Business success has long been synonymous with diversifying income sources and driving revenue streams. However, eliminating and simplifying work processes is equally critical to ensure that companies run efficiently.

As companies grow, the quantity of documentation and invoices increases as well. So, today’s business leaders must seek innovative ways to maintain profitability by streamlining their operations.

How can businesses scale up and optimize their financial operations without adding too much unnecessary risk? One solution is to outsource financial services to a reliable BPO provider.

How Financial Services Outsourcing Helps Businesses Streamline Processes

Upgrading financial operations has become the top priority for companies in 2023 and beyond.

A study from the American Productivity & Quality Center (APQC) cited “improving finance processes” as among the top three priorities for organizations this year, with over 55% stating it as one of their focus areas. The same study also found that 97% of executives consider finance business partnering as a solution to their streamlining efforts.

Considering the significant investment in optimizing financial services, businesses should turn to BPO solutions for help. Industry analysts predict skyrocketing demand for financial outsourcing services, estimated to reach $68.8 billion by 2030, with a 6% compound annual growth rate (CAGR) from 2022 to 2030.

Here are a few reasons why companies should consider outsourcing as a strategic solution for streamlining financial operations:

Minimize your core team’s workload by delegating time-consuming tasks to outsourced professionals.

Previously, a financial team’s role was limited to stereotypical back-office scorekeeping functions. Today, they shoulder many responsibilities, including linking data across departments, performing financial analysis and accounting, monitoring cash flows, and executing proactive planning.

However, juggling multiple core tasks presents more significant risks for liabilities. As the firm grows, even a slight oversight in the calculation, forecasts, and planning can cause irreversible harm to its bottom line.

Businesses must seek strategies to make their financial processes productive, infallible, and cost-effective. One solution for that is outsourcing financial services.

Through financial services outsourcing, your finance department can offload non-core and specialized tasks, delegating them to experienced professionals.

For instance, you can appoint an outsourced bookkeeper, accountant, or financial planner to work on your financial statements, expenditure planning and forecasts, and commercial records. Thus, your business can dedicate more time to revenue-raising projects such as customer service, content marketing, and branding.

Gain access to top-of-the-line technologies that help you optimize your financial operations.

The financial and accounting (F&A) industry was one of the pioneers of digital transformation — but, unfortunately, it came to a standstill as other sectors continued evolving. Since then, most banks and financial institutions have depended on antiquated and obscure tech systems incompatible with modern business expectations.

Companies must expedite transformation and digitalize specific processes to achieve financial operations excellence. A 2023 Gartner study revealed that optimizing financial processes using emerging technologies is the top five priorities for most Chief Financial Officers (CFOs) with these few initiatives:

- 92% intend to accelerate tech investments.

- 85% have adopted artificial intelligence (AI) in some way.

- 64% aspire to implement AI en masse within two years.

Instead of forcing your in-house team to sail through these uncharted waters, you can leverage the expertise of outsourced financial services professionals. They help you gain access to innovative techs, allowing you to streamline your financial processes further.

When done manually, generating invoices, settling payables, and reconciling accounts are prone to errors. By investing in robust financial technology (FinTech), companies can minimize inaccuracies and improve work precision while integrating cloud storage to prevent sudden data loss.

Leverage the expertise of outsourced accounting and finance professionals.

A third-party provider specializing in financial and accounting functions can help uncover potential inefficiencies you and your in-house team may have missed.

With outsourced financial services , companies leverage the knowledge and experience of existing professionals instead of finding, recruiting, and training in-house accountants, which can be costly and time-consuming. These accounting professionals are also technically skilled and well-trained in addressing intricate accounting issues such as insufficient financial analysis, payroll errors, and fraud.

The 5,593-page Consolidated Appropriations Act of 2021 (CAA) introduced major tax reforms to individuals. As such, BPO providers ensure their outsourced finance teams stay updated on the latest regulations through rigorous training and upskilling, including:

- In-house seminars: Training events that utilize corporate expertise

- Face-to-face courses: Tax modules are taught in person

- External conferences: Attending talks held outside of your office

Accountants audit your tax returns, ensuring no wrong computations, accidental omissions, or false disclosures that can make you legally liable. Ultimately, your outsourced financial and accounting experts are well-positioned to provide error-free and meticulous guidance, adapting to uncertain economic conditions with fluctuating tax amendments.

Track, monitor, and measure the performance of your outsourced financial team with ease.

When you outsource financial services to a BPO provider, you won’t have to rely on anecdotal evidence or hearsay to know whether your outsourced team is increasing the efficiency of your operations.

Instead, you can measure their performance and see the results by setting relevant key performance indicators (KPIs) — the scorecards of your financial health.

Regularly gauging and monitoring these KPIs lets you track your financial statements and activities and check whether they align with your project goals. It also allows you to address any loopholes head-on and identify areas for improvement.

In short, no measurement = no improvement.

Examples of KPIs for your outsourced accounting and financial team include:

Internal Accounting KPIs

Responsible for budget planning and financial reporting, the internal accounting department employs KPIs to measure performance in its relationship across various organizational stakeholders. Here are some metrics the sector uses:

- Budget to Actual Variances: Calculates the discrepancies between actual and budgeted costs

- First Contact Resolution Rate (FCRR): Quantifies the number of tickets solved upon first contact

- Errors Detected by External Auditors: Measures the number of errors not detected by in-house auditors

Accounts Payable KPIs

Tracking outstanding invoices isn’t sufficient to determine the success of your accounts payable (AP) team. Sitting at the intersection of several business functions, an AP team needs KPIs to strengthen vendor relationships and stabilize financial performance. Some common AP KPIs include:

- Cost Per Invoice: The total expenditures spent for every processed invoice

- Days Payable Outstanding (DPO): The number of days it takes a company to pay back its AP and extinguish debt

- Top Payment Methods: Ranks from “most used” to “least used” payment methods between the company and clients

- Exception Rate: Calculates the rate of problematic invoices needing additional review

Accounts Receivable KPIs

Your ability to collect and manage cash efficiently is the building block for a solid financial forecast. Let’s look at some performance metrics for accounts receivable (AR):

- AR Ratio Turnover: Tallies the times you collect your average receivable balances during a given period

- Days Sales Outstanding (DSO): Estimates how promptly your customers pay their bills

- Best Possible Days Sales Outstanding: Counts a customer’s average days to pay you, assuming their payment is always timely

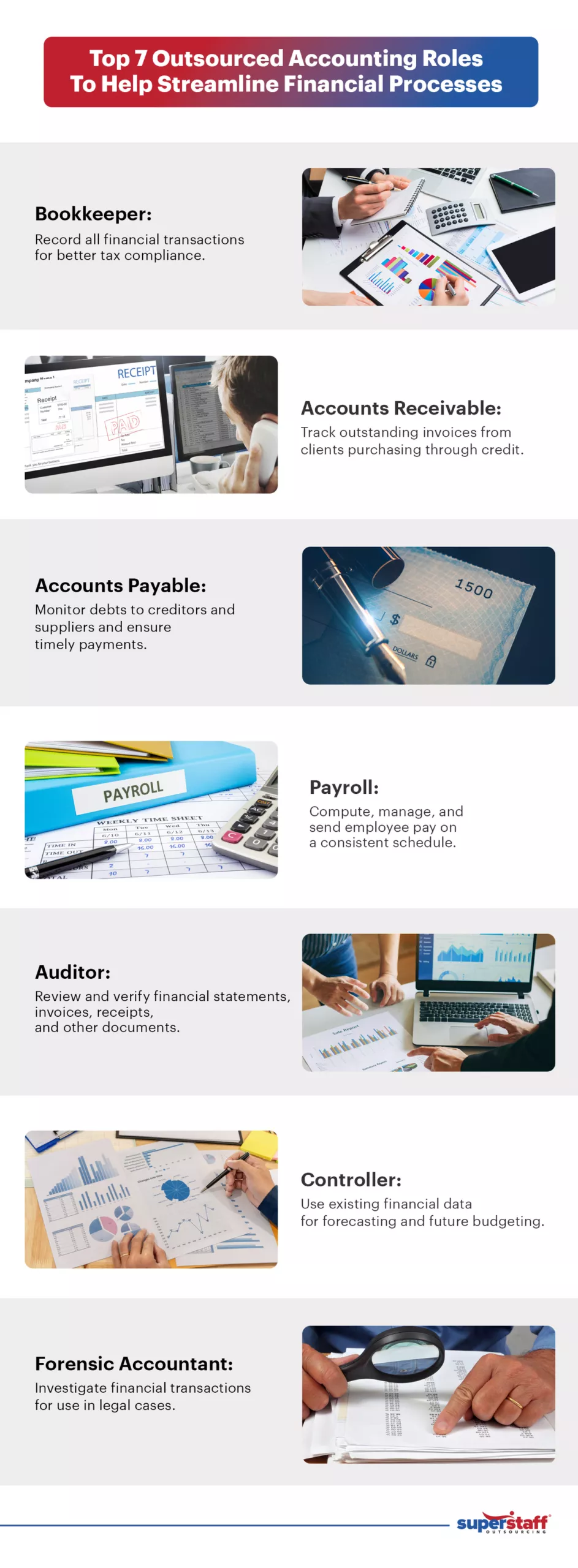

7 Accounting Roles You Can Outsource To Streamline Financial Operations

In the U.S., 37% of small businesses outsource finance and accounting to increase efficiency. Regardless of your company’s size, financial services outsourcing helps companies strive to improve their financial procedures’ accuracy, agility, and practicality while slashing significant overhead costs.

So, here are some roles to consider if you want to outsource financial accounting services for your company:

Bookkeeper

You’re legally obliged to file accurate tax returns. A slight discrepancy can incur unnecessary penalties, unwanted interests, and extra papers to submit. Thankfully, avoiding tax and finance errors is easier with a dedicated bookkeeper.

A bookkeeper can record and manage your financial activities, including expenditures, purchases, invoices, payments, and sales revenue. From these transactions, they validate receipts while keeping an accessible yet comprehensive financial ledger for your reference when calculating your estimated tax payments.

Accounts Receivable (AR)

Your accounts receivable (AR) team records and manages the debt from clients who purchased your products and services on credit. When you keep a large volume of outstanding invoices, AR can help you track the amount you should receive.

One go-to strategy for managing accounts receivables is streamlining invoicing workflow. Here, your outsourced finance team can create an easy-to-follow format by establishing transparent payment processes and policies — a key to preventing potential bad debts.

Accounts Payable (AP)

Expanding your business means keeping a healthy balance of revenue and expenditures. Simply put, your accounts payable (AP) are the “yin” to your AR’s “yang.”

Accounts payables are your short-term debts to creditors and suppliers, appearing on your balance sheet as a current liability. If your AP grows, your company charges more costs (purchasing more products and services) on credit instead of cash.

When you entrust your AP to reliable outsourcing accounting services, they can reorganize your invoices according to priorities, preventing you from paying additional interest for late payments. They can also streamline your operations by handling numerous manual processes and paper invoices, which are inherently expensive and time-consuming.

Payroll

Earning a timely salary is a primary motivation for most workers. As such, neglecting payroll can result in your company losing diligent and skillful workers to your competitors.

Payroll management entails computing employee work hours, reimbursing your employees, withholding appropriate taxes, and preserving financial records.

Remember: maintaining flawless payroll processes isn’t a walk in the park. Without proper foresight, your company may have to deal with legal ramifications, causing monetary losses.

With the expert help of finance professionals, you can access a digitally driven and employee-friendly payroll system featuring self-service functions. Being technologically savvy, outsourced payroll managers can consolidate employee data in the platform, offering comprehensive reporting details.

Auditor

Auditors are qualified and well-trained finance professionals who review a company’s financial statements, accounting entries, invoices, receipts, and other documents. Once assessed, they extract relevant information and lay it out cohesively and accurately, ensuring no fraudulent or suspicious transactions affect the presentation.

You can directly source these professionals from Colombia or the Philippines if your business finds recruiting competent local auditors difficult. These countries produce thousands of certified public accountants (CPAs) annually, providing U.S.-based firms with a vast labor pool to select from.

Controller

An outstanding financial forecast doesn’t only need to be consistent; controllers must make sure it is also comprehensive and data-driven.

After the auditors diligently verify the financial statements, the controllers will strategize for their business future, use existing data for forecasting, and summarize industry or market trends. They also investigate budget deficiencies by overseeing your daily financial operations.

Forensic Accountant

Fraud can exist anywhere, but financial transactions are especially vulnerable. The Federal Trade Commission reported that consumers have lost almost $8.8 billion to fraud in 2022, a 30% uptick from 2021.

Naturally, the demand for forensic accountants is high. Acclaimed for their exceptional analytical skills, they investigate a person’s or business’s financial transactions to detect suspicious activities. Furthermore, they evaluate financial documents and data to find legal evidence. They are often called expert testimonies in court cases for fraud and embezzlement.

Optimize Your Financial Operations with SuperStaff

Driving the efficiency and productivity of your finance team can look different from one company to the next. Before developing a streamlining strategy, it’s best to understand your financial model and team members to create an ideal workflow.

Whether your financial processes require a mild tweak or a giant overhaul, SuperStaff is here to help. Our team comprises qualified finance professionals dedicated to guiding you through your journey. Count on us to help you manage your finances and optimize your operations efficiently.