No matter the industry, business leaders often need to take risks to achieve a specific goal, whether expanding to a new market, creating an innovative product, or enhancing their operational models.

In these cases, they’ll likely seek strategic advice and guidance from your risk financing consultancy firm.

With your expert advice, companies can weigh the pros and cons of a tricky decision, determine how to maximize the benefits while minimizing the risks and align strategies with their overall business goals.

However, what will happen when dealing with an unexpected spike in client demand? How will you navigate increasingly complex risk financing cases without sacrificing quality service?

Strengthen your operations through finance and accounting BPO services. These outsourcing solutions have become a strategic asset for your industry, enabling you to access specialized expertise, increase cost savings, and improve business focus.

By leveraging local talent with global expertise, you can achieve new operational efficiency and accuracy heights. In this article, we’ll explore precisely how outsourcing finance solutions can benefit your risk financing consultancy firm.

Top Challenges Faced By Risk Financing Consultancy Firms (and How BPO Finance Professionals Can Help)

Risk financing consultancy firms like yours provide a critical service for business leaders, enabling them to continually examine their priorities and map out a plan for taking calculated risks. However, the modern business environment has become increasingly volatile, disruptive, and unpredictable, making it harder for you to do your job well.

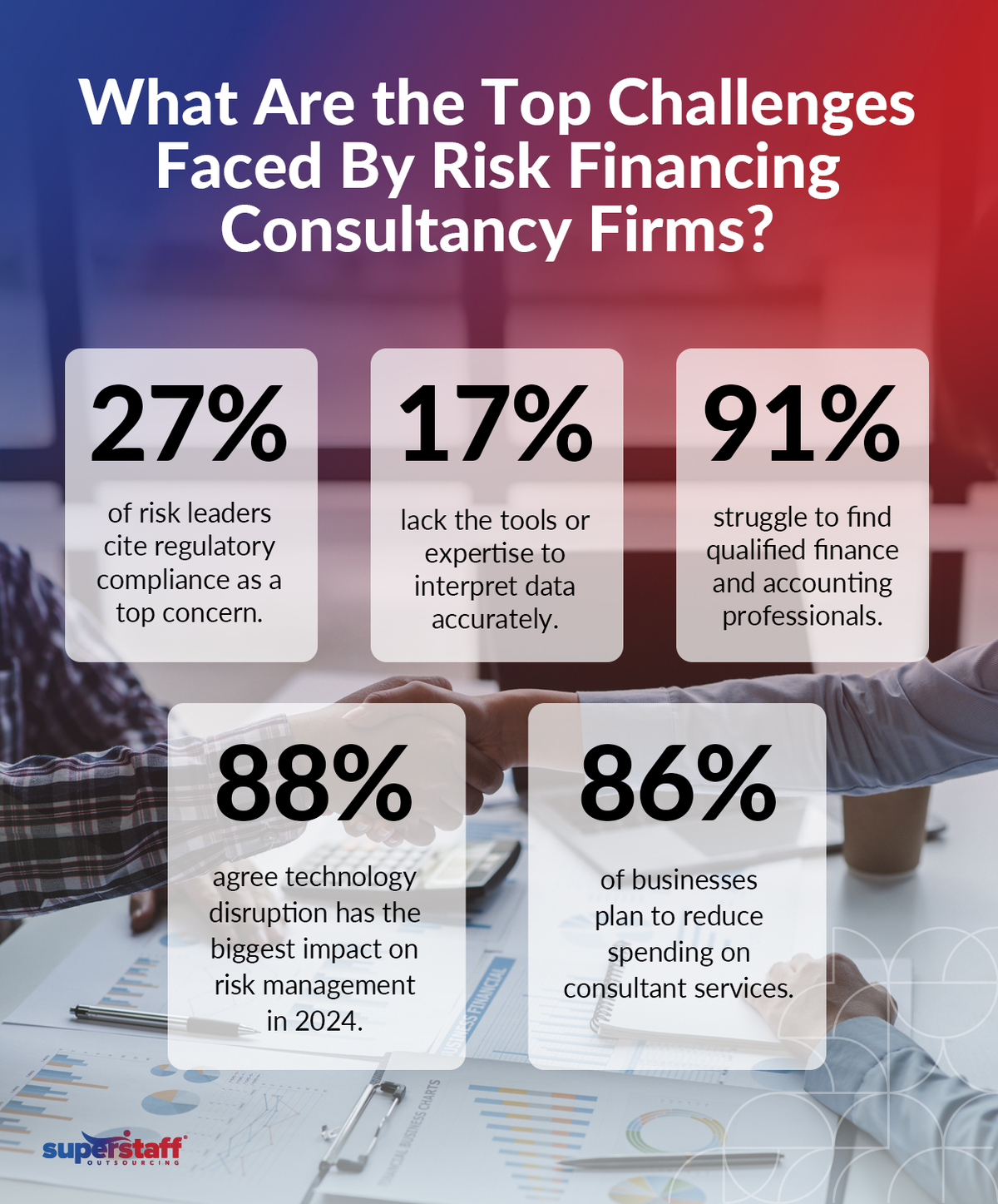

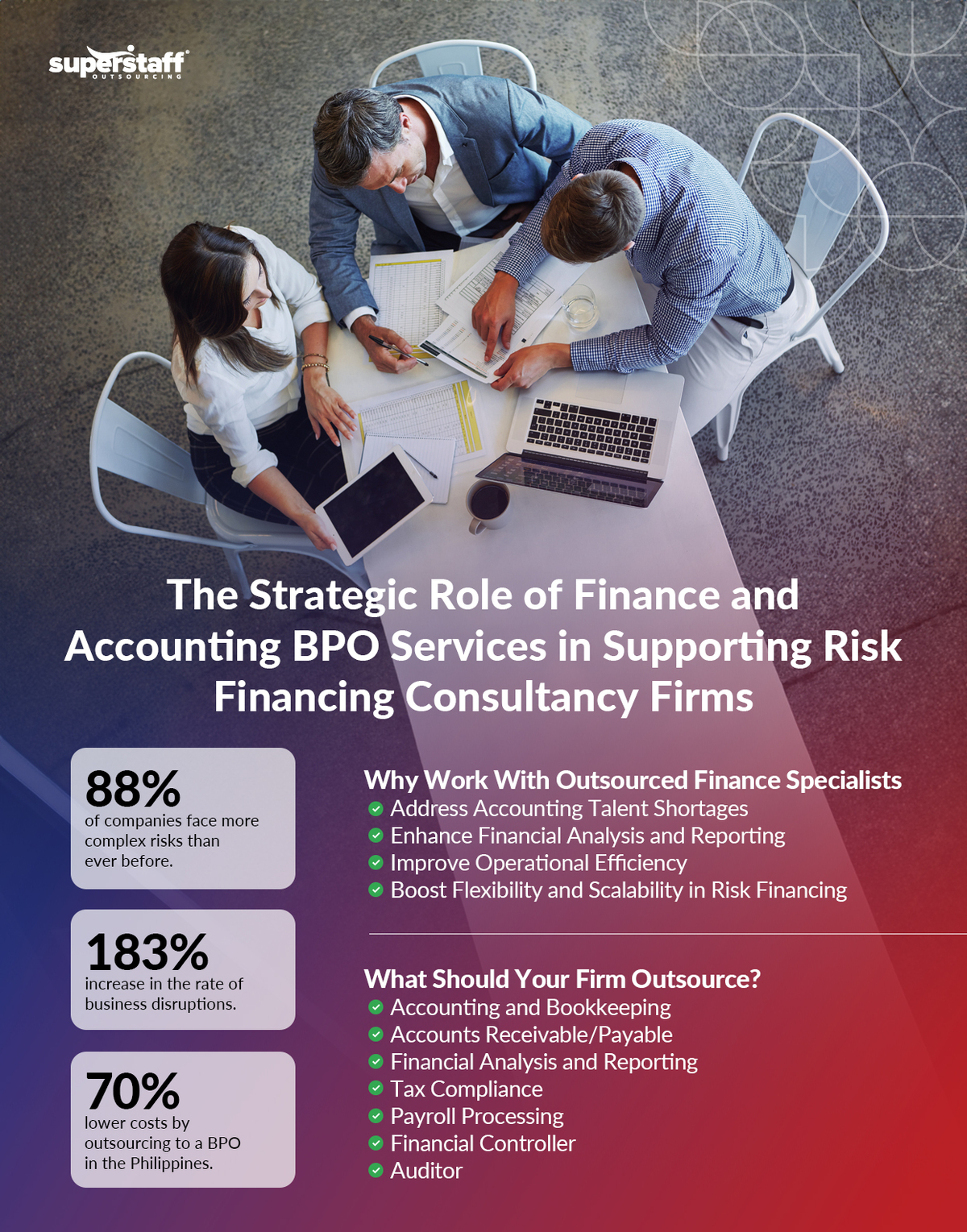

According to the 2024 Pulse of Change Index, the rate of change and disruption affecting businesses has increased by 183% over the past four years. Even post-pandemic, over 88% of companies say complex risks are emerging faster than ever. Here is a quick overview of the most significant challenges your firm faces today:

Regulatory Compliance

Complying with industry-specific, nationwide, and global regulatory requirements is essential for companies to stay afloat. It promotes transparency between a firm and its investors, builds customer trust, protects employees, and allows businesses to avoid hefty penalties and fines.

Here’s the problem: Navigating the complex web of local, national, and international regulations can be daunting for even the most seasoned executives. Not to mention how costly it can be to revamp operating models and internal company policies to stay aligned with new legislation.

In a 2024 study, risk professionals cited regulatory compliance as one of their top emerging concerns at 27%, rising eight percentage points since the previous years. Because regulations are continually being tweaked, updated, or revised, firms like yours must stay updated on every new change to help your clients ensure compliance.

The good news is that working with a finance and accounting BPO can make it easier for you to stay on top of regulatory compliance issues. These outsourced professionals monitor all emerging trends and legislation locally or internationally. Delegating this task to them can allow you to focus on your core business activities while receiving regular updates on matters relevant to your industry.

Data Management and Security

Beyond regulatory compliance, data management and security are another top concern for many risk consultancy professionals. The same 2024 Risk Study found that business leaders cite data quality (22%) and availability (18%) as problems for evaluating risks.

Meanwhile, among leaders with access to quality data for risk management, 17% lack the right tools or expertise to interpret and gain insights accurately from mountains of raw information.

Truthfully, handling large volumes of diverse data from multiple sources is a massive challenge for companies of all industries. Still, it is particularly challenging for risk financing consultancy firms like yours. You will not only need to ensure data accuracy and integrity to create reliable risk assessments, but you will also need to protect your clients’ sensitive data from cybersecurity threats and breaches.

By hiring a BPO finance team, you can address these challenges head-on. Hiring an outsourcing partner can give you access to qualified data entry and management professionals who can help you maintain your database, verify data accuracy and reliability, and prepare raw information for further analysis and interpretation.

Talent Acquisition and Retention

The 2024 Pulse of Change Index found that C-suite leaders rank talent issues among the top four factors impacting business change and disruption this year. The combination of widespread skills shortages and low employee engagement has created significant challenges for companies of all sizes and industries.

For risk financing consultancy firms like yours, hiring professionals with the right skills, experience, and expertise can sometimes feel like searching for a needle in a haystack. You’re probably facing stiff competition from other consulting firms and industries, all vying for the same small pool of top local professionals.

In addition to navigating the tight labor market, you’ll also need to invest in your workforce’s continuous training and development, enabling them to stay updated on the latest industry practices and regulatory changes.

How can you strengthen talent acquisition and retention in these challenging times? Leveraging finance and accounting BPO services can be an excellent strategic solution.

Hiring a BPO will allow you to broaden your talent search beyond your home country, connecting you with qualified professionals from across the globe. Instead of competing with other firms for the same small pool of local talent, you can work with a diverse team of nearshore and offshore specialists who meet your needs and requirements.

Technological Advancements

According to the same 2024 Pulse of Change Index, technology disruption (88%) was the most significant factor impacting risk management this year, rising to 1st place from 6th place in 2022. Over 61% of C-suite executives expect technology disruptions to accelerate even further in coming years, and 47% say they are not fully prepared or equipped to handle these changes.

As a risk financing consultancy firm, you must keep updated on the rapidly changing technology landscape. Your clients expect you to be familiar with the latest innovations and help them integrate these tools and software into their existing processes and systems.

For example, artificial intelligence (AI) is one of the most talked-about advancements today. Many companies of all sizes and industries seek to implement this new technology into their operations but are struggling with the significant investment required to expedite their AI projects.

To optimize resources and focus on core activities, even tech giants like Microsoft outsource AI development support to reliable providers. Your firm can adopt this same strategy, accelerating your digital transformation initiatives without overwhelming your in-house team or taking on significant overhead expenses.

The same Global Risk Study found that 1.9x more business leaders manage risks and cut costs through outsourcing. Compared to their peers who don’t adopt this strategy, they are more satisfied with their transformation efforts and have improved their risk-taking capabilities.

Client Expectations and Communications

Finally, your risk financing consultancy firm may face another obstacle: continually evolving client expectations. Recent studies have found that senior executives across industries are cutting back on hiring consultants, with as many as 86% planning to tighten their budgets.

At the same time, today’s business leaders expect more from their consulting partners, asking for more transparency, better personalization, faster service delivery, and more excellent value for money. With these high expectations and standards, you may be bending over backward to meet your client’s needs, creating comprehensive and actionable risk assessments at a quicker pace but without sacrificing quality.

To continually provide tailored solutions that meet each client’s specific needs and circumstances, you should consider partnering with a BPO finance and accounting team. As these outsourced professionals handle crucial administrative and support functions, you can focus on strengthening client relationships and ensuring clear and effective communication with them when discussing risk management strategies.

The Strategic Role of Finance and Accounting BPO Services in Supporting Risk Financing Consultancy Firms

Having explored the top challenges faced by risk financing consultancy firms like yours, let’s discuss how financial service outsourcing can help not only address these issues but also give you a competitive edge in today’s unpredictable business landscape.

Quick Overview: What Is Financial Service Outsourcing?

Finance and accounting BPO services include a wide range of specialized solutions designed to support a company’s money and resource management. These back-office tasks strategically support your risk financing consultancy firm’s core functions by reducing costs, giving you access to specialized skills, and improving operational efficiency. Some examples of outsourced financial services include:

- Accounting: Process, record, and summarize financial information to improve resource management and boost business performance and growth.

- Bookkeeping: Keep an accurate record of all financial transactions, ensuring proper organization and maintenance.

- Accounts Payable: Monitor money owed to vendors and suppliers and oversee timely payments.

- Accounts Receivable: Create and send invoices to customers for goods and services paid on credit.

- Financial Reporting: Document financial activities over a specific period and create organized reports to aid business leaders in decision-making.

- Tax Compliance: Help clients adhere to tax regulations and requirements through proper documentation and reporting.

- Payroll Processing: Handle employee salaries, benefits, and taxes, making sure everyone is paid on time and without error.

- Financial Controller: Oversee all accounting activities to ensure ledger accuracy and reliability.

- Auditor: Review companies’ financial statements and documents to comply with relevant laws and regulations.

Impact of BPO Finance Services on Business Performance

A Robert Half Staffing Benchmarking Report found that 91% of senior managers struggle to find qualified finance and accounting professionals. The shortage of skilled accountants in North America has created gaps in many companies’ operations, preventing them from scaling their business and taking risks on innovative ideas.

By outsourcing finance functions, you can sidestep the nationwide accountant shortage and tap into a larger pool of global professionals. Beyond simply filling gaps in your firm, you can also increase operational efficiency, boost business growth, and cut costs by up to 70%.

With a clear understanding of outsourcing’s strategic role in supporting the performance of risk financing consultancy firms like yours, we can investigate how these services enhance financial analysis and reporting.

Enhancing Financial Analysis and Reporting

Before you can give businesses an accurate risk assessment, you must perform thorough financial analysis and reporting. This means evaluating your client’s projects, budgets, and policies, monitoring economic trends, and helping them build long-term plans to ensure financial stability even when taking risks.

Performing this crucial step can allow your clients to see their financial health objectively, identify areas for improvement, and make more informed financial decisions. Accuracy in financial reporting is of the utmost importance to make this work.

Thankfully, working with BPO finance and accounting specialists can enhance the quality and accuracy of your financial analysis and reporting. They use state-of-the-art software and technologies when analyzing financial, market, and economic data.

Armed with specialized knowledge and expertise, your outsourced finance team will help you compare a client’s performance against their closest competitors and help you find innovative ways to strengthen their competitive advantage.

Improving Operational Efficiency

While financial analysis is critical, the operational efficiency gained from BPO services is equally transformative. As companies grow, they’ll also have to deal with a larger volume of financial transactions, invoices, and documentation. This can be overwhelming for many in-house teams, especially those with insufficient qualified accountants.

Your risk financing consultancy firm may be experiencing this problem firsthand. Since you must maintain relationships with multiple corporate clients, the amount of financial reports and statements you have to review may sometimes be too much for your core team to handle.

Through finance and accounting BPO services, you can streamline your financial operations by delegating time-consuming tasks to nearshore and offshore specialists. This way, you reduce your in-house staff’s administrative burdens and focus on strategic activities like maintaining client relationships.

Another way BPOs help improve your overall operational efficiency and productivity is by giving you access to the latest accounting and finance technologies. Automating and optimizing some aspects of your operations can empower you to pivot away from outdated legacy systems, minimize human error and inaccuracies, and improve precision when generating risk assessments and reports.

Flexibility and Scalability in Risk Financing

With operational efficiency maximized, the focus shifts to the flexibility and scalability these partnerships offer. In previous sections, we mentioned how modern businesses face an increasingly volatile and unpredictable environment, making assessing and managing risks harder.

As a risk financing consultancy firm, it’s your job to guide companies through these highs and lows, giving them accurate reports and helping them make informed decisions. However, what can you do when there are sudden and unexpected spikes in client demand? How about off-seasons? Do you just bite the bullet and incur high costs even during times of low sales volumes?

BPO finance services can provide the flexibility and scalability you need to adapt to the evolving demands of risk financing consultancy. Depending on fluctuating market conditions, you can quickly scale your operations up or down to meet client demand. Outsourcing can give you the agility and adaptability to pivot strategies when disruptions arise without compromising your core business activities.

Ready to Strengthen Your Financial Operations? Partner With the Outsourcing Specialists at SuperStaff

Finance and accounting BPO services are strategically important in the risk financing industry. By working with the right outsourcing partner, firms like yours can ensure accuracy in financial analysis and reporting, boost operational efficiency, and enhance flexibility and scalability.

If you hope to leverage local talent with global expertise, turn to the experienced BPO team at SuperStaff. We offer comprehensive, customizable financial service outsourcing solutions that can help you optimize your processes, improve financial management, and drive business growth.

Count on us to help you provide your corporate clients with the best possible risk management services. To get started, contact us for a quick consultation today!