Payroll is a vital business task that ensures employees are paid correctly and on time. Many leaders ask, how long does it take for payroll to process? The answer depends on the steps involved, the size of the company, and the tools used. Understanding these steps helps business owners and HR teams manage payroll efficiently and avoid costly errors.

Payroll is more than just writing checks or sending payments. It involves collecting accurate data, calculating wages and deductions, staying compliant with tax laws, and keeping clear records. Knowing how does payroll processing work step by step will show why it can take a few days to complete and how every part matters for smooth operations.

How Long Does It Take for Payroll to Process? A Quick Overview

The time it takes for payroll to process varies. Generally, payroll can take anywhere from a few hours to several days. Here is what affects this timeline:

- Payroll method: Manual payroll usually takes longer than automated systems.

- Payroll schedule: Weekly, biweekly, or monthly schedules impact processing time.

- Number of employees: More employees mean more data to process.

- Payroll complexity: Includes bonuses, commissions, taxes, and deductions.

- Approval processes: Some companies require multiple approvals before payroll runs.

Most businesses find that payroll processing takes between 2 to 5 business days from start to finish. Knowing how long does it take for payroll to process helps avoid last-minute rushes and errors.

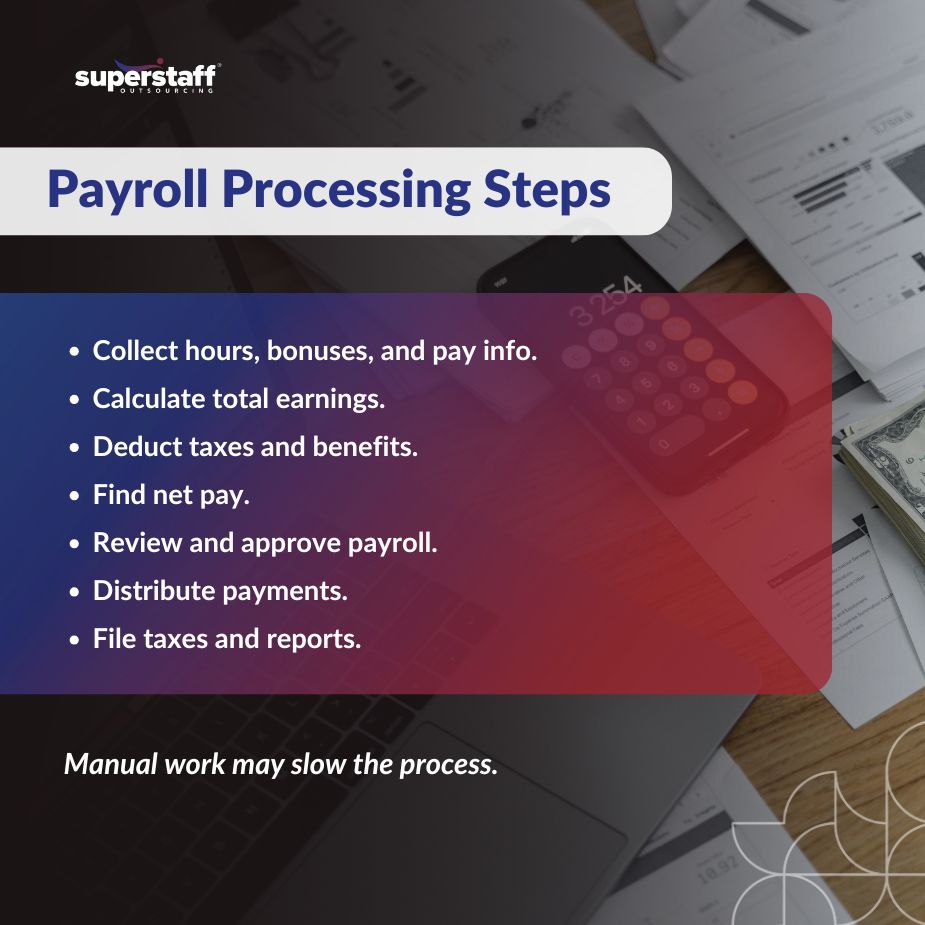

How Does Payroll Processing Work Step by Step?

Understanding the payroll process gives clarity on where time is spent. Here is a simple breakdown of how does payroll processing work step by step:

-

Collect Employee Information

Collect hours worked, leave, bonuses, and any other pay adjustments.

-

Calculate Gross Pay

Multiply hours worked by pay rate, add bonuses and commissions.

-

Calculate Deductions

Deduct taxes, benefits contributions, retirement plans, and any other withholdings.

-

Calculate Net Pay

Subtract deductions from gross pay to get the final amount to be paid.

-

Review and Approve Payroll

Payroll data is reviewed for accuracy and approved by managers or finance.

-

Distribute Payroll

Payments are made via direct deposit, checks, or other methods.

-

File Taxes and Reports

Employers submit required tax filings and payroll reports to government agencies.

Each of these steps can take time, especially if done manually or with limited software support.

What Affects How Long Does It Take for Payroll to Process?

Certain factors can increase or decrease payroll processing time. Some of the common ones include:

-

Payroll System Used

Automated payroll software handles calculations faster and with fewer errors compared to manual methods, which speeds up the entire process.

-

Employee Data Accuracy

When employee information is incomplete or incorrect, payroll processing slows down because corrections and clarifications are needed before payments can be made.

-

Tax Updates

Updates to tax laws require payroll systems to be adjusted, which can delay processing until new rates and rules are properly applied.

-

Compliance Requirements

Following regulations related to overtime, benefits, and labor laws adds steps to payroll calculations and approval, increasing the time needed.

-

Volume of Payroll

The larger the number of employees, the more data there is to manage, which naturally lengthens the time required to process payroll.

By understanding these factors, companies can focus on improving their payroll systems and data quality to reduce how long does it take for payroll to process.

Advantages of Outsourcing Payroll Services

Outsourcing payroll is a common choice for many businesses. It offers clear benefits in terms of efficiency and time management. Here are some advantages of outsourcing payroll services:

- Faster Processing Time – Payroll experts use specialized software and have streamlined processes to reduce processing time.

- Accuracy and Compliance – Outsourced providers stay up to date on tax laws and regulations, minimizing errors and penalties.

- Reduced Administrative Burden – Business owners and HR teams can focus on core activities instead of payroll tasks.

- Access to Expert Support – Payroll companies offer professional help for any questions or issues.

- Cost Savings – Outsourcing can be more affordable than hiring full-time payroll staff.

Choosing to outsource can answer the question how long does it take for payroll to process with a faster, more reliable turnaround.

How to Speed Up Payroll Processing

If a company decides to keep payroll in-house, there are ways to reduce processing time:

- Use payroll software to automate calculations.

- Keep employee data updated and accurate.

- Standardize payroll schedules and deadlines.

- Train HR staff on payroll compliance.

- Use direct deposit to speed payment delivery.

- Prepare tax filings in advance.

By focusing on these areas, businesses can shorten how long does it take for payroll to process while maintaining accuracy.

What to Expect When You Outsource Payroll

For companies new to outsourcing, the process usually follows these steps:

- Select a payroll service provider.

- Share employee and company data securely.

- Set payroll schedules and deadlines.

- The provider processes payroll and files taxes.

- Receive payroll reports and confirmation.

- Address any employee payroll questions with the provider’s help.

Outsourcing changes the question from “how long does it take for payroll to process” to “how quickly can the provider deliver payroll,” which is usually faster and more efficient.

Get Payroll Done Faster with the Right Approach

Knowing how long does it take for payroll to process is essential for smooth business operations. Whether payroll is handled internally or outsourced, being aware of the steps and factors involved helps set realistic expectations.

Outsourcing payroll with SuperStaff offers many advantages, including faster processing times and access to expert help. It is a good option for businesses looking to improve accuracy, reduce administrative work, and ensure timely employee payments.

If you want to reduce payroll delays and improve your payroll management, consider outsourcing with SuperStaff. The right provider will handle the details so you can focus on growing your business. Contact SuperStaff today to learn how they handle payroll step by step and how long does it take for payroll to process on time, every time.