With the ongoing War in Ukraine, the continued ripple effects of the global pandemic, rising costs of goods, and various geopolitical tensions in different parts of the world, it’s no wonder why companies are seeking strategies to increase their flexibility and agility amid disruptions.

For many U.S. businesses hoping to reduce risks and strengthen their supply chains, nearshoring to South America has become an attractive strategic investment. Moving certain business functions outside their borders but not too far away from their home country has allowed these companies to lower costs while retaining needed control over their operations.

South America: The World’s Fastest-Growing Tech Outsourcing Hub

Companies of all industries can benefit from nearshoring. However, the tech sector, in particular, has been utilizing this outsourcing solution to its advantage. U.S. businesses eye Latin American countries as strategic nearshoring markets for technology outsourcing.

One example is Fetch Package Inc., an Austin-based company that provides delivery services. Due to pandemic-induced labor shortages, the U.S. business struggled to find qualified engineers, so they began looking for workers outside of the country, interviewing candidates from Europe and Africa before finally settling on South American workers.

Now, Fetch Package Inc. has its ideal engineering team, with 10% of its workforce stationed in Latin American countries like Argentina, Brazil, and Peru. Because of those countries’ proximity to the United States, Fetch has no issue setting up meetings or collaborating with their nearshore engineers because they all work in the same time zone.

Why are U.S. companies choosing South America as their go-to nearshore technology outsourcing destination?

Closely aligned time zones make it easier to collaborate on tech projects.

The main reason why many companies are outsourcing their tech functions to Latin America is because of the region’s proximity to the U.S. As such, South American countries often operate in the same or at least similar time zones as U.S. companies.

According to a Bloomberg report, more and more global tech companies are choosing to expand their operations by hiring coders and other tech workers in South and Central American nations. Countries such as Colombia, Chile, Uruguay, and Guatemala share closely aligned time zones.

Compared to offshore outsourcing in Asian countries, the time zone variations between the U.S. and Latin America are less severe. Outsourcing tech jobs to South America allows for fewer work disruptions, easier real-time collaboration, faster problem resolution, and fewer missed deadlines.

Lower cost of living and labor costs drive South America’s global competitiveness.

In addition to geographical proximity and similar time zones, Latin America boasts lower labor costs and cost of living, making the region an ideal outsourcing hub for businesses looking to save money.

Tech companies significantly reduce overall expenses by nearshoring technology functions to Latin America. According to the U.S. Bureau of Labor Statistics, software developers in the U.S. earn a median salary of $127,000. Meanwhile, the same role in Latin American countries will cost businesses around $74,000 annually.

Compared to remote workers from other parts of the world, not just in the United States, South American hires are still more financially attractive for global companies. According to industry experts, workers from Latin America make $20,000 less per year than their Asian counterparts.

As wages increase across the board, wages in Latin America have reduced, falling by 4% within the same period.

Latin American nations are increasing their investments in IT infrastructure and training.

Beyond geographical proximity and lower labor costs, Latin American countries are attractive tech outsourcing destinations because their governments have been making significant infrastructure investments.

As the business world evolves and adapts to new technologies, many South American nations have kept pace with every development and innovation, allowing for greater global competitiveness.

Many countries in Latin America have also been proactive in making education and training more accessible to young people. They have been working with local universities and technical schools to invest in the progress of their most promising students.

Top BPO Destinations for Nearshoring to South America

Colombia

Colombia is quickly becoming the top destination for many U.S. businesses for good reason. It is South America’s leading BPO location thanks to its massive labor force, a wealth of highly skilled and educated bilingual professionals, and improving tech infrastructure.

For over 20 years, Colombia has led the charge as a BPO market, being one of the pioneers of the first outsourcing wave in the Latin American region. To this day, the country continues to develop its industries and diversifies its outsourced services to attract more foreign investments.

Since 2019, when the Colombian government began promoting nearshoring, the country has attracted over $1 billion in foreign investments, with hundreds of global companies delegating business processes to BPOs in the country.

In Kearney’s 2021 Global Services Location Index, Colombia ranked 13th, beating neighboring countries like Mexico, Chile, and Brazil. Meanwhile, the country took the top spot in the 2022 Offshore BPO Confidence Index, winning first place for the second year in a row.

The Latin American powerhouse also boasts the region’s fourth-largest economy, next to Mexico, Argentina, and Brazil. It also has the fourth biggest call center market, with centers spread across its six most populated cities (including Medellin, Cali, and Bogota).

Why Choose Colombia for Tech Outsourcing?

With a population of over 23 million workers, Colombia boasts the third-largest labor force in Latin America. Out of this massive workforce, approximately 600,000 are employed in call centers and BPOs.

The local government plans to support the country’s outsourcing boom by investing in the latest technology and IT infrastructure, helping ensure Colombia’s competitiveness in the global technology market.

In addition, Colombia is home to over 5,000 tech companies, which is why the country has been called the “Silicon Valley of Latin America.” To encourage further technological development, the government has been working with local schools and universities to offer training and education for in-demand technical skills like software development and coding.

Argentina

Argentina is another fast-growing outsourcing destination in South America, thanks to its substantial investments in infrastructure, workforce education, and favorable government policies and initiatives.

Several prestigious universities offer degrees for in-demand fields such as engineering and software development. Argentina also boasts a high literacy rate of 98% and the highest English proficiency score in Latin America.

To enhance its reputation as a prime destination for nearshore technology outsourcing, the Argentine government launched “Argentina Programa,” a nationwide program to make tech education more accessible to its citizens. The initiative funds 60,000 programming scholarships, offers a financial incentive of 100,000 Argentine pesos for workers to purchase computers, and provides free Internet access and connectivity.

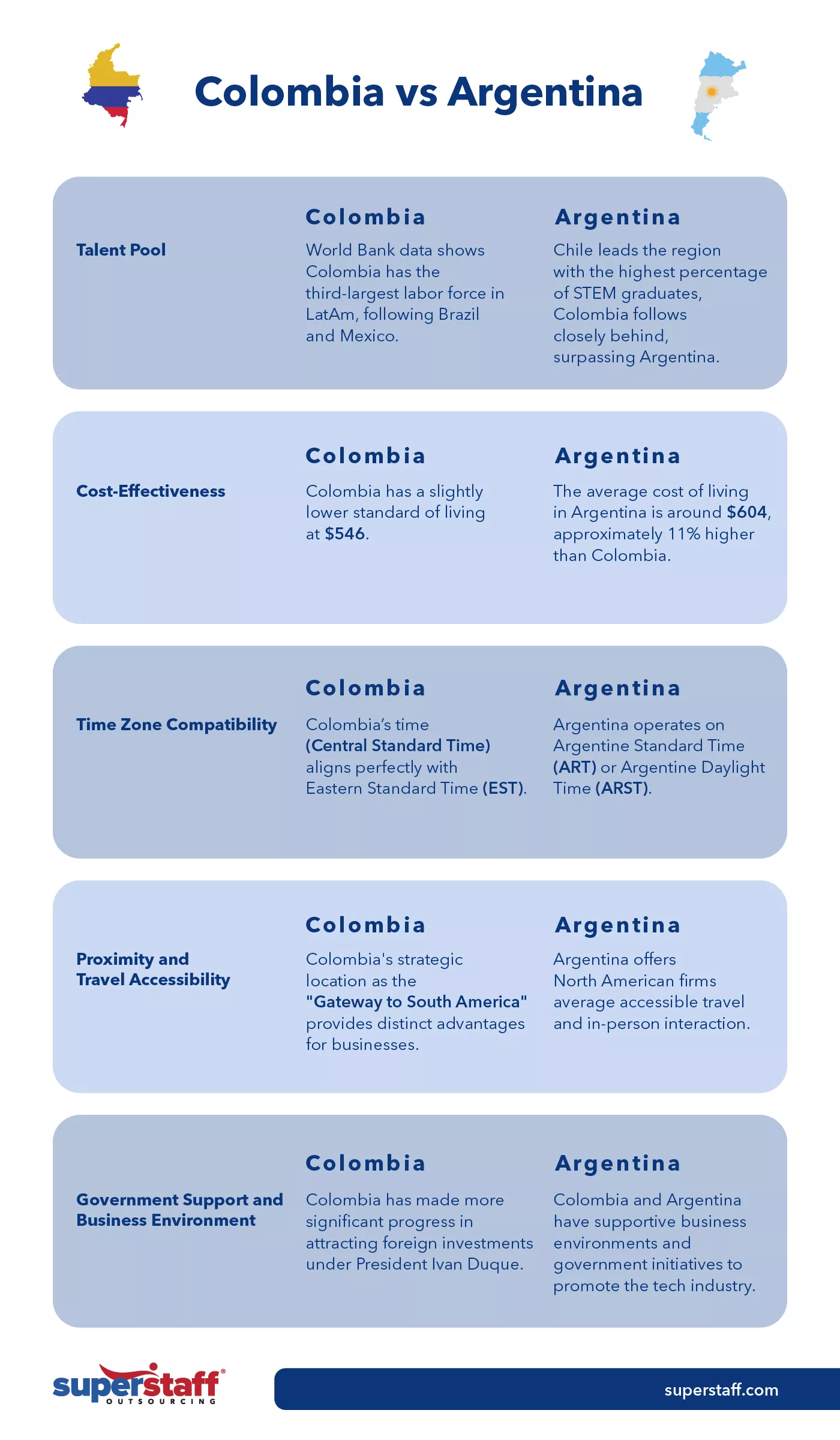

Colombia vs. Argentina

Although both Colombia and Argentina are considered top nearshoring destinations, Colombia offers a competitive edge when it comes to labor costs.

Colombia has a lower cost of living overall than Argentina, making it a more attractive BPO location for businesses concerned with reducing costs. To illustrate: In Argentina, the average cost of living is around $604, which is 11% higher than Colombia’s, which is $546.

Another advantage of nearshoring to Colombia vs. Argentina is geographical proximity. Known as the “Gateway to South America,” Colombia’s strategic location makes it more accessible for in-person business travel than Argentina, which is farther away from the United States.

Mexico

Being the United States’ closest Latin American neighbor, Mexico has long been one of the top BPO destinations in the region. In addition to its favorable location, the country offers competitive labor costs and a large skilled workforce.

In recent years, more and more companies have been outsourcing their business processes to Mexico to reduce costs, streamline their supply chain, and increase operational efficiency. This is particularly true for the manufacturing sector.

To address supply chain disruptions, the U.S. and Mexican governments have worked together to establish the Border Industrialization Program. This partnership allows American companies to establish factories and warehouses in Mexico, creating products using raw materials and components sourced from the U.S.

U.S. manufacturers have long relied on skilled Mexican workers to handle the assembly operations of their vehicles, televisions, electronics, and other crucial products. However, the country is also quickly becoming one of Colombia’s biggest competitors in technology outsourcing.

Colombia vs. Mexico

When it comes to nearshore technology outsourcing, both Colombia and Mexico are known for their large population of highly qualified tech professionals. However, Colombia has the upper hand in one specific area: its government incentivizes foreign companies to outsource in their country, unlike Mexico.

The Mexican government has recently established amendments to their labor and tax laws, which have affected global companies’ ability to outsource business processes to the country. Before hiring a nearshore Mexican worker, businesses must be registered with Mexican labor authorities.

Meanwhile, U.S. companies are not only allowed but encouraged to hire Colombian workers. Foreign businesses may even receive certain financial benefits, tax incentives, and exemptions by hiring software and IT specialists in Colombia.

Brazil

Compared to Colombia and Mexico, Brazil’s outsourcing industry is still young and finding its footing. However, the country does have an opportunity to expand its influence over the next few years, making it one of the more promising BPO destinations in South America.

Over the past decade, Brazil has established itself as a critical player in the international call center market. Even amid the global financial crisis of 2008, the country’s economy and call center operations managed to stay afloat and even grow despite the challenges.

In two short years (between 2005 to 2007), Brazil moved its ranking from tenth place to becoming the fifth top offshoring destination in the world.

By 2018, Brazil made it to the top 3 of the Tholons Digital Nations list, standing alongside India and the Philippines, both heavyweights in the outsourcing industry. It has remained on the list ever since, but its ranking slipped slightly during the pandemic.

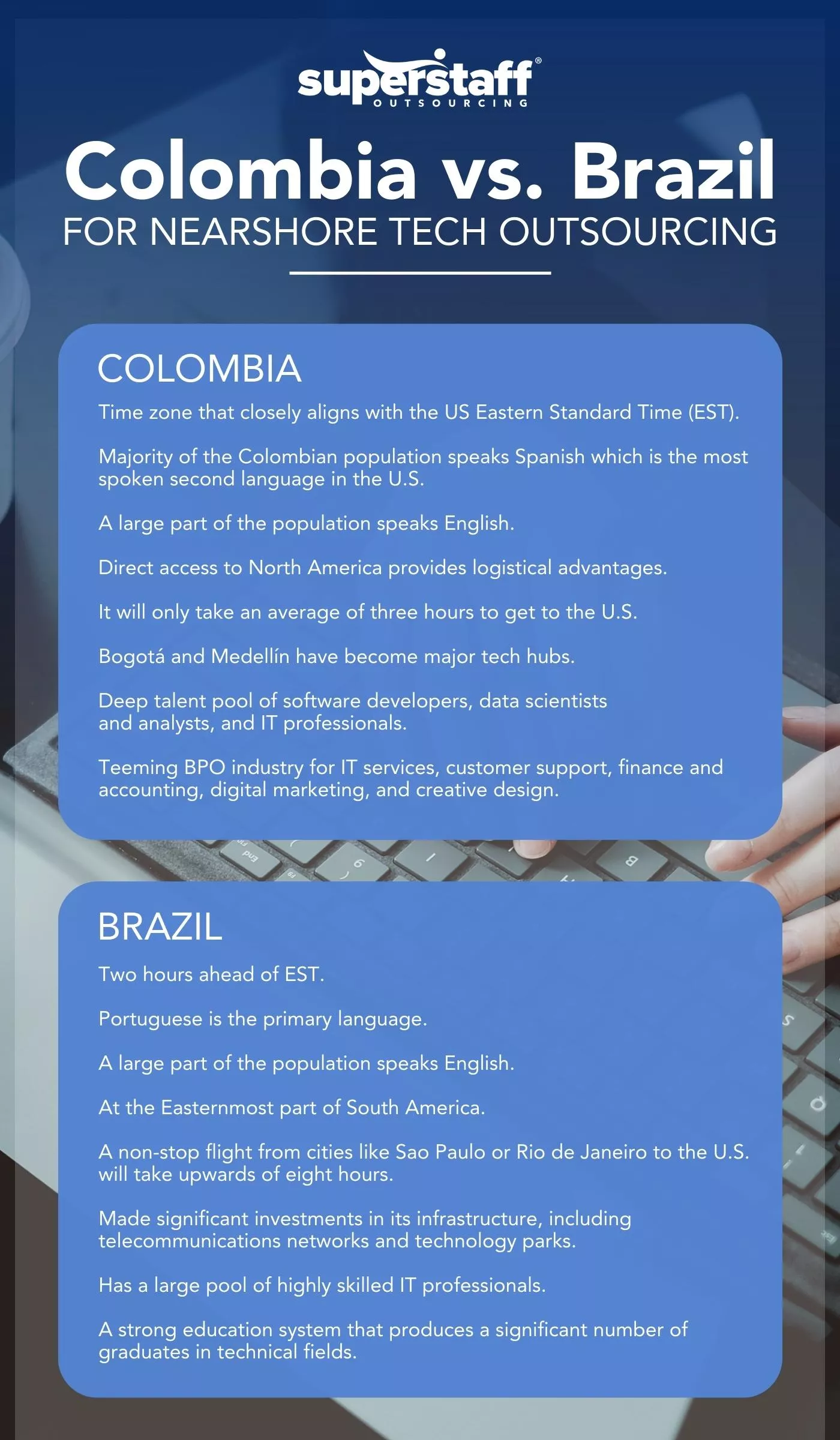

Colombia vs. Brazil

Industry experts see Brazil as an emerging competitor for software development services in the Latin American region, potentially rivaling Colombia.

However, compared to Colombia, one of the pioneers of nearshoring, Brazil is still new to the outsourcing game and may not be as fully reliable as a BPO destination. Time will tell whether Brazil can step up to the challenge, but Colombia is still the safer strategic option, especially for businesses hoping to reduce risks.

Costa Rica

According to the World Economic Forum, Costa Rica is home to the top human capital in South America, especially for technology outsourcing. The primary reason for Costa Rica’s large number of highly skilled workers is its flourishing education system.

Housing the most prestigious universities in Latin America, including Instituto Tecnológico de Costa Rica (TEC), INCAE Business School, and Universidad de Costa Rica (UCR), Costa Rica produces about 3,500 engineers and over 7,000 STEM (Science, Technology, Engineering, and Mathematics) graduates each year.

Global companies, particularly from the United States and the United Kingdom, have been tapping into Costa Rica’s highly educated workforce, taking advantage of their quality work while keeping costs low thanks to the Latin American country’s relatively low cost of living.

Colombia vs. Costa Rica

The main disadvantage of outsourcing to Costa Rica is the quantity of its workforce.

Because it’s a much smaller country than its other Latin American neighbors, Costa Rica can’t compete with the larger populations of countries like Colombia. So, despite having very highly skilled and educated software developers, the country may not have enough of them to meet high global demand.

The shortage of skilled labor in the country also contributes to a more competitive and tight local labor market, which means that wages in Costa Rica are higher than in other South American nations.

Peru

For software development outsourcing, Peru is one of the top BPO destinations in Latin America, boasting a booming tech scene and some of the region’s most skilled software developers and engineers.

In 2021, the Peruvian IT industry grew by 9% – one of the highest growth rates in South America. Despite being a newer nearshoring market, this up-and-coming BPO destination has plenty to offer, including over 38,000 experienced software developers and a healthy startup economy that has incurred about $160 million in recent deals.

To continue pushing Peru forward as a competitor in tech outsourcing, its local government is making further investments in the country’s tech ecosystem. Peru invests heavily in new technology and infrastructure, innovative startups, and software-related economic growth.

Colombia vs. Peru

Despite being a promising BPO location for software development, Peru may not be as reliable as Colombia for one specific reason: Peru is still experiencing continued political instability, which may create a tense business environment for foreign investors.

Political tensions were at their highest point during the COVID-19 pandemic, with the number of protests spiking significantly. These disruptions even affected electricity and internet stability in the nation, creating problems for BPO workers.

Although the political unrest in Peru is dying down post-pandemic, U.S. businesses that want to avoid disruptions in their tech operations may choose locations like Colombia that are more politically stable.

Partner With an Experienced and Reliable Nearshoring Provider

Are you ready to start nearshoring in South America? Your next step should be to find and work with a trustworthy BPO provider.

At SuperStaff, we are passionate about helping our clients solve their most significant challenges–whether it’s addressing tech talent shortages or strengthening their supply chains–through our comprehensive and scalable outsourcing solutions.

Contact us today, and let’s discuss how our nearshore centers in Colombia can help empower your growing business!