The fintech industry has grown immensely in recent years, fueling rising demand and expectations. Even in the post-COVID landscape, contactless payments and digital banking have become part of the new normal for both consumers and companies.

Businesses of all sizes and industries utilize fintech for seamless e-commerce transactions and payment processing. This opens a treasure trove of opportunities for fintech startups.

With demand skyrocketing, fintech companies must step up their game and scale their operations – and this is where outsourcing comes in handy.

What Is Fintech Outsourcing, and How Does It Help Address Industry Challenges?

Fintech outsourcing, which refers to delegating back-office or support solutions to third-party providers, can help expedite or improve the efficiency of a fintech firm’s operations.

Since fintech companies are expected to deliver fast and secure financial technology solutions, scaling operations can be challenging, notably when lacking specific in-house capabilities. Some of the most pressing challenges businesses in this industry face include:

User Acquisition and Retention

Achieving and maintaining a robust consumer base is the key to building a successful fintech startup. The right outsourcing company can help you develop and execute a comprehensive user acquisition strategy, including effective marketing, seamless onboarding processes, and continuous innovation.

Customer Experience

Customer experience (CX) has become a critical competitive differentiator for fintech products, with buyers seeking quick yet personalized online banking solutions. Your outsourcing provider can help elevate your CX strategy through 24/7 omnichannel customer and technical support.

Rising Costs

Fintech app development can be costly and time-consuming, but outsourcing critical back-office services can help keep expenses down without affecting performance quality.

Fraud and Account Takeover

Cybersecurity has become another top concern for fintech businesses. Working with an outsourcing provider knowledgeable in data protection and security protocols can help you handle large volumes of data without worrying about hackers and breaches.

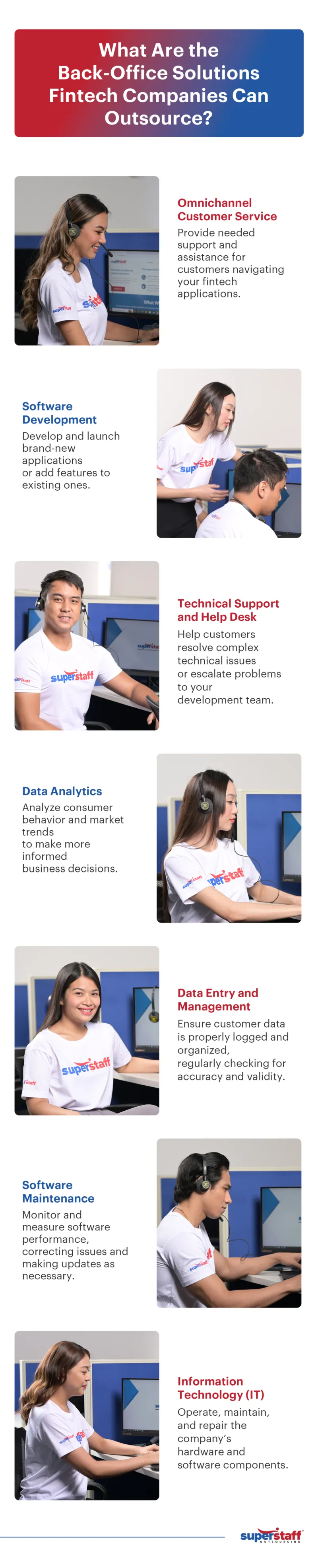

7 Crucial Support Roles Fintech Companies Can Outsource

Omnichannel Customer Service

A recent Salesforce study found that 78% of customers perform banking transactions or sign up for an account through fintech websites or applications. If unsatisfied with the company’s service, 35% are willing to switch providers in exchange for a better customer experience.

Since online banking often involves many complex elements, from payment processing to cashback, many customers need assistance and guidance to navigate each step. Many people may feel confused and frustrated without access to dependable support, causing them to turn away from your fintech products.

The good news is that investing in omnichannel customer service can prevent this problem. With dedicated teams handling support at all times and on all platforms, you can easily ensure your clients can utilize the full spectrum of available services on your application.

Software Development

As the fintech sector gains momentum worldwide, continuous innovation is necessary to remain competitive. Companies must keep track of the latest technological developments and how they can incorporate them into their existing software and applications.

However, before firms can launch their new fintech applications or features, they first need qualified software developers to help them kick-start the project. By outsourcing fintech software development, companies can easily create digital systems and solutions that meet the particular needs of their client base.

In addition to being experts in coding and programming languages, these outsourced developers are also knowledgeable on banking and finance processes.

Since software development is a collaborative process involving constant communication, partnering with a nearshore team may benefit fintech companies, with similar time zones allowing them to schedule meetings and site visits easily.

Technical Support

Once you’ve launched your new fintech product or feature, you’ll need a reliable technical support and help desk team to guide customers through the software changes. Your support agents are responsible for helping users solve all technical problems, whether simple or complex.

With the right outsourcing partner, you can find highly qualified support representatives who can be trained to intimately understand the ins and outs of your fintech applications, capable of providing your customers with the in-depth assistance they need to make the most of your products. Much like your customer service team, they must also offer support through phone, email, live chat, and any other platform your customers utilize.

If there is a problem your help desk agents can’t solve, your call center partner can also connect you with an escalation support team. They can work closely with your software developers, helping them keep track of bugs that need to be fixed in a future update or before the next product launch.

Data Analytics

Combining financial solutions with digital convenience, fintech companies collect, manage, and secure large amounts of data at all times. By understanding user behavior and trends, they can make informed business decisions, leading to better products, services, and experiences for customers. This is where data analytics comes in handy.

Data science specialists are essential in driving growth and profitability for fintech companies. Beyond helping business leaders identify market trends and opportunities, they can also improve risk management by using historical data to predict future economic and market conditions.

Additionally, qualified data analysts can assist fintech businesses with fraud detection. They can help spot patterns and anomalies in banking transactions to identify and address potentially fraudulent activity quickly.

Data Entry and Management

Before your data analysis team can identify customer behavior patterns and trends, you must ensure that your raw information is accurate and organized. Thankfully, the right outsourced services provider can set you up for success through proper data entry and management.

Your outsourced data entry and management team will ensure your data’s accuracy, reliability, and completeness. They achieve this by performing thorough validation processes to identify and correct possible errors.

For fintech companies, investing in robust data management is essential to effectively harness the power of data for decision-making and to remain compliant with data protection laws and regulations. The right outsourcing team will stay updated on the best practices in cybersecurity while complying with industry-specific guidelines and regulations.

Software Maintenance

In fintech, software outsourcing involves more than just developing digital systems and networks. Firms must also proactively maintain, modify, or update software to meet evolving customer needs and expectations.

By outsourcing tech jobs to the right provider, you can enhance the customer experience through proper software maintenance. Your offshore or nearshore team will help you constantly monitor your fintech applications, correcting bugs, boosting performance, and finding ways to improve the overall software.

Information Technology (IT)

Finally, another back-office service fintech companies can outsource is information technology or IT. Since your operations revolve around financial technology, you will need dedicated IT specialists to help all departments function at maximum efficiency and productivity.

IT professionals handle various tasks and responsibilities, including monitoring and operating a company’s tech ecosystem, maintaining all hardware and software components, complying with technology regulations, and protecting your networks against cybersecurity threats and breaches.

The Indispensables Advantages of Outsourcing Support Roles for Fintech Startups

With the widespread adoption of fintech solutions, consumers and businesses increasingly rely on digital technologies to manage their day-to-day financial transactions. As demand grows, fintech companies must scale their operations and capabilities to keep up with it.

Business expansion is challenging for even the most well-established fintech companies, but the right outsourcing provider can make the process simpler and more manageable. Here’s how:

Connect with offshore and nearshore professionals with specialized expertise.

According to a 2023 Statista report, over half of all organizations worldwide (54%) still face a tech skills shortage. With hiring challenges persisting in 2024, many fintech companies may struggle to find qualified candidates to accelerate their business growth and expansion goals.

Thankfully, working with a fintech development outsourcing team can be your strategy to succeed this year. Your BPO partner can help you broaden your talent search beyond borders and connect you with offshore and nearshore professionals who meet your needs and requirements.

From specialists with expertise in software development and maintenance to back-office workers who support your in-house team, you can rely on your outsourcing provider to fill the talent gaps in your organization.

Improve the flexibility and scalability of your fintech operations.

Continuous improvement and innovation are critical to retaining your competitive edge in today’s cutthroat fintech landscape. With technology constantly evolving, your firm must be flexible enough to adapt to changes in market conditions and consumer expectations.

Through outsourced financial technology back-office solutions, you can upgrade or downgrade your operations depending on fluctuations in demand. You won’t need to invest in infrastructure, equipment, utilities, and all other costs of having an in-house team. You’ll also have the flexibility to quickly scale up and down to meet your goals.

Ensure better data management.

As previously mentioned, proper data management is crucial for fintech companies. You will need to keep customers’ financial information and personal data safe from hackers and other cybersecurity threats. At the same time, you must collect and manage data properly to take advantage of data science for better decision-making.

Partnering with an outsourcing provider can help you safeguard your valuable information and keep your database well-organized and maintained. The right BPO partner follows proven cybersecurity practices and strict data protection protocols to ensure all information about you and your clients is safe and secure.

Speed up project delivery and development timelines.

Accelerating time-to-market is crucial for fintech firms hoping to enhance their competitive edge, increase their market share, and maximize their bottom line. Thankfully, working with an outsourcing partner can help facilitate faster development and project completion.

With BPO professionals handling administrative and support roles, your in-house team can focus on doing what they do best, improving overall efficiency and speeding up project development.

Also, since fintech businesses won’t have to spend all their time hiring and training new in-house employees, leaders can invest more time and resources into other revenue-driving aspects of their operations.

Enhance performance while saving costs.

One final advantage of outsourcing back-office functions is cost reduction. Having a fully staffed in-house department is often more costly than outsourcing, with firms spending on salary and benefits, training and upskilling costs, equipment, utilities, office space, and infrastructure.

When you work with an outsourcing team, you can gain significant cost savings. Depending on your agreement with your BPO provider, you can pay only for hours worked or submitted output. At the same time, they handle all other costs associated with hiring and managing development teams.

Accelerate Your Fintech Projects With Help From SuperStaff

Whether you want to start building your next banking app or upgrade and maintain your existing one, working with an outsourcing partner can help you get the job done.

At SuperStaff, we are passionate about helping fintech companies expedite project delivery, scale up their operations, and improve their bottom line. We offer various outsourcing services, from customer support to software development.

Get in touch with us today and learn more about what our team can do for you!