Singapore may be the smallest country in Southeast Asia, but the city-state is a powerhouse. It is home to more than 4,000 start-ups and ranks 1st in StartupBlink’s Startup Ecosystem Index 2022 list of best countries for start-ups in the Asia-Pacific region. Worldwide, the city-state ranks 7th among 100 countries, joining global powerhouses like the United States, Britain, Israel, Canada, Sweden, and Germany in the top 10.

With its robust tech ecosystem, advanced infrastructure, and business-friendly policies, the country attracts massive investments and hosts global tech firms — including the most prominent players worldwide. Singapore is also APAC’s largest data center market and the second-largest globally.

Indeed, The Lion City is a regional and global leader in innovation. The Asian powerhouse is thereby pushing the envelope further by transforming itself into becoming a Smart Nation.

A Digital-First Singapore

Singapore is working toward becoming a hyper-networked and digital-first nation, leveraging tech breakthroughs to elevate people’s comfort, convenience, connection, security, and overall quality of life. It envisions a country where smart solutions are embedded seamlessly in all aspects of daily life, from transportation and commerce to healthcare and government services.

To realize the vision of a Smart Nation, the city-state needs a nationwide adoption of artificial intelligence and other smart technologies. At the same time, it has to stay at the forefront of technological advancements.

The country has undergone two digital transformations on a national scale between the 1980s and 2010s: National Computerization and ICT Growth initiatives. Both were a success and contributed to developing the global ICT leader Singapore is today.

How is the labor market in Singapore?

Singapore is on its way to a gradual economic recovery after powering through what could be its worst recession thus far. Thousands of employers in the country plan to increase hiring in 2023 and beyond. But one significant challenge stands in the way: labor shortage.

Singapore businesses face acute labor shortages.

Recruiters have difficulty filling open positions despite the upbeat economic outlook. In 2021, the country’s labor market capped the year with all-time high job openings of 98,700 or more than two vacancies per one job seeker ratio.

Employers face a more rigid Singapore labor market in 2023. As health restrictions ease and economic activities resume, more job opportunities open and further widen the labor gap in the country.

NTUC LearningHub’s Emerging Jobs and Skills Report 2022 revealed that only 1 in 10 employees are actively searching for a new job. Singapore’s global competence may suffer if this rate continues.

Employee retention is also an uphill battle.

Attracting talents is not the only major problem hounding employers in Singapore. As job options outnumber candidates, retaining employees becomes challenging. The global phenomenon dubbed “The Great Resignation” reached The Lion City and exacerbated the talent shortage in Singapore.

According to Qualtrics 2022 Employee Experience Trends report, the country has the lowest employee retention in the Asia-Pacific region at 53%. Randstad’s Employer Brand Research 2022 shared a similar finding: Nearly 1 in 3 workers plan to look for a new job in the first half of 2022.

Employers, particularly SMEs, corroborated the reports. A study by SAP SE revealed that 62% of SMEs said more staff are resigning in 2022 compared to 2021.

Unresolved labor shortages can impede Singapore’s innovation, productivity, and economic performance in the next few years or even decades.

Why is there a labor shortage in Singapore?

The COVID-19 pandemic severely affected Singapore’s labor market. But even before the health crisis turned the global labor market upside down, the city-state already had challenges filling the labor gap due to various cultural, social, and political factors.

Rapidly Aging Population

The Lion City is among the countries with high life expectancy and low fertility rates. As of June 2022, 17.6% of the country’s population is aged 65 and above. This rate may reach as high as 25% by 2030 as the aging population is forecasted to double to more than 900,000.

The issue has been hounding the country for decades hence Singapore’s reliance on foreign workers. But as competition for foreign talents tightens due to “The Great Resignation” and other global disruptions, the city-state must draw new plans to augment its shrinking workforce.

Skills Mismatch

The emergence of the COVID-19 pandemic prompted many companies to adopt digital business models, increasing the demand for digitally adept workers, even for non-tech industries. However, the country’s talent pipeline lacks workers ready to respond to the challenge.

According to Salesforce’s Global Digital Skills Index 2022:

- 64% of workers in Singapore felt unprepared for the workplace digital skills needed today.

- 71% felt unequipped with the resources to learn digital skills required in the next five years.

These data support the findings in Randstad Workmonitor’s 2021 survey, which revealed that:

- 53% of workers in Singapore struggled to acquire new skills in their current job to see them through the COVID-19 pandemic.

- 19% said they do not update their skills and competencies to enhance their employability.

An Old Problem Exacerbated

The issue of skills mismatch is not new in Singapore. About seven years ago, DBS reported that despite low job creation of 22,000, the job vacancies in the country registered at 60,500 — indicating that employers had challenges finding talents that meet the skills requirements.

As global economies reemerge from the pandemic, employers in Singapore foresee skill shortages to continuously dampen recovery measures. The Randstad Workmonitor’s 2021 also revealed that 55% of employers believed they would have difficulty finding the right talents in the post-COVID world.

Gender Inequality

As a progressive nation, The Lion City has made significant efforts to close the gender gap in the workplace. The year-on-year increase in female labor participation and median monthly wage rates signifies that the country is moving in the right direction. There was also a significant increase in female representation in male-dominated industries.

- From 2018 to 2021, Singapore’s female labor force participation rate rose from 60.2% to 64.2%.

- The number of female engineers in the Land Transport Authority’s (LTA) workforce increased to 24% in 2020 from 0% in 2009.

- Women’s participation on the boards of the top 100 companies rose from 15.2% in 2018 to 17.6% in 2020.

Despite Lion City’s laudable progress, many workers believe that gender inequality persists in the workplace and contributes to the labor shortage in Singapore.

A YouGov study found that:

- 71% of women agreed that men and women experience unequal treatment at work.

- 74% of women between 18 to 24 years old were most likely to say there is a gender disparity in the workplace.

- 69% of women more than 55 years old said men and women are still treated unequally in the workplace.

- 82% of women in the construction and 77% in the engineering, design, or architecture sectors agreed that gender disparity exists in the workplace.

More of an Equity Issue

Aside from implementing policies that ensure equal opportunities, Singapore’s government and businesses must do more to create a truly inclusive workplace. One must consider the circumstances that put women in a disadvantaged position at work.

One such circumstance is societal expectations. Women still carry the brunt of domestic and caregiving responsibilities even as they perform at work.

Another example is infrastructure. The workplace design of traditionally male-dominated fields is often logistically challenging for female workers.

These issues, requiring profound culture change initiatives, drive many women out of the workforce and contribute to Singapore’s acute labor shortage.

Negative Sentiments Against Foreign Workers Among Singaporeans

Since the 1980s, Singapore has relied on foreign workers to boost business and economic growth despite labor supply constraints. Still, the country’s foreign worker policies spark heated debate among residents and politicians.

An Institute of Policy Studies survey in early 2021 found that 70% of Singapore residents, particularly older ones, wanted the government to limit the influx of foreigners in the country.

As the COVID-19 pandemic puts the country at its worst recession in 2020, many perceive that the practice puts locals, particularly low-waged blue-collar workers, at a disadvantage. Other concerns include overcrowding of public places, skyrocketing housing costs, and increasing job competition.

These issues, often taken into traditional and social media, increased the pressure for the government to revise its foreign hiring approach.

Tighter Regulations for Foreign Workers

As of 2010, the population of non-resident workers in Singapore increased to 1,113,200, a spike of 81.8% from 612,200 a decade earlier. But the number of foreign workers in Singapore fell by 235,700 between December 2019 and September 2021. This rate may soon show an even more drastic drop with new regulations.

In February 2022, the government announced stricter policies for hiring foreign workers to ensure the high caliber of foreign talents and give equal opportunities to local graduates. However, employers must brace themselves for multiple impacts.

Employers face fiercer talent wars.

As talent availability continues to be a key concern globally, the policy may exacerbate The Lion City’s acute labor shortage problem. Companies are not only competing against each other for foreign and local talents. They are head to head against organizations worldwide.

Even now, thousands of Singapore’s foreign healthcare workers have emigrated to other countries, causing a significant strain to a sector already plagued by talent shortages.

Hiring foreign workers is now more costly.

The new policies also have a significant financial impact on businesses with the imposition of higher salaries for foreign workers. Effective September 2022, the minimum qualifying wage for new EP and S Pass applicants will increase by 500 Singapore dollars or about $350. Another series of increases will occur for S Pass holders in September 2023 and September 2025.

Skill Shortages in Singapore: Top Industries Suffering the Most

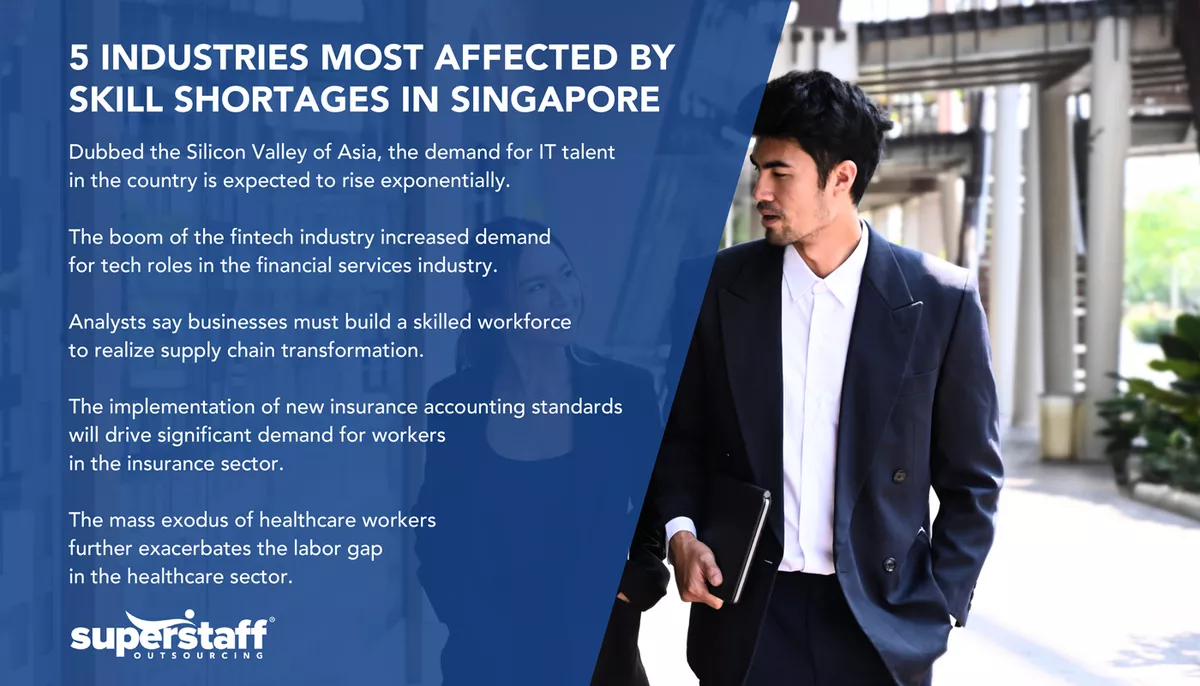

Information Technology

Dubbed the Silicon Valley of Asia, Singapore is among the most advanced ICT markets in the world. The country’s modern technological infrastructure, business-friendly policies, and strategic location continue to attract global tech investors—including 80 of the world’s top 100 tech players.

While most markets suffered pandemic-induced losses in 2020, Singapore broke a 12-year record with SG$17.2 billion in investment commitments. The country welcomed another SG$11.8 billion in investment commitments in 2021.

As companies from all over the world and across a range of industries continue to expand operations in Singapore to serve Asia and other international markets, the demand for IT talent in the country is expected to rise exponentially.

Finance and Accounting

Singapore’s financial services sector saw continuous growth amid the pandemic. Annually, the sector creates 2,500 to 3,000 jobs, but in 2021 alone, the industry generated 6,500 jobs.

This positive development is credited mainly to the boom of the fintech industry. As banks and corporations heighten their digitalization efforts, job ads for various tech roles in the financial services industry grew by 152.1% in 2021 — five times higher than the previous year.

Supply Chain

The Lion City has always managed to secure its food supply through importation. But one major issue stands in the way of successful implementation: skill shortages.

Gaps in knowledge and competencies have hindered Singapore’s plan to be a sustainable nation. Analysts say businesses must build a skilled workforce to realize supply chain transformation. However, building a skilled workforce takes years to accomplish.

Insurance

Another sector that saw growth during the pandemic was insurance. The COVID-19 pandemic raised significant awareness of the importance of being prepared for uncertainties.

The sector’s swift transition to remote operations during the early months of the pandemic also contributed significantly to its resilient growth. According to the Life Insurance Association, Singapore’s life insurance industry gained SG$1.21 billion in new business premiums in the first quarter of 2022.

Along with the industry’s steady growth, the implementation of new insurance accounting standards will drive significant demand for workers in the insurance sector. By January 2023, insurance companies must adhere to IFRS 17, the International Financial Reporting Standard that aims to modernize insurance accounting practices to increase transparency, accountability, and consistency.

Healthcare

The COVID-19 pandemic strained Singapore’s healthcare sector significantly. Due to the sharp increase in cases and hospital utilization, healthcare workers were spread too thin. Many experienced burnout and quit their jobs. The mass exodus of healthcare workers in the country further exacerbates the labor gap in the healthcare sector.

Reports from the Ministry of Health and Ministry of Manpower revealed the gravity of the issue:

- About 1,500 healthcare workers resigned in the first half of 2021 — nearing the 2,000 average annual resignations of the sector.

- Many vacancies for registered or assistant nurses were left unfilled for at least half a year.

- In November 2021, the dire need for nurses forced one private hospital to offer an SG$12,000 finder’s fee to boost recruitment efforts.

- The attrition rate of foreign nurses in 2021 was 14.8% — double the 7.4% rate attrition rate of local nurses.

- Public healthcare workers remain severely stretched even with help from the private sector and the Singapore Armed Forces.

Compelling Insights About Singapore’s Skills Shortage

Singapore needs an additional 1.2 million digitally skilled workers by 2025 to remain competitive.

Singapore places second among six Asia-Pacific economies with a digitally skilled workforce. Currently, 63% of workers in the country apply digital skills in their jobs. Still, this rate is insufficient to keep pace with the rampant technological transformation happening in and around the county.

As the pandemic forces many businesses to shift to digitally enabled platforms, The Lion City will need to upskill more workers to keep pace with technological change. According to an Amazon Web Services (AWS) report, the county needs 1.2 million more digitally skilled workers — or increase its digitally skilled workers by 55% — by 2025 to remain competitive.

Singapore used to rely on foreign workers, which make up 40% of the country’s 5.6 million occupants, to fill the skill shortage. The rising costs of hiring foreign workers and the growing clamor to reduce the entry of foreign workers into Singapore contribute to the recruitment challenge in the country.

Filling crucial tech roles remains a challenge in Singapore.

Singapore produces 4,500 ICT graduates yearly. However, it struggles to meet the demand for tech experts, estimated to reach 60,000 by 2023. Lion City’s strategic location offers businesses eyeing international expansion a unique geographical advantage. As such, many establish a presence in the country.

But tech talent shortage is not unique to Lion City.

Business leaders in other parts of the Asia Pacific have a hard time filling crucial tech roles due to a lack of sufficient local talent with relevant skill sets. One study found that 73% of APAC businesses face critical skills shortages in their IT departments.

As the labor crunch continues, companies in the region resort to a costly measure: increasing salaries to attract new talents. Compared to a year earlier, the average salaries for IT professionals in the region increased by 10% — the most significant hike globally.

Most in-demand job roles require specialized skills and expertise.

If a market is experiencing labor shortages, it’s sensible to infer that the number of job interview requests sent is at par with the number of job openings. This inference does not apply to Singapore.

A survey by Randstad Singapore and YouGov found that despite the skyrocketing demand for tech talents, only 48% of participating ICT professionals received at least one job interview request monthly. This disparity revealed a more profound challenge faced by business leaders — the skills gap.

Candidates do not have the experience or skills required.

As Singapore emerges as Southeast Asia’s regional technology and data center hub, companies seek specialized skill sets that many workers are yet to possess.

Tech firms — which drive most job openings — need professionals with more integrated and cross-functional skills. Aside from technical and analytical expertise, most roles require one to possess the management, business know-how, communication, and soft skills.

To bridge the gap, Singapore has to conduct 23.8 million digital skill training from 2020 to 2025 and equip its workforce with the most in-demand skills today and in the future.

What are the most in-demand skills in Singapore?

With both tech startups and giants co-habiting in Singapore, the future looks bright for the country’s tech sector and economy in general — if the businesses manage to get over the labor crunch and hire talents equipped with the following future skills.

-

Artificial Intelligence

The Lion City has long been pushing toward being a global leader in artificial intelligence. In 2018, the country announced a Model AI Governance Framework — the first in Asia — designed to transform Singapore into a Smart Nation. So far, the framework has benefited various key industries, including:

- Healthcare

- Transportation

- Finance and Business

- Manufacturing

Although the city-state is on track to achieving its goal of establishing an AI ecosystem and digital economy, the country’s AI adoption lags behind some neighboring ASEAN countries. Pushing such an ambitious goal will require the country to produce and tap more professionals with artificial intelligence expertise.

-

Machine Learning

Artificial intelligence and machine learning go hand in hand. The Singaporean government invested SG$180 million to implement AI in the country’s financial sector. But just like most tech professionals with specialized expertise, machine learning professionals are in short supply and highly sought after globally. The multidisciplinary nature of machine learning and the increasing complexity of its models and applications make it harder and harder for employers to fill ML roles.

Singapore will have to compete for machine learning designers, engineers, researchers, and other specialists with the rest of the world. In the U.S. alone, job postings for machine learning engineers grew by a staggering 344% from 2015 to 2018, according to Indeed.

-

Data Science

Global businesses racing to translate data into meaningful and profitable insights have been flocking to Lion City. According to Cushman & Wakefield’s 2022 report, Singapore holds the top spot for data center markets in the Asia-Pacific region. Globally, the country shares the second spot with California’s Silicon Valley.

Among the biggest drivers of data center industry growth are global hyperscalers colocating in the country. These include tech giants such as Google, Amazon, and Facebook. In fact, Facebook is building an SG$1.4 billion data center in Singapore.

The country’s fertile data center market drove the competition for data professionals with technical expertise and business acumen to new heights. On average, qualified candidates receive three to four job offers, prompting companies to increase salaries by as much as 50%.

As the world continues to produce data exponentially, Singapore looks forward to welcoming more investors to house data — and further pushing the demand for data analysts and scientists — in the country.

- Cybersecurity

In 2021, the Cyber Security Agency of Singapore (CSA) released a report reflecting the country’s 2020 cybersecurity landscape. It revealed that cybercrime cases, attributed to the rapid increase of online transactions and social media usage since the pandemic, accounted for 43% of overall crime in the country during the said year.

Some of the Most Common Cyberthreats in 2020:

- Ransomware (+154%)

- Malicious Command and Control Servers (+94%)

- Botnet Drones (6,600 average daily detections)

- Phishing (47,000 detections)

As a response, the CSA unveiled a master plan in 2021 to elevate cybersecurity to benefit enterprises and end-users throughout the country. Along with private companies’ individual measures to improve cybersecurity, the said government-initiated plan will further drive the increase in the demand for cybersecurity professionals.

Between 2020 and 2021, employer demand for cybersecurity professionals was more than 3,400 — nearly a 110% hike compared to 2017 and 2018.

Singaporean tech workers are rejecting job offers.

Amid the fierce war for tech talents, employee expectations have evolved to a new level. Candidates are well aware of their worth and have become more selective about what they want from their next jobs and employers.

Tech talents want higher pay.

Candidates with the most in-demand skills know they have plenty of options to choose from and are playing their cards right. A Tech Salary Report published by NodeFlair in February 2022 revealed that better salary packages are the top reason why talents look for new opportunities. It noted that:

- Software engineers’ average salaries reached an all-time high following a 22% to 32% hike in 12 months.

- The current median base salary for a junior software engineer is SGD$4,750.

- It increases to SGD$6,500 for mid-level software engineers and SGD$7,500 for senior software engineers.

- Meanwhile, the salary for mid-senior level reaches SGD$9,000.

Yet, attractive salary packages alone aren’t enough.

Despite the attractive compensation and benefits packages, many Singaporean tech talents are turning down job offers. Some are not even entertaining interview requests. About 38% of ICT professionals say they only accept less than a quarter of the interview requests they receive.

Work-life balance and exciting opportunities also hold weight.

Apart from higher salaries, talents desire work-life balance, flexible work schedules, a conducive work environment, and a pleasant atmosphere.

New job opportunities also have to be exceptionally compelling to candidates. Active job seekers are strongly motivated to work for companies at the forefront of innovation and offer abundant opportunities to explore new technologies.

Candidate experience matters, too.

Employers’ recruitment processes and candidate experience appear to have a significant role to play in Singapore’s record-high job vacancies (114,000 as of December 2022). According to Randstad Singapore and YouGov’s 2021 Tech Talent Expectation Survey:

- 59% of respondents declined a job offer due to discrepancies between the advertised job scope and the actual job requirements.

- 41% of candidates rejected job offers because they did not have a positive impression of the hiring manager.

- 39% of respondents were dissuaded by the interviewers’ lack of adequate understanding of the role they are trying to fill.

How SuperStaff Can Help With Singapore’s Labor Shortage

Labor and skills shortages are not unique to Singapore. All over the world, businesses are feeling the crunch fueled primarily by the pandemic and subsequent disruptions. But what makes Singapore’s labor shortage particularly challenging is that companies in the country need to fulfill volume hiring for talents with specialized and highly in-demand skills.

SuperStaff is no stranger to specialized staffing.

SuperStaff is an outsourcing solutions provider launched in 2009 to serve a parent company specializing in healthcare technology and biopharma. Our initial suite of services involved providing solutions requiring technical expertise, such as programming, design, and information technology.

We have since expanded our offerings to include all sorts of remote staffing solutions for start-ups to Forbes-ranked enterprises across North America, Europe, and the Asia Pacific. Our staying power proves our remarkable capabilities of fulfilling volume hiring and specialized staffing needs.

Key Outsourcing Solutions for Singapore Businesses

Knowledge Process Outsourcing

SuperStaff designs agile and scalable KPO solutions for businesses looking to fill high-level and knowledge-intensive roles. Our main Philippine headquarters is located in Makati, the country’s financial hub. We also have a center in Clark, Pampanga, a highly urbanized province in the Philippines eyed to host major digital innovations across the Asia Pacific.

By leveraging our global recruitment process, we can help Singapore businesses tap into candidates with advanced expertise, including:

- AI, ML Engineers and Software and Programming Development Professionals

Nearly all industries need to integrate digital technologies to stay competitive today and in the future. Our programming outsourcing solutions enable businesses to meet complex technical requirements and the analytical expertise to fulfill software development projects.

- Data Analysts

The future belongs to those capable of turning large datasets into meaningful business insights. SuperStaff connects enterprises to professionals with solid data analytics expertise and business acumen.

- Data Scientists

Responding to today’s shifts in market trends and demands has become nearly impossible for businesses lacking data management expertise. SuperStaff’s data science outsourcing simplifies the otherwise complicated and costly processes of developing machine learning models and deep learning techniques.

Finance and Accounting

As part of Singapore’s Smart Nation project, the Monetary Authority of Singapore (MAS) has enforced risk management guidelines for the financial services sector. The guidelines require financial institutions to prioritize risk mitigation and business continuity.

SuperStaff’s accounting outsourcing services in the Philippines allow Singaporean businesses to meet these requirements. Delegating various financial and accounting operations overseas is a proven risk mitigation and business continuity strategy utilized by global financial service conglomerates, such as Citibank and American Express.

Additionally, we enable financial institutions to collaborate with Filipino financial and accounting professionals — a workforce with a global reputation for impeccable ethics, integrity, and professionalism.

Logistics

COVID-19 exposed the vulnerabilities of the global supply chain ecosystem, and the ramifications of the disruptions will not go away anytime soon. Industry analysts foresee issues will persist, and supply chain management will become more costly.

SuperStaff helps companies increase resilience in the age of global supply chain disruptions. We offer cost-effective solutions designed to minimize logistics and operational costs while maximizing productivity, including:

- Back Office Outsourcing

- Multilingual Customer Support Outsourcing

- Chat Support Outsourcing

- Data Entry Outsourcing

- Dispatch Services

Our headquarters in the Philippines is only 3.5 flight hours away from Singapore and share its timezone. These logistical advantages provide seamless collaboration and communication with our agents.

Insurance

The insurance industry has long been employing outsourcing primarily as a cost-saving measure. But as the industry grew more competitive and the regulations became more stringent, many insurance firms embraced outsourcing as part of a more comprehensive strategy to expand their client bases and maintain a competitive advantage.

Today, as significant disruptions continue to cause more financial and operational implications to businesses, it is vital for insurance companies to have the capacity to scale according to fluctuating business volumes and evolving regulations — all while elevating customer experience.

SuperStaff offers Singapore insurance firms and providers comprehensive outsourcing capabilities that suit the industry sector, including:

- Policy Management

- Claims Administration

- Data Entry

- Customer Support

- IT Services

- Operations Management

Specialty Healthcare

One of the significant factors that led thousands of healthcare workers in Singapore to quit in 2021 was burnout. The long schedules and taxing workloads took a severe toll on many local and foreign doctors, nurses, and other health professionals. As the healthcare labor shortage continues, more workforce members are being pushed to the brink of resignation.

SuperStaff’s specialty healthcare outsourcing solutions provides hospitals and other health organizations the crucial support their workforce need. We build a dedicated remote workforce qualified to perform a range of specialized non-clinical functions, such as:

- Medical Coding and Billing

- Patient Appointment Setting

- Medical Transcription

- Customer Service

- Healthcare Recruitment

- Healthcare Information Technology

As the BPO arm of a leading biopharma company, SuperStaff understands the pressing and sensitive nature of the healthcare service industry. We apply our extensive knowledge and experience to ensure that our agents meet the special qualifications required for the positions.

Partner With SuperStaff

Realize your post-pandemic recovery and growth efforts with help from a reliable BPO and KPO provider in the Philippines. From customer service outsourcing to IT, data analyst, or programmer staffing, companies in Singapore can rely on SuperStaff for scalable solutions.

Consult with one of our solutions architects today.