Filing an insurance claim is often the moment of truth for policyholders—the point where they find out whether their provider truly delivers on its promise. It’s also one of the most operationally intense tasks for insurers. From verifying documents to processing payouts, claims management involves multiple steps, systems, and stakeholders. Any delay or error not only impacts the bottom line but also damages customer trust.

For many insurers, handling the entire claims process in-house is becoming unsustainable. Limited staff, growing case volumes, and rising expectations for fast, frictionless service make it harder to keep up. That’s why more carriers and third-party administrators are turning to insurance claims business process outsourcing as a strategic solution.

But outsourcing isn’t just about reducing overhead. Done right, insurance claims BPO builds a faster, more flexible, and customer-centric claims operation—one that improves accuracy, ensures compliance, and enhances the overall policyholder experience.

In this blog, we’ll explore what insurance claims business process outsourcing really involves and why it’s proving to be a game changer for forward-thinking insurers.

What Is Insurance Claims Business Process Outsourcing?

Insurance claims business process outsourcing (BPO) involves delegating specific parts—or the entirety—of the claims lifecycle to specialized third-party providers. These BPO partners manage everything from initial intake and documentation to adjudication, verification, and even post-settlement communication.

Typical services include:

- FNOL (first notice of loss) intake

- Claims adjudication and processing

- Fraud detection and prevention

- Compliance documentation and audit preparation

Most providers use a mix of automation, AI-driven tools, and highly trained domain experts to handle large volumes of claims efficiently. This tech-enabled support reduces manual workloads and increases claims throughput.

Now that we’ve defined it, let’s explore why outsourcing claims processing is changing the game for insurers.

The Operational Benefits of Outsourcing Claims

Outsourcing streamlines claims operations, reduces processing time, and improves overall efficiency. With a dedicated offshore or nearshore team, insurers can meet demand surges without burdening internal teams or sacrificing service quality.

Key operational benefits include:

- 24/7 claims handling across time zones, ensuring no delays

- Consistent, standardized workflows that align with regulatory and internal benchmarks

- Faster claims resolution that improves policyholder satisfaction and loyalty

When insurers leverage outsourcing insurance claims handling, they gain agility in staffing and eliminate the bottlenecks that often arise during peak seasons or disaster events.

Beyond speed and savings, outsourcing can also play a strategic role in risk management.

Compliance, Accuracy, and Fraud Prevention

Modern BPO partners bring robust quality control and compliance capabilities to the table. Keeping up with changing insurance regulations—both local and international—requires deep industry expertise and constant monitoring.

A qualified third party claims administrator or BPO partner offers:

- Built-in adherence to HIPAA, GDPR, and insurance-specific compliance frameworks

- Detailed, audit-ready documentation and version-controlled workflows

- Advanced fraud detection tools powered by AI and data analytics

By outsourcing, insurers not only reduce their risk exposure but also build more reliable and trustworthy claims operations.

Just as important as regulatory rigor is the experience your policyholders receive throughout the process.

Improving Customer Experience Through Claims BPO

Outsourcing helps insurers deliver faster, clearer, and more empathetic support to policyholders at critical moments. This is where claims handling directly influences brand perception and retention.

How claims BPO improves CX:

- Agents trained in empathy and customer-first communication

- Multichannel support options: phone, email, live chat, SMS

- Proactive status updates that reduce anxiety and eliminate guesswork

- Multilingual services that cater to diverse customer bases

One reason why insurers partner with BPOs for claims processing is to enhance their service reputation—especially in today’s digital-first, experience-driven market.

To stay competitive, insurers are also embracing technology—and BPO is helping them accelerate that journey.

BPO as an Enabler of Digital Transformation

Claims BPO is often the first step in a broader digital transformation for insurance companies. With the help of a tech-enabled BPO partner, insurers can modernize operations without the cost and complexity of doing it alone.

Digital advantages include:

- Custom dashboards with real-time claims analytics and performance metrics

- Robotic process automation (RPA) for faster document handling

- Secure, cloud-based platforms that ensure data integrity and access across teams

As digital demands grow, insurance claims business process outsourcing becomes more than just a back-office solution—it becomes a driver of innovation.

With all these benefits, you might wonder what kinds of claims are best suited for outsourcing.

Types of Insurance Claims Best Suited for BPO

Not every claim needs in-house handling. Certain standardized or high-volume claims can be processed more efficiently and accurately by outsourcing teams.

Claims ideal for BPO:

- Dental, travel, and warranty claims that follow a repeatable process

- Auto or property claims with well-defined policy terms and documentation requirements

- Health insurance claims requiring medical billing, coding, and compliance expertise

By outsourcing these functions, insurers can free up internal experts to focus on complex or high-risk cases while maintaining quality at scale.

Whether a startup insurer or an established carrier, outsourcing can unlock real scalability.

When to Consider Insurance Claims Business Process Outsourcing

The best time to outsource claims is when operational pressures start outweighing internal capacity. BPO can provide immediate relief during transitions, launches, or rapid growth.

Common triggers for outsourcing:

- Growing backlog and increasing customer complaints

- Launching new insurance products or entering new markets

- Mergers, acquisitions, or major system upgrades

- Overloaded in-house teams bogged down by manual tasks

These moments offer the perfect opportunity to reassess and restructure with the help of experienced BPO partners.

Of course, successful BPO depends on choosing the right partner.

Choosing the Right Insurance Claims BPO Provider

Not all BPOs are created equal. Choosing the right partner means aligning on technology, expertise, compliance, and service quality.

What to look for:

- Industry-specific certifications and a proven track record in insurance

- Seamless integration with your CMS and internal reporting tools

- Transparent SLAs covering turnaround time, accuracy rates, and compliance benchmarks

- Cultural compatibility and training programs tailored to your market

The best third party claims administrator doesn’t just plug into your operations—they become a true extension of your team.

Let’s recap why insurance claims BPO is becoming a foundational strategy for insurers.

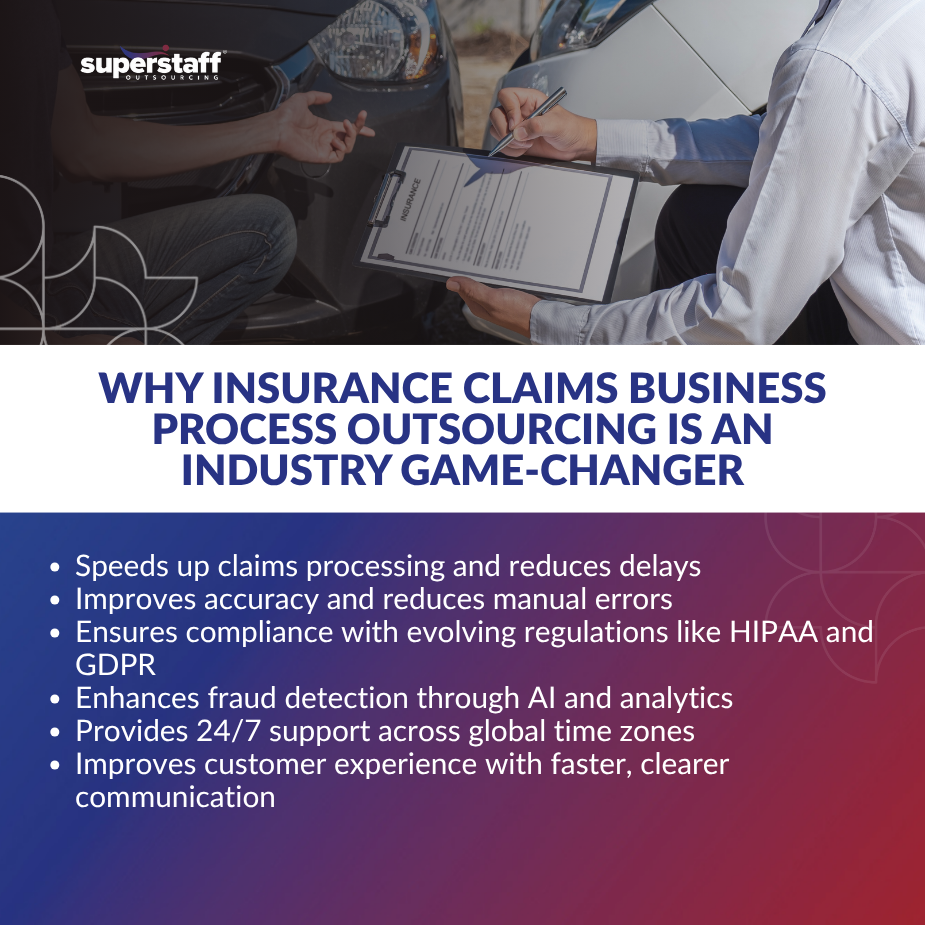

Why Insurance Claims BPO Is a Game Changer

Insurance claims business process outsourcing transforms claims management from a back-office burden into a strategic asset. It empowers insurers to process claims faster, respond to policyholders more effectively, and drive business growth without increasing costs.

By partnering with experienced BPO teams, insurers can:

- Improve processing speed and accuracy

- Enhance regulatory compliance and fraud prevention

- Deliver world-class customer experiences

- Accelerate their digital transformation journey

Ready to modernize your claims process? SuperStaff’s expert BPO teams are trained in U.S. insurance standards and ready to support your growth. Let’s talk about building a better claims experience together.