In a world that has been re-shaped by the pandemic, one must learn to adapt new, strategic ways of managing finances. Evolve with the changing times through accounting outsourcing services in the Philippines. This guide can help you get started.

The State of Finance and Accounting in the Philippines

Over the past decade, the Philippines’ financial sector has matured considerably following the state’s continuous efforts to liberalize the industry. About 26 foreign financial services companies, including top international players such as Citibank, JPMorgan Chase Bank, and Wells Fargo, saw a gold mine and established operations in the country.

But just like the rest of the world, the Philippines was not spared from the brunt of the COVID-19 pandemic. However, with initiatives coming from both the government and private banking sectors, the country’s financial industry is poised to bounce back. Early this year, the central bank reported signs of recovery in the overall business confidence index in 2020 (10.6% in Q4; from 5.3% in Q3).

Another sector playing an integral role in the country’s road to recovery is accounting. Producing about 8,000 new Certified Public Accountants annually, the Philippines is rich in accounting talents in-demand across all industries locally and internationally. This is among the reasons why the country is among the locations with the best outsourced accounting services.

How Accounting Outsourcing Services Benefit Businesses

#1 – Assess Loss Due to Pandemic

Having an accurate picture of where you stand financially is the first step to curbing your losses. But with the COVID-19 pandemic affecting organizations in many different ways, financial reporting is more complex than before.

The International Financial Reporting Standards (IFRS), for instance, outlines specific accounting considerations related to the COVID‑19. Fundamental changes include clarifications on the following:

- Disclosure of sensitivities of estimates based on conditions at the reporting date

- Accounting for penalties on late delivery

- How a lessee accounts for a modification

- Statement of asset of loss

With the considerable amount of time and resources required to assess pandemic-related losses accurately, small and large organizations benefit greatly from delegating this function to a finance and accounting outsourcing partner with expertise in the matter.

#2 – Receive Expert Advice on PPP Loans and Other Financial Aids for Businesses

Having a financial expert to consult on demand is one of the major benefits of accounting outsourcing services. This statement is especially true if you outsource accounting to a BPO in the Philippines that operates 24/7.

As experts in taxation and financial analysis, accountants can help you maximize opportunities you may not know available. They can share valuable insights about loans and other financial aids that can help you stem pandemic-related losses. One example is the Paycheck Protection Program loan forgiveness program.

To help self-employed individuals cope with the volatile economy, PPP updated provisions of its loan forgiveness programs. The changes include the following conditions:

- The amount that is eligible for loan forgiveness covers expenses incurred between 8 to 24 weeks following the disbursement from your lender.

- At least 60% of the loan must be spent on payroll.

- The employee headcount must be maintained.

- 75% of each employee’s wages must be kept.

#3 – Recover From the Pitfalls of the Pandemic

The International Monetary Fund regarded the COVID-19 pandemic as the worst global economic crisis in human history, overshadowing the Great Depression. While the impact will likely be felt for a long time, accounting outsourcing services can help businesses step out of the deepest pit and begin their way to recovery.

Here’s How a Finance and Accounting Outsourcing Partner Can Help You Get Back on Your Feet:

- Augment workforce rapidly to recover lost productivity.

- Enhance business continuity and other risk mitigation measures by expanding remote work capability.

- Gain instant access to technology to speed up results.

- Save a significant amount of money by tailoring solutions according to your goals, conditions, and finances.

The COVID-19 pandemic unraveled multiple holes on how companies have been operating for the longest time. Accounting outsourcing services is a significant step toward building a future that is resilient to change.

#4 – Meet Clients’ Evolving Needs for Holistic Accounting

The role of accountants is no longer confined to managing books and taxes. Take a look at the job descriptions and qualifications for accounting jobs today. You’ll see how the functions of accountants have expanded from being specialists to generalists.

This bigger-picture approach is referred to as holistic accounting. It takes into account other aspects of your business to promote efficiency and growth. Instead of focusing on tax compliance, holistic accountants offer sound advice on payroll and benefits management to bookkeeping and investment. They do not just analyze the numbers but discover the story behind them.

Where Does Accounting Outsourcing Services Come Into Play?

For decades, outsourcing has been catalyzing holistic growth across all industries, bringing a full suite of solutions to the table—people, process, and technology. Outsourcing empowers businesses with accountants equipped with the tools to deliver fast and accurate results, oversee a client’s financial health, and offer strategic business advice.

#5 Catch Up With Technology-Based Service Rendering

In 2019, the International Revenue Service unveiled its plan to modernize the agency’s key systems and build infrastructures to improve the taxpayer’s experience. The modernization, targeted to be completed by 2026, also aims to improve data security and workforce efficiency. The updates include the incorporation of smart technologies, such as:

- Cloud

- DevOps

- Agile

- Robotic Process Automation

- Application Programming Interfaces

Even though the plan has met funding challenges, it is likely to push through, especially since the pandemic demands for the phase-out of antiquated systems.

Stay Ahead of the Curve With the Best Outsourced Accounting Services

The IRS plans will undoubtedly impact all taxpayers. For businesses, the sensible response is to keep pace with modernization. It’s a win-win approach. Staying abreast with the rapid technological advancements will make IRS compliance easier and elevate efficiency on other aspects of your business.

The question is, do you have the time and resources to purchase new systems and infrastructure? We live in a world where technology evolves and continues to grow; keeping up will undoubtedly be costly. The most cost-efficient way to gear up for the digital future is to wear the available digital armor offered by accounting outsourcing services.

#6 – Access to Tech-Savvy Accountants

If smart technology is the rocketship to the future, digitally adept accountants are the pilots. Tech-savvy accountants are no stranger to innovation. Having natural intuition and inclination to technology, they offer insights and ingenuity that translate real business value.

Want to Build a Future-Ready Workforce? Partner With an Accounting BPO in the Philippines

In 2020, the Philippines recorded an explosive growth in internet users. About 79.7 million, or more than half of the country’s population, go online regularly. The number is expected to grow up to 91.57 million by 2026.

Additionally, 20% of the country’s working population are digital native Gen-Zs. This generation grew up surrounded by gadgets and is highly confident about their technological skills. Considering that the youth comprises about 40% of the Philippine population, the country is expected to produce more digitally savvy professionals to augment its workforce.

#7 – Scalability

Following everything that transpired since the pandemic gave birth to the new normal, we need to anticipate that change will be constant in all aspects of life. We’ve seen how demands for once-thriving industries, such as tourism and live entertainment, dropped instantaneously.

While it is true that market demand is never fixed, we live in a time in history where it is as unpredictable as ever. This reality illuminates the importance of scalability.

A scalable accounting outsourcing service ensures that you pay only for the solutions you need and use. It allows you to stay on top of your expenses and manage your resources smartly.

#8 – Access Tax Experts Without Strains on Company Resources

Even pre-pandemic, there has already been a scarcity of qualified accountants. The U.S. Bureau of Labor Statistics reported a 2% decrease in the annual growth of accounting and bookkeeping services. The decline was attributed to the following factors:

- Many long-time accountants have reached retirement age.

- The pandemic’s impact on education has prevented the replenishment of new accounting professionals.

- Many accountants have not evolved with the modern qualifications companies are looking for.

Given the crucial role that accountants play in helping businesses achieve growth, finding those with solid expertise and new normal competencies is essential. However, attracting, training, and retaining talents require considerable financial investments.

Accounting outsourcing services can help you address staffing shortages without draining your company’s resources. By leveraging offshore economics, an accounting BPO in the Philippines can build you a team of accounting experts while reducing your operational expenses.

When Is the Right Time to Outsource Accounting Services?

If Accounting Services Is Not Your Core Competency

Have you ever tried writing using your non-dominant hand? You may complete the task but not as fast as when you use your dominant hand. The result is also not as good. This analogy perfectly describes why you should outsource accounting if the task is beyond your expertise.

By opting for finance and accounting outsourcing, you can eliminate the time-consuming and tedious process of understanding tax codes and laws. Your team can also focus on what they do best.

Some of the functions best left to an outsourcing partner are as follows:

- Bookkeeping

- Reporting to authorities and management

- Payroll processing services

- Account payables (payments creation)

- Account receivables (debtors follow up)

- Payroll

If You Need to Reduce Your Overall Operating Cost

Ensuring the profitability of your business sometimes means finding the right places to cut down on spending. Outsourcing has been proven to deliver a solid bottom-line impact. By capitalizing on economies of scale, eliminating training and overhead costs, and scaling services as needed, an accounting outsourcing service partner can reduce your operating expenses by up to 60%

How To Find the Right Accounting Outsourcing Service Partner

1. Identify the Best Outsourcing Model for Your Business

Not all businesses are the same, and neither do all outsourcing providers. What works for you may not work for others. Fortunately, there are different outsourcing models to choose from. Each has its strengths and drawbacks.

Carefully assess your business needs and goals to find out which model is ideal for you. Take the following into consideration:

Weighing the Distance: Consider the Location of the Finance and Accounting Outsourcing Provider

With the advancement of technology, distance is becoming less and less of an issue in service delivery. However, this statement is not universal to all businesses and industries. Consider the strengths and weaknesses of the following location-based outsourcing models when weighing your options:

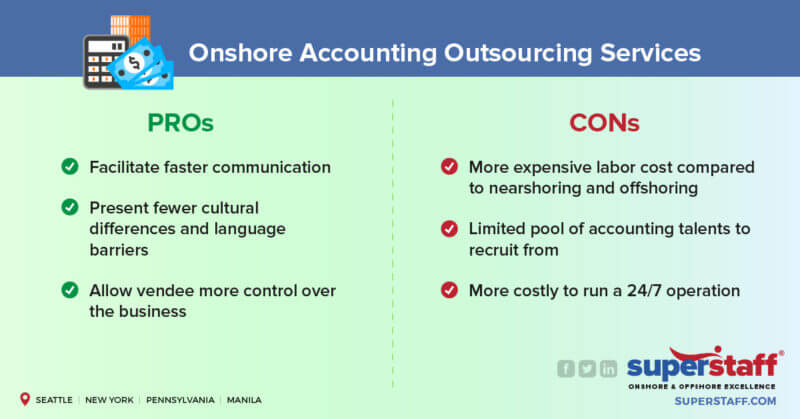

- Onshore Accounting Outsourcing Services. Also known as local or domestic outsourcing, onshore outsourcing is the practice of obtaining the services of a contractor from the country where you are based.

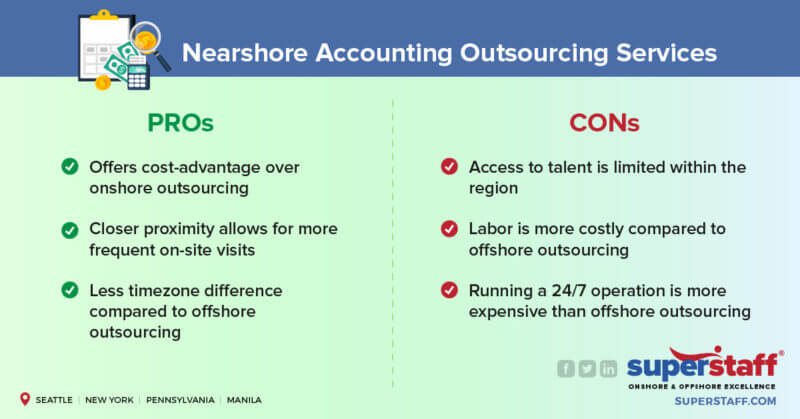

- Nearshore Accounting Outsourcing Services. With this outsourcing model, the services are contracted from a provider based in your neighboring country, usually within the same region.

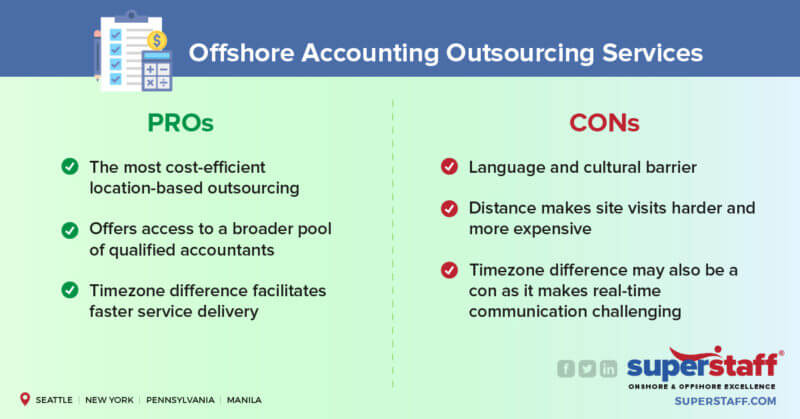

- Offshore Accounting Outsourcing Services. Still the most popular form of outsourcing, offshore outsourcing acquires the services of BPO based outside the country and region of the client’s base.

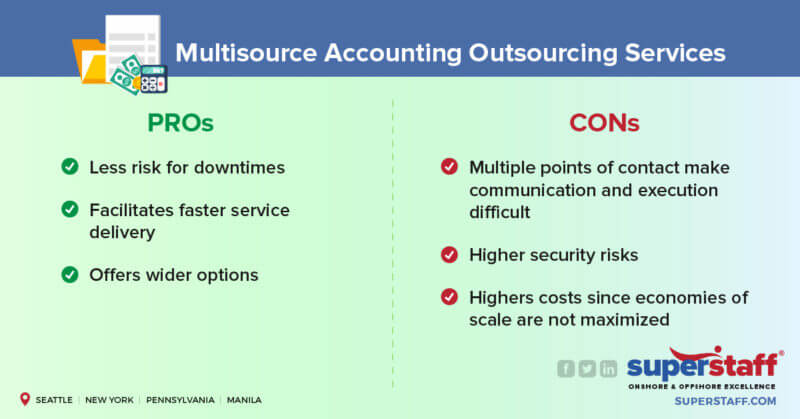

- Multisource Accounting Outsourcing Services. Multisourcing is the process of obtaining outsourcing services from providers in multiple locations.

Counting the Cost: Consider The Most Suitable Payment Arrangement

Budget plays a crucial role in outsourcing. Explore the advantages and disadvantages of each outsourcing pricing model to see which one suits you best.

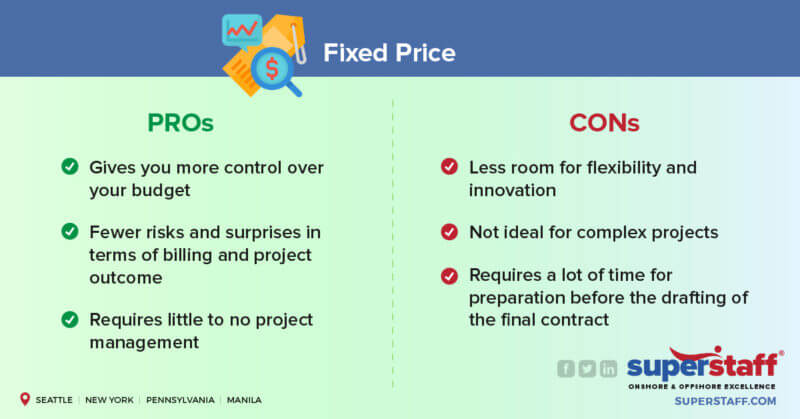

- Fixed Price. This model entails both parties to agree on a specific cost for the finance and accounting outsourcing solutions rendered in one particular period.

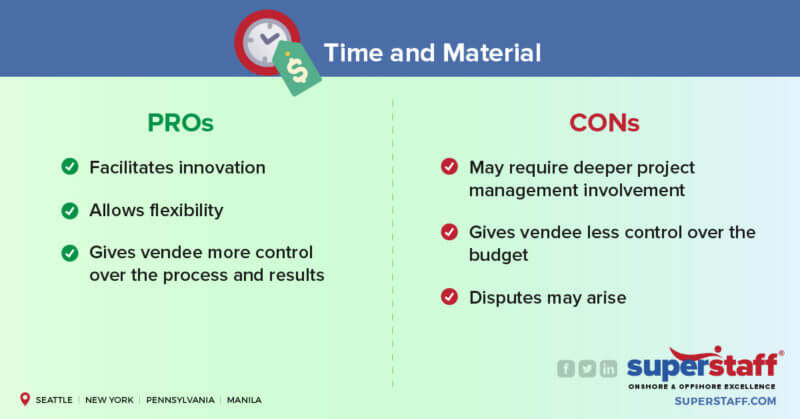

- Time and Material. Opposite of the fixed price model, T&M bills you to use the time and resources of your chosen provider.

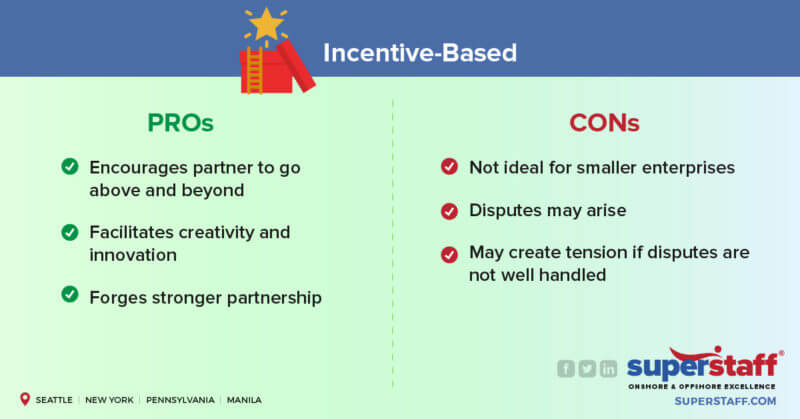

- Incentive-Based. To further advance business goals, you may opt to incorporate an incentive-based model into another payment scheme.

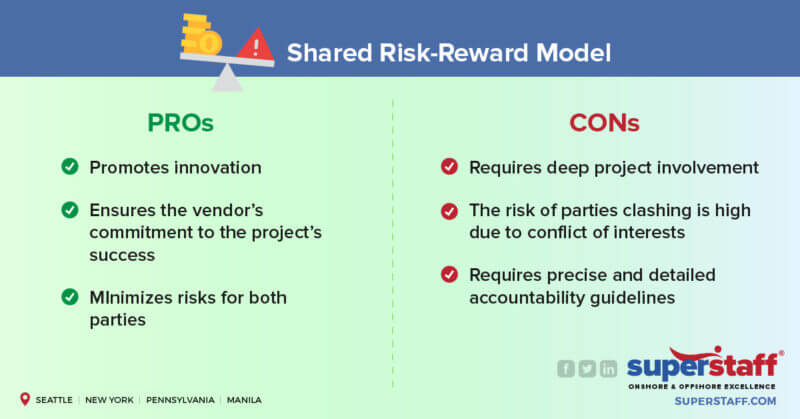

- Shared Risk-Reward Model. In this model, both the vendor and the client take responsibility for the project and share gains and losses. The shared risk-reward model is commonly used for jointly funded projects.

2. Assess Whether Your Accounting Outsourcing Service Partner Is in a Strategic Location

Where you choose to acquire finance and accounting outsourcing solutions directly impacts the results of the venture. While technology bridges the distance gap, it can’t cover other important factors like culture and expertise. This is the reason why location should be given enough weight when choosing a partner.

Why Consider Accounting Outsourcing Services in the Philippines

The Philippines has grown to be known as one of the best places for accounting outsourcing services. Here are some reasons why the country stands out among all the other countries in the world:

- Filipino accountants are globally recognized and equipped with the technical and digital skills needed to thrive in today’s accounting landscape.

- English is one of the country’s primary languages; 95% of the Philippine population are fluent.

- Filipino culture shares a close semblance to Western culture.

- The country offers geographical advantages for companies aiming to expand their global presence.

3. Ask Potential Vendors of Their Talent Acquisition Strategies

Does a future partner employ recruitment and engagement models that fit the new normal? Ask your potential vendor how they find top talents in your industry. Pay special attention to their ability to recruit remotely and adapt to the latest recruitment practices. Your ideal finance and accounting outsourcing partner should also know how to navigate the challenges of recruiting in the new normal.

4. Evaluate a Potential Partner’s Current and Future Digital Capabilities

Can a potential partner support multichannel and omnichannel communication? How can they incorporate intelligent technology into your system seamlessly? How about their cybersecurity measures? These are significant factors to consider when gauging a partner’s digital preparedness. Apart from evaluating a contractor’s current digital architecture, assess if their tech vision fits a sustainable future.

5. Discover Other Ways a Potential Partner Can Enrich Your Business

While cost reduction remains the top benefit of finance and accounting outsourcing, choosing a partner based solely on pricing is not the smartest approach. Consider all the other solutions that a potential partner can bring to the table, such as technical support, continuous training, and management support. Choose the one that can forge long-term strategic partnerships and add holistic value to your business.

6. Conduct a Research About the Vendor’s Reputation

It’s easy to draft core values and make claims about one’s credibility. But can the vendor back it up? How are their agent retention and tenure rates? How long have they been serving their clients? How transparent are they with their rates? These factors speak more volumes about a potential accounting BPO partner’s reputation.

Redefining Accounting. Reshaping the Future

Bank on SuperStaff to help you build a resilient, future-ready operation. Contact us today to discover why we are the ideal accounting BPO in the Philippines.