The Red Sea, a crucial waterway for international trade, is under siege — and the domino effect it triggered is trickling down to virtually all aspects of global trade, from logistics to manufacturing and retail.

Understanding the Red Sea Crisis

The supply chain crisis began in October 2023, when Houthi rebels in Yemen launched missiles and drones at Israel, demanding an end to the invasion of Gaza. Since then, the Houthis have targeted commercial shipping vessels traversing the Red Sea and the Bab el-Mandeb strait, causing major disruptions to supply chains.

The Red Sea attacks have forced shipping companies to reroute vessels around the Cape of Good Hope, adding weeks to voyage times, increasing freight costs, and leading to a disruption of around 30% of worldwide container trade.

To help you get a fuller grasp of the issue, here are a few numbers you need to know:

- $1 trillion in annual merchandise at risk as conflict escalates

- 80 “incidents” in the Red Sea and the Gulf of Aden.

- > 33 reported attacks

- 30% of the world’s container traffic has seen disruptions

- 2% projected increase in goods inflation if the crisis continues

- 50% drop in Suez Canal Trade; 32% in Panama Canal Trade

- 20-day delay in delivery times due to Cape of Good Hope rerouting

- Port Call Decrease Per Region:

- Sub-Saharan Africa-6.7%

- European Union, Middle East and Central Asia-5.3%

Sources: International Monetary Fund, MarketWatch

Impact of the Red Sea Crisis on Retail Sector

The crisis has hit retailers hard despite being among the last links in the supply chain. The attacks spelled disaster for European and Western markets.

European retailers, such as Adidas and Next PLC, which relied heavily on the Suez Canal for maritime imports from Asia, struggled with disruptions. While U.S. retailers had more flexibility, they also faced delays in the delivery of spring and summer fashion collections, particularly impacting companies like Abercrombie & Fitch Co. and Gap Inc.

Smaller operators, especially those with high import exposure for low-cost products, face significant cost increases. Worse, the crisis also affects other industries, such as arts-and-crafts and home goods, with companies like Joann Inc. and At Home taking a hit.

The Real Problem for Retailers: Consumer Behavior

While delays are the immediate effect, the main issue for retailers is the impact of the crisis on consumer behavior.

The disruptions have caused container spot rates and insurance costs to soar, leaving consumers to bear the cost. Rising inflation and living costs add to the challenge. Meanwhile, retailers struggle to balance the hike in shipping fees with the loss of sales.

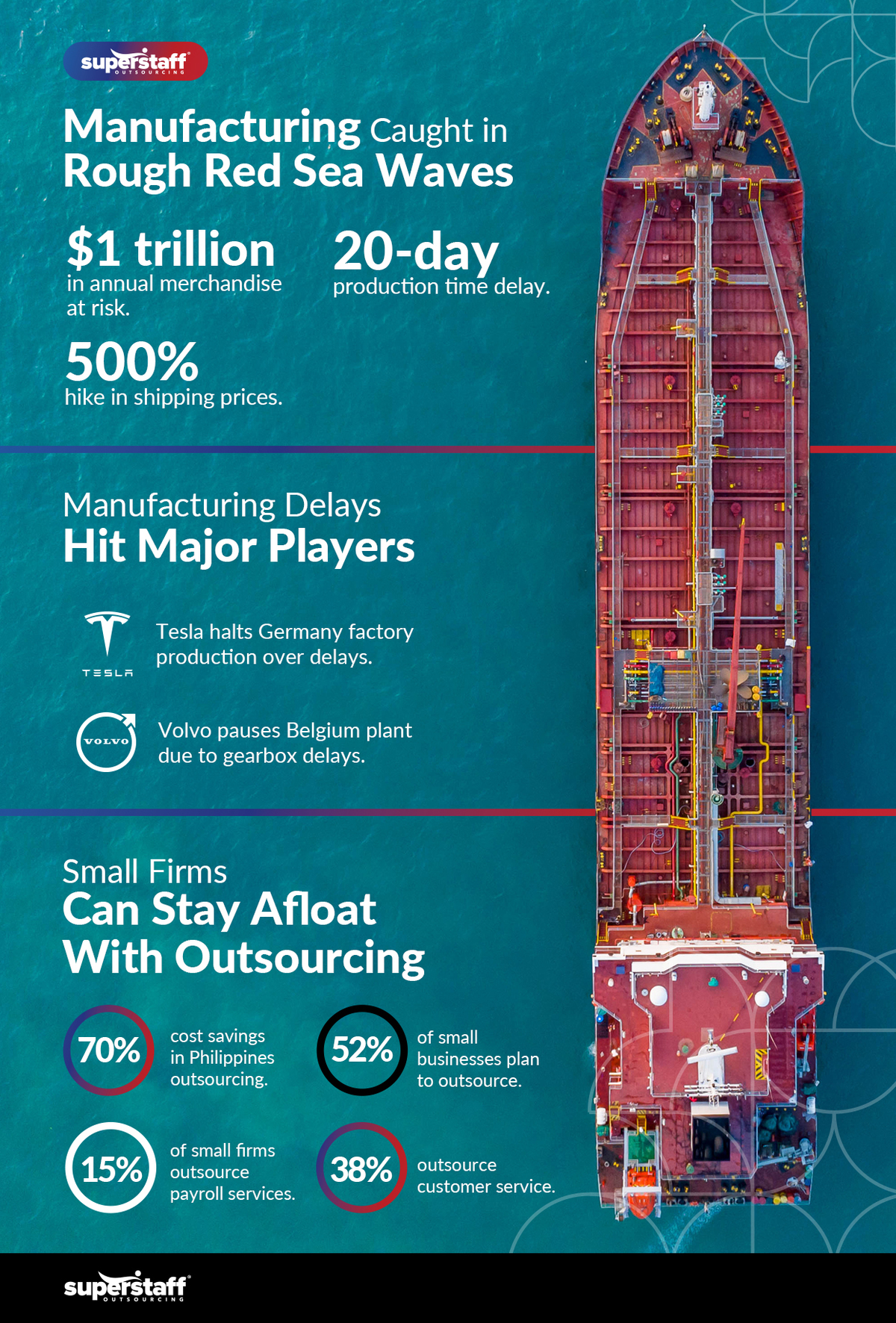

Impact on the Manufacturing Sector

Unfortunately, manufacturers were not spared from the crisis either.

A recent survey revealed job losses and cuts in purchasing and stocks, with the sector remaining in decline at the start of 2024. The crisis led to delays in raw material deliveries, higher costs, and extended supplier lead times.

Input cost inflation hit an 11-month high, prompting manufacturers to raise selling prices or accept delays. Despite some improvement, the industry has contracted for the past 19 months. Experts stress the need for government support, including policy direction and investment in skills and infrastructure projects.

In January, the Red Sea crisis caused notable disruptions to European companies, especially those engaged in shipping routes between Asia and Europe.

Ship redirection, prompted by Red Sea attacks, has resulted in substantial delays as vessels circumvent the Cape of Good Hope instead of traversing the Suez Canal. This adjustment prolongs most Asia-to-Europe journeys by nearly two weeks.

According to S&P Global data, among the European countries under observation, UK manufacturers bore the brunt of the crisis, with 12% of the manufacturing PMI survey respondents reporting deteriorated delivery times. Greece (9%), France, and Germany (8%) followed closely.

Impact on the Logistics Sector

The logistics sector stands as one of the hardest-hit sectors.

Shipping rates for 40-foot containers soared to $10,000 because of extended detours around the Cape of Good Hope. According to Gartner, shipping rates from Asia to the U.S. West Coast have surged by 38%, while West Coast to Asia has increased by 21%.

The situation is even more severe for shipments from Asia to Europe, where costs have skyrocketed by 175-250%. This surge in shipping costs has resulted in a staggering 500% total price point hike compared to pre-crisis levels.

Additional costs such as extended transit times, increased fuel consumption, and surging war risk premiums due to naval and air strikes in Yemen also add to the pressure. Ultimately, the Suez Canal Authority’s increase in transit fees by 5-15% further escalated shipping costs.

Such unprecedented price increases pose significant challenges for businesses, from manufacturers to retailers, grappling with the need to absorb higher costs or pass them on to consumers, exacerbating inflationary pressures and impacting consumer spending habits.

Freight Forwarders

The crisis is prompting manufacturers to seek alternative routes, leading to increased demand for air freight. While air freight prices remain stable, rates on the China-to-Europe route surged 91% week-on-week.

Logistics firms also reported rising inquiries for air capacity, with some shifting from ocean to air due to longer delivery times and higher costs. As the crisis continues, more manufacturers are expected to turn to air freight to mitigate supply chain disruptions.

However, with consumer behavior directly impacted by the attacks, freight forwarders are left with the unenviable task of finding solutions to mitigate the effects on retailers and end consumers.

They must anticipate and adapt to changing consumer demand patterns caused by delays in supply chains — rerouting shipments, prioritizing certain products, or leveraging technology to improve efficiency and visibility throughout the transportation process.

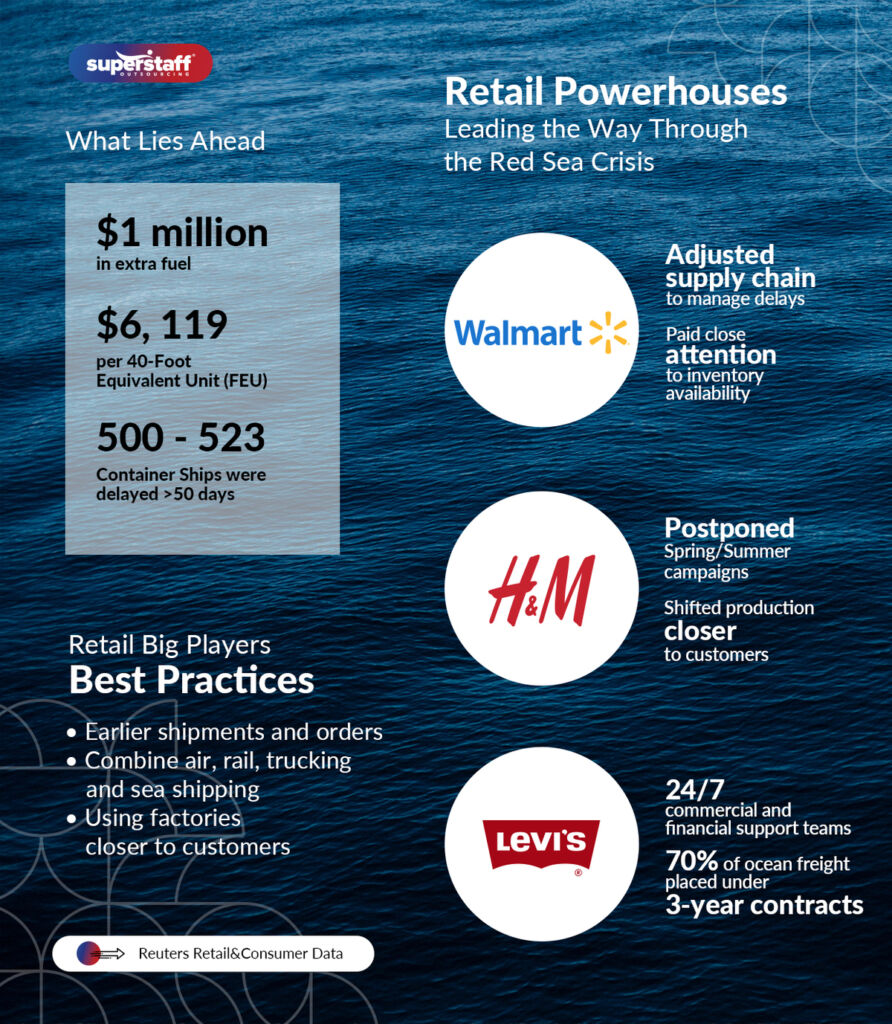

How Big Players Are Coping?

Amid the crisis, some major players are finding more innovative ways to survive—and here’s how they’re doing it.

H&M

Due to shipping delays, H&M, the world’s second-largest fashion retailer, adjusted its Spring/Summer campaigns. CEO Daniel Erver said that they postponed the start of some campaigns to accommodate the delays, with a minor impact on customer product availability. The delay in campaign launches could be around two weeks in some markets.

Shipping firms avoiding the Suez Canal due to militant attacks have caused container vessels to be rerouted around Africa’s southern tip, increasing freight costs and delaying the arrival of clothes and shoes from Asian factories to Europe. The retail giant emphasized in its first-quarter report that it was closely monitoring the situation in the Red Sea and taking measures to minimize any impact on product availability, freight costs, and stock levels.

Walmart & Adidas

Meanwhile, the Maersk Tanjong, carrying cargo for retailers and clothing brands including Walmart, Adidas, and ASOS, diverted south to navigate Africa’s Cape of Good Hope due to Maersk pausing vessel movements through the Red Sea. The diversion added thousands of miles and five days to the Tanjong’s trip to Norfolk, Virginia, incurring around $1 million in extra fuel costs for a northern European trip.

In response to the crisis, some companies are exploring alternatives such as combining sea, air, and rail shipping, ordering goods earlier, and using factories closer to home, a strategy known as nearshoring.

Tesla and Volvo

Manufacturers, including automakers like Tesla and Volvo, are taking a similar approach.

Tesla announced the suspension of car production at its Germany factory due to delayed shipments after ships were rerouted around Africa. Meanwhile, Volvo Car is also pausing output at its Belgium plant due to delayed delivery of gearboxes.

The attacks on shipping in the Red Sea have led to increased shipping costs and delays, prompting some tanker operators to cease traversing the region. This crisis and logistical challenges, like low water levels in the Panama Canal, are disrupting maritime trade routes.

Maersk, MSC, and Hapag-Lloyd

MSC, the world’s largest shipping carrier, will no longer transit the Suez Canal due to security risks after its container ship, MSC PALATIUM III, was attacked in the Red Sea.

This decision follows similar moves by shipping giants Hapag-Lloyd and Maersk, who have also paused travel through the Red Sea. With these three shipping giants controlling about 40% of global trade, their collective pause in vessel transits will heavily impact the supply chain.

DHL

Like many other logistics firms, DHL anticipates a surge in demand for air freight due to disruptions in maritime trade caused by the attacks. While they haven’t seen many conversions from ocean to air freight yet, they expect this to change if the situation persists.

To prepare for this potential increase in demand, DHL is already blocking additional air capacity on core trade lanes. This proactive measure aims to ensure that freight keeps moving smoothly despite the disruptions in sea routes.

Despite declining air cargo spot rates in December, DHL and other logistics companies are gearing up for the expected surge in demand for air freight services as the Red Sea crisis continues to disrupt maritime trade.

Riding Out the Red Sea Tide: Overcoming Common Challenges in Operational and Supply Chain Management

In the face of the crisis, businesses face severe challenges that can disrupt operations and impact customer satisfaction. From shipping delays to inventory management woes, these hurdles require strategic solutions to maintain efficiency and meet customer demands.

Poor customer experience

One of the most pressing concerns for businesses is the potential for poor customer experience resulting from shipping delays, in a cutthroat landscape where reliability and efficiency are key, late deliveries and missing orders can have serious repercussions.

Consistent shipping delays can tarnish a company’s reputation. Customers expect reliability and dependability from their suppliers, and repeated issues with shipping can erode trust.

Negative experiences can lead to dissatisfaction and prompt customers to seek alternative suppliers. Additionally, a lack of clear communication about the reasons behind delays can exacerbate the problem. Customers appreciate transparency and updates about the status of their orders, and failing to provide this information can further strain the relationship.

Inventory Management

As shipping routes face disruptions and delays, companies find it increasingly challenging to maintain optimal inventory levels.

The uncertainty surrounding shipping schedules can complicate inventory management decisions. On one hand, there’s the risk of overstocking, where companies order excess inventory to mitigate the potential impact of delays. However, this approach can tie up valuable capital and warehouse space, increasing costs and inefficiencies.

On the other hand, the risk of stockouts looms large, as delayed shipments or rerouted goods may result in inventory shortages. This can lead to lost sales, decreased customer satisfaction, and reduced revenue.

Delivery delays

The longer route around the Cape of Good Hope has caused a notable drop in vessel capacity, surpassing the pandemic’s impact on the supply chain.

Beyond affecting vessel capacity, the disruptions have far-reaching implications for global trade and energy markets. Shell and BP have already suspended shipments through the Red Sea, and several tanker operators and energy companies are avoiding the area. Product tanker rates show signs of increase, indicating the market’s response to the crisis.

High overhead spending

The economic impact also cannot be denied.

Shipping costs have surged along routes typically passing through the Suez Canal, with spot rates from China to the U.S. rising by approximately 140% and 120%, respectively.

Disruption-Fueled Spike in Inflation

- Global Core Goods Inflation — +0.7 percentage points

- Overall Core Inflation — 0.3 percentage points

While there is an excess supply of container ships globally, elevated shipping rates may persist, impacting global industry and economic recovery in the first half of 2024.

Weathering the Storm: The Role of Logistics and Dispatch Services

Against the backdrop of the Red Sea crisis, businesses are seeking more innovative strategies to ensure business growth and mitigate risks. One such strategy is partnering with strategic BPO partners to gain access to valuable resources, information, and support mechanisms that will help them navigate geopolitical uncertainties effectively.

Outsourcing is particularly beneficial for smaller firms, with more than half (52%) of small businesses planning to outsource. 38% already outsource customer service, while another 15% outsource payroll services. This enhances their resilience and operational agility while facilitating smooth global trade flows in the face of geopolitical challenges.

Seamless Customer Experience

An exceptional customer experience lies at the heart of every successful business operation. From offering expert advice on shipping regulations to providing real-time updates on shipment status, every interaction with customers is an opportunity to exceed expectations and differentiate oneself in a competitive marketplace. With outsourced customer experience, businesses can maintain high responsiveness and service quality levels across order tracking, shipment status updates, and resolving inquiries and complaints.

Multilingual Support for Seamless Interactions Across Diverse Stakeholders

Businesses often operate multicultural, engaging with clients, suppliers, customs officials, and other stakeholders worldwide. Communication is essential in such a landscape for building trust, resolving issues, and delivering exceptional service.

Fortunately, outsourcing multilingual support enables businesses to bridge language barriers and communicate effectively with stakeholders across different regions and cultures. Whether communicating with shippers, consignees, customs officials, or other stakeholders, multilingual support ensures effective communication and comprehension, regardless of language barriers.

Back Office Support To Keep Operations Running Smoothly

BPO companies offer freight forwarders the opportunity to outsource administrative tasks related to documentation and paperwork handling. With expertise in document management systems and regulatory compliance, back-office providers ensure accuracy, efficiency, and adherence to industry standards in handling critical paperwork, ultimately contributing to the seamless flow of goods through the supply chain.

Accounting & Bookkeeping

Accounting and bookkeeping involve managing financial records, transactions, and reporting. Outsourcing these tasks can help businesses maintain financial stability during the Red Sea crisis.

Data Entry and Management

Data entry involves inputting, organizing, and managing data in various formats, such as electronic databases, spreadsheets, or CRM systems. Data management encompasses tasks like data cleaning, deduplication, and updating records.

Efficient data entry and management are essential for businesses to track inventory, monitor supply chain activities, and maintain customer records accurately. Outsourced data entry services can handle large volumes of data quickly and accurately, allowing businesses to focus on core functions and respond swiftly to changes in the supply chain.

Virtual Assistants

Virtual assistants (VAs) provide administrative support remotely, handling tasks such as email management, scheduling, research, and customer support.

Virtual assistants can play a crucial role in helping businesses adapt to the challenges of the Red Sea crisis. By outsourcing administrative tasks to VAs, companies can free up valuable time and resources to address supply chain disruptions and maintain customer satisfaction. VAs can assist with tasks like managing customer inquiries, coordinating with suppliers, and organizing virtual meetings, ensuring smooth communication and operations despite the crisis.

Recruitment Process Outsourcing (RPO)

Recruitment Process Outsourcing involves delegating all or part of the recruitment process to an external service provider. This includes job posting, candidate sourcing, screening, and onboarding.

During severe global labor shortages, businesses may need to adapt their workforce to meet changing demands and operational challenges. RPO providers can help enterprises to quickly scale their workforce up or down as needed, ensuring continuity of operations despite disruptions in the supply chain. By outsourcing recruitment, companies can access specialized expertise, streamline hiring processes, and reduce time-to-fill roles, enabling them to respond effectively to evolving business needs during the Red Sea crisis.

Logistics and Dispatch Services

With disruptions to shipping routes and delivery delays, companies across industries are turning to logistics and dispatch services to navigate these turbulent times. Logistics services providers excel in managing complex supply chains, coordinating transportation, and optimizing routes to ensure timely delivery.

Dispatch services also offer real-time monitoring and tracking of shipments, allowing businesses to stay informed about the status and location of their cargo.

Invoice Processing

Invoice processing becomes critical for maintaining financial operations during the Red Sea crisis. Logistics and dispatch services can handle invoice processing efficiently, ensuring that bills are accurately processed and paid on time. By streamlining this process, businesses can maintain good relationships with suppliers and avoid disruptions to their supply chain due to payment delays.

Emergency Hotlines and Dispatching Services

In times of crisis, having an emergency hotline and dispatching service is essential for quick response and resolution of issues. Logistics providers can offer 24/7 emergency hotlines and dispatching services to address urgent matters, such as shipment delays, rerouting requests, or emergency assistance for stranded shipments.

Service Rate Inquiry

Amid the Red Sea crisis, service rate inquiries have become crucial for businesses to manage their logistics costs effectively. Logistics services can handle rate inquiries, providing accurate and up-to-date information on shipping rates, surcharges, and other fees associated with different transportation options.

Tracking and Tracing Inquiry

With shipments facing delays and reroutes, tracking and tracing have become indispensable for businesses to monitor their cargo’s whereabouts. Logistics providers offer tracking and tracing inquiry services, allowing businesses to stay informed about the status and location of their shipments in real-time.

Air WayBill Processing

Air waybill processing becomes essential as companies explore alternative shipping methods like air freight to bypass the Red Sea crisis. Logistics services can handle air waybill processing efficiently, ensuring that all necessary documentation is completed accurately and promptly for air shipments.

Freight Bill Auditing

Amid supply chain disruptions, businesses must ensure they are accurately billed for freight services. Logistics providers offer freight bill auditing services to review and verify invoices, identify any discrepancies or errors, and ensure that businesses are only charged for the services they receive.

Freight Payment Processing

Freight payment processing is vital for maintaining positive carrier relationships and ensuring smooth logistics operations. Logistics services can handle freight payment processing, ensuring that invoices are paid on time and accurately to avoid service disruptions.

Freight Booking Management

With the need to reroute shipments and book alternative transportation, efficient freight booking management is crucial. Logistics providers offer freight booking management services to handle the booking process, secure available capacity, and coordinate transportation for businesses facing challenges due to the Red Sea crisis.

Freight Bill of Lading Services

Freight bill of lading services are essential for documenting shipments and ensuring that cargo is transported accurately and securely. Logistics providers can handle the preparation and processing of freight bills of lading, ensuring compliance with regulations and facilitating smooth transportation of goods despite the crisis.

Data Analytics To Assess Geopolitical Risks and Optimize Routing Decisions

Data is the lifeblood of modern logistics operations, providing valuable insights into every aspect of the supply chain. For freight forwarders, the ability to collect, analyze, and leverage data effectively is essential for making informed decisions, identifying trends, and mitigating risks.

Outsourcing logistics services empowers businesses to leverage data analytics tools and techniques to analyze vast amounts of data related to geopolitical events, trade patterns, weather conditions, and security threats. Through advanced data visualization techniques, such as heat maps and geospatial analysis, they have access to actionable insights that will help them optimize routing decisions and mitigate the impact of geopolitical uncertainties.

Why the Philippines?

Outsourcing to the Philippines, known for its English-proficient workforce and cost-effective labor, has become increasingly popular among companies seeking to enhance efficiency and streamline operations. Studies have shown that businesses can save up to 70% cost savings by outsourcing in the country.

Navigate the Red Sea Crisis With BPO Support

As a leading outsourcing provider, SuperStaff specializes in delivering tailored solutions to meet the diverse needs of businesses across various industries. We empower organizations to streamline operations, reduce costs, and enhance overall performance by leveraging our focus on quality, efficiency, and innovation.

With a commitment to excellence and continuous improvement, SuperStaff ensures that clients receive exceptional service and support tailored to their specific requirements. Whether handling customer service or managing back office outsourcing services, we consistently deliver results that exceed expectations, enabling businesses to thrive in today’s dynamic and fast-paced environment.