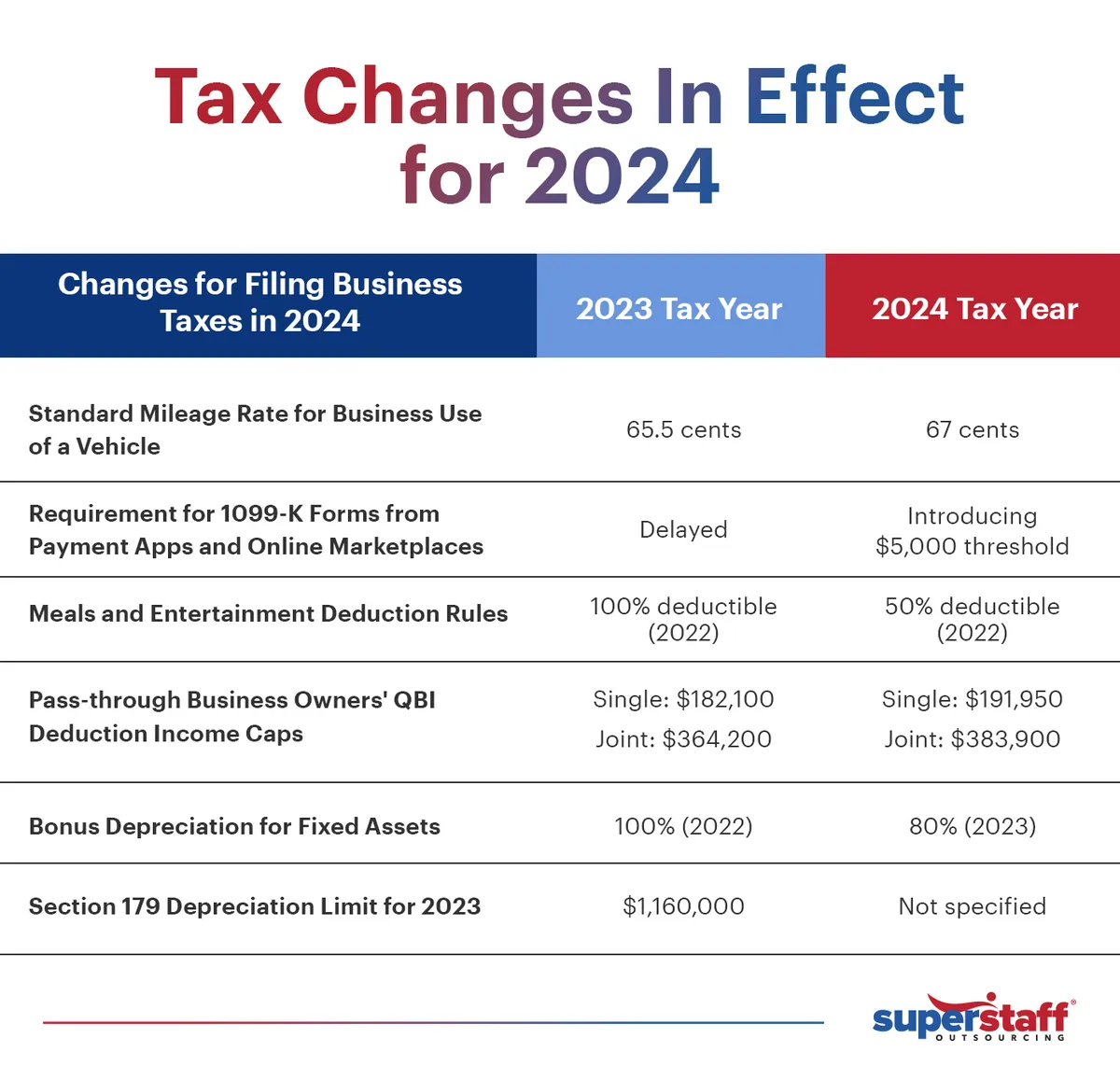

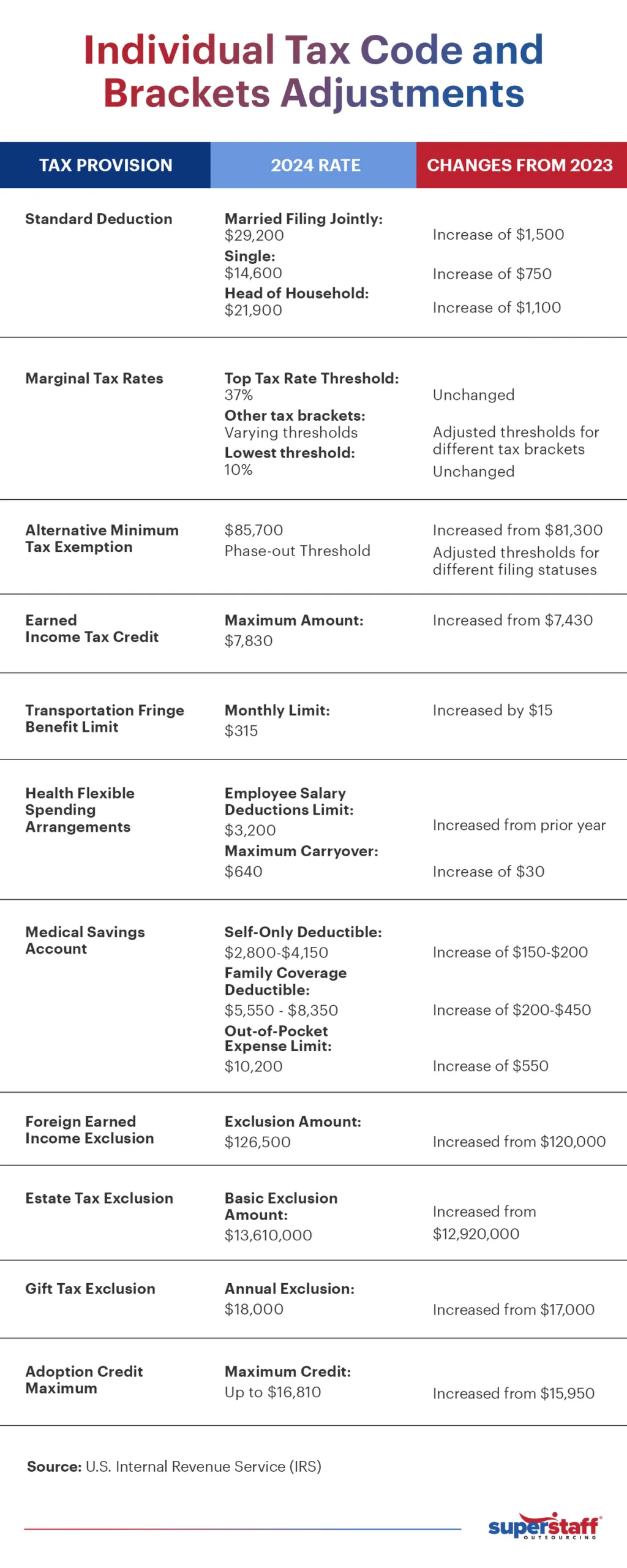

The tax landscape is in constant flux, and businesses must adapt to the changes brought about by yearly revisions to the tax code. This dynamic nature is driven by various factors, including economic conditions, political priorities, and the need for tax policies that foster a thriving business environment. For businesses, staying informed and agile in the face of evolving laws is crucial to maintaining financial health and compliance.

While tax legislation didn’t undergo significant reformations in 2023, some regulatory tweaks were implemented to cushion taxpayers against unforeseen inflation and rising expenses — the same goes for this tax season 2024.

Keeping abreast of these changes in tax codes, thresholds, and deductions is essential to ensuring compliance and optimizing business financial strategies. Many executives turn to tax professionals, accountants, and technology solutions to help them navigate the regulatory maze, ensuring they are well-positioned to capitalize on available opportunities while mitigating risks.

Things To Know This Tax Season 2024

Tax Season vs. Tax Year

As the calendar turns and the days unfold, many individuals find themselves entangled in the complexities of tax-related matters. “Tax season” and “tax year” are often used interchangeably but represent distinct concepts.

The tax year is a fixed period during which taxpayers assess and report their financial activities to the government. For most individuals, the tax year aligns with the calendar year, from January 1st to December 31st. However, some businesses and certain taxpayers may adopt a fiscal year that spans 12 consecutive months but begins on a date other than January 1st.

Individuals and businesses generate income during the tax year, incur expenses, and engage in various financial transactions. All taxpayers must maintain accurate records of these financial activities throughout the tax year, as this information will serve as the foundation for calculating their tax liability during tax season.

On the other hand, tax season is when taxpayers file their income tax returns for the preceding tax year. In the U.S., tax season typically opens in late January and concludes on the tax filing deadline, usually April 15th. However, this deadline can be extended later on weekends or holidays.

The tax year sets the stage for financial activities and recordkeeping. In contrast, tax season is the designated timeframe for reporting and filing income tax returns based on the events of the preceding tax year.

When Is Tax Season in 2024?

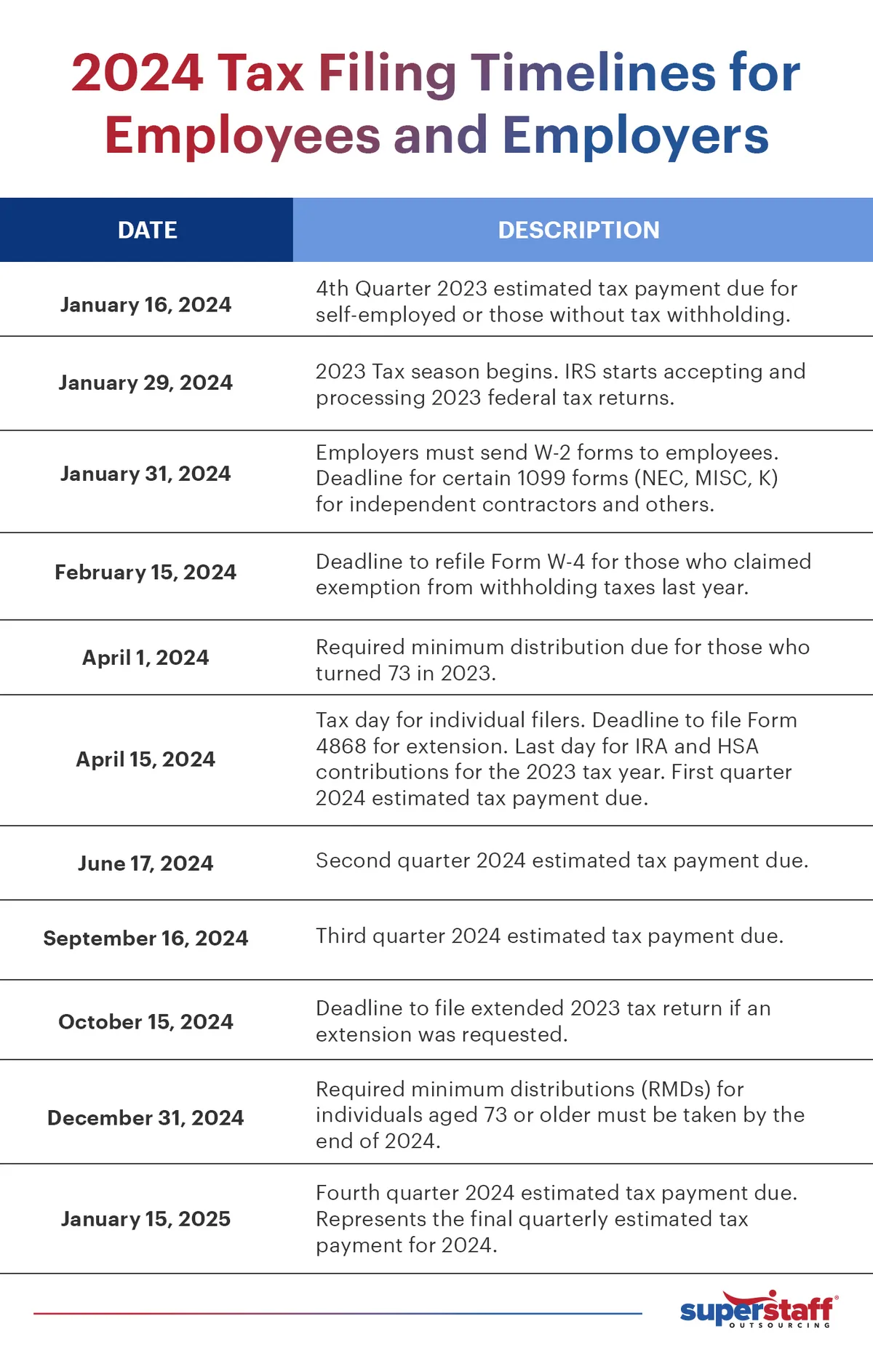

Whether you’re a seasoned business owner or starting, understanding the critical tax deadlines is crucial for a smooth and stress-free filing process.

It’s essential to note that the official start date for filing individual income tax returns for the 2023 tax year is January 29, 2024. Meanwhile, the tax deadlines vary for businesses such as startups, corporations, and limited liability companies.

Regularly Check Official Resources

As tax rules and policies grow increasingly complicated, frequent updates and verifications with official resources like the IRS or other relevant government websites become all the more critical. Doing so helps you keep track of the appropriate percentage in incurring sales tax and tax exemptions. As an added layer of protection, it’s also wise to subscribe to newsletters, follow official social media accounts, or visit their websites to be informed about new rules and announcements.

Utilize Reliable Tax Software

As a business owner, you must file your taxes efficiently and accurately while maximizing your revenue and productivity.

Leveraging tech is a great way to achieve this. Modern tax software solutions typically integrate real-time updates and alerts about regulatory changes while delivering a user-friendly interface and making tax filing as seamless as possible.

However, not all software is reliable, so it’s best only to use those the IRS recommends. Research shows that the majority (68%) of taxpayers who self-prepare their taxes using software were either “very likely” or “somewhat likely” to shift to an IRS-provided online tool. Using tools directly from the source grants you an oversight of the necessary compliance without the fuss of cross-checking.

Stay Updated With Industry News

Keeping yourself informed about how specific industries are affected by regulatory shifts can grant you a competitive edge, allowing you to maintain legal compliance and uphold professional standards. From time to time, the IRS relays specific announcements and guidelines that can affect the integrity of your returns on the news. Hence, you must stay current and make appropriate changes to avoid fines from outdated tax filing methods. Periodically, these updates could include regulations about overseas taxation, vital for filing your US expat tax returns.

Conduct Regular Internal Audits

One of the easiest ways to expose your business assets to threats is by filing an inaccurate state and federal tax return. Conducting an internal inspection of your tax materials allows you to vet any questionable, fraudulent, or erroneous information that may dunk you in legal hot water. You can also review any documented deductions and tax credits, ensuring your tax returns comply with the new regulations.

Plan and Seek Guidance

Proactively seeking guidance and planning for potential changes allows you to adapt strategies and explore new opportunities within the updated regulatory framework. As tax laws are ever-changing and intricate, selecting a qualified tax return professional with outstanding analytical skills is vital. These include credentialed lawyers, retirement planners, certified public accountants, and actuaries.

Online communities, professional associations, or forums related to finance and taxation are great platforms to discuss and share insights about regulatory changes. Engaging in these communities allows you to learn some of the best tax regimens and stay aware of any changes relevant to your financial situation.

Outsource to the Philippines or Colombia

Fulfilling tax responsibilities means pointing at a moving target. With the ever-evolving nature of tax rules and regulations and the tax authorities’ increasingly tight scrutiny, you may struggle to stay ahead of the curve on in-house tax compliance, leading to more missed deadlines and financial headaches.

Whenever your tax processes become complicated, consider outsourcing accounting and bookkeeping services from the Philippines or Colombia to navigate the tax maze seamlessly. Here are some tasks you can outsource to these outsourced professionals:

- Controller: Supervises the accounting and bookkeeping team when conducting tax preparations

- Payroll: Sets up automatic tax payments to be forwarded to the IRS

- Bookkeeper: Records your expenses, including tax dues, and updates your general ledger

- Auditor: Examines legal compliance on your financial statements and prepares your tax returns

- Forensic Accountant: Assesses questionable transactions within your legal and financial documents

Keep Pace With the Changing Tax Landscape, Start This Tax Season 2024

In the face of a volatile market and elevated costs, it’s easy to drown in paperwork when tax season 2024 finally kicks in. Not only must you fulfill your tax deadlines to avoid hefty penalties, but you also have to file accurate tax returns to navigate the processes seamlessly.

Allow SuperStaff to be your lifebuoy from the sea of tax hassles.

Aside from being allies that revitalize your financial health, our team of certified accountants can file your tax returns and stay up-to-date with the shifting tax regulations in your area, seamlessly supporting you in fulfilling your tax requirements. With our tailor-made packages, our professionals can help identify the perfect approach to make your tax operations more effective and precise, and adhering to the shifting tax regulations.