothly.

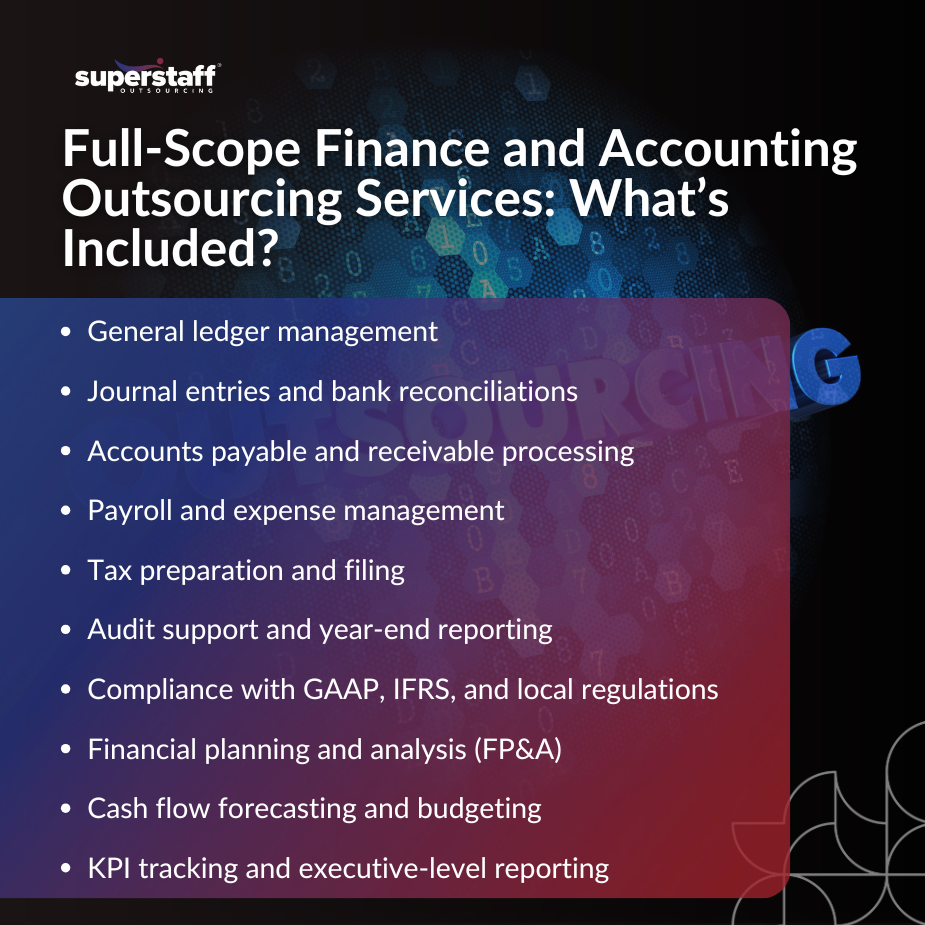

Typical services include:

- General ledger maintenance and journal entries

- Bank reconciliations and monthly closing processes

- Accounts payable and accounts receivable management

- Payroll processing, benefits administration, and expense tracking

These functions may seem routine, but getting them wrong can lead to cash flow disruptions, compliance risks, and poor financial visibility. By outsourcing these services, companies ensure accuracy, timeliness, and consistency—all without having to build and manage an internal finance team.

But full-scope finance and accounting outsourcing services don’t stop at transactions. They move into more complex areas where the real value begins.

Compliance, Tax, and Regulatory Support You Can Count On

The global regulatory landscape is shifting faster than ever. Whether it’s navigating evolving tax laws or meeting international reporting standards, compliance is a moving target for most businesses. Finance and accounting outsourcing providers help companies stay ahead.

When you outsource financial services, offshore teams often handle the following:

- Preparation and filing of local and international tax returns

- Support during audits and year-end financial reporting

- Expertise in frameworks like GAAP, IFRS, and industry-specific standards

Staying compliant isn’t just about avoiding penalties; it’s about building trust with stakeholders and regulators. A good outsourcing partner ensures you meet every deadline, file accurate reports, and remain in full legal standing.

And there’s more—strategic advisory services can further elevate your financial operations.

Strategic Financial Services: CFO-Level Thinking Without the Overhead

Finance leaders do more than count numbers—they guide growth. With full-scope finance and accounting outsourcing services, businesses gain access to senior-level strategic insights without hiring an in-house CFO.

Strategic outsourced finance services include:

- Financial planning and analysis (FP&A) to assess profitability and efficiency

- Cash flow forecasting and budget development for smarter resource allocation

- KPI tracking and customized financial reporting tailored for executives and investors

With this level of support, decision-makers can plan for future investments, respond to market changes, and optimize capital allocation. The result? A more agile, resilient, and financially literate organization.

But strategy alone isn’t enough. Industry context matters too.

Industry-Customized Services: No One-Size-Fits-All Approach

One of the most overlooked benefits of outsourcing is industry-specific expertise. Top-tier BPO firms don’t offer cookie-cutter solutions; they tailor services to your business model and regulatory environment.

Here’s what that looks like:

- Retail and Manufacturing: Inventory accounting, cost allocation, and supplier payment tracking

- Healthcare: Revenue cycle management, insurance claims processing, and HIPAA-compliant reporting

- Professional Services: Project-based accounting, time tracking, and client billing reconciliation

These customized services are designed to handle the unique financial complexities of different sectors, making finance and accounting outsourcing not just convenient but mission-critical.

And technology plays a major role in making these solutions scalable.

Tech-Driven Finance: The Role of Automation and Cloud Tools

Today’s finance and accounting services are powered by digital platforms that automate repetitive tasks, improve data accuracy, and accelerate reporting.

Modern outsourcing providers use advanced tools such as:

- ERP and accounting software integration (e.g., NetSuite, QuickBooks, Xero)

- Automated workflows for invoice processing, payment matching, and bank reconciliations

- Real-time dashboards for financial insights, KPIs, and cash position tracking

By embracing automation, outsourced finance teams reduce errors, increase reporting speed, and free up time for higher-value analysis. Businesses benefit from 24/7 access to cloud-based systems and transparent financial snapshots.

All of these capabilities ultimately fuel smarter, faster business decisions.

The Business Impact: Why Full-Scope Outsourcing Is a Strategic Move

Outsourcing finance and accounting is no longer just about cutting costs. It’s a growth-enabler.

With full-scope outsourcing, companies gain:

- Scalability: Add or reduce services based on changing needs without recruiting or training new staff

- Clarity: Make informed decisions with timely, data-rich insights

- Risk mitigation: Navigate audits, tax changes, and operational risks with expert oversight

Businesses that outsource financial services are better positioned to adapt, innovate, and grow—without being bogged down by routine or regulatory tasks.

But to get all these benefits, choosing the right partner is critical.

Choosing a Full-Scope F&A Outsourcing Partner: What to Look For

Not all finance outsourcing firms are created equal. A true full-scope partner should offer flexibility, expertise, and accountability.

Here’s what to evaluate:

- Service coverage: Can they handle everything from bookkeeping to strategic advisory?

- Industry experience: Do they understand your sector’s specific needs and compliance rules?

- Security and compliance: Do they follow robust data protection protocols and international standards?

- Engagement models: Can you choose between dedicated teams or project-based setups?

As finance and accounting outsourcing continues to evolve, selecting a capable and trusted partner ensures your business stays one step ahead.

Empower Your Firm With SuperStaff’s Full-Scope Finance and Accounting Services

Outsourcing finance is no longer just about balancing books—it’s about unlocking your company’s full financial potential.

From payroll to planning, from compliance to consulting, full-scope finance and accounting outsourcing services give businesses the tools, insights, and flexibility to scale smarter and faster.

Discover how SuperStaff’s finance and accounting services can support your growth and simplify your operations. Reach out to our team today.