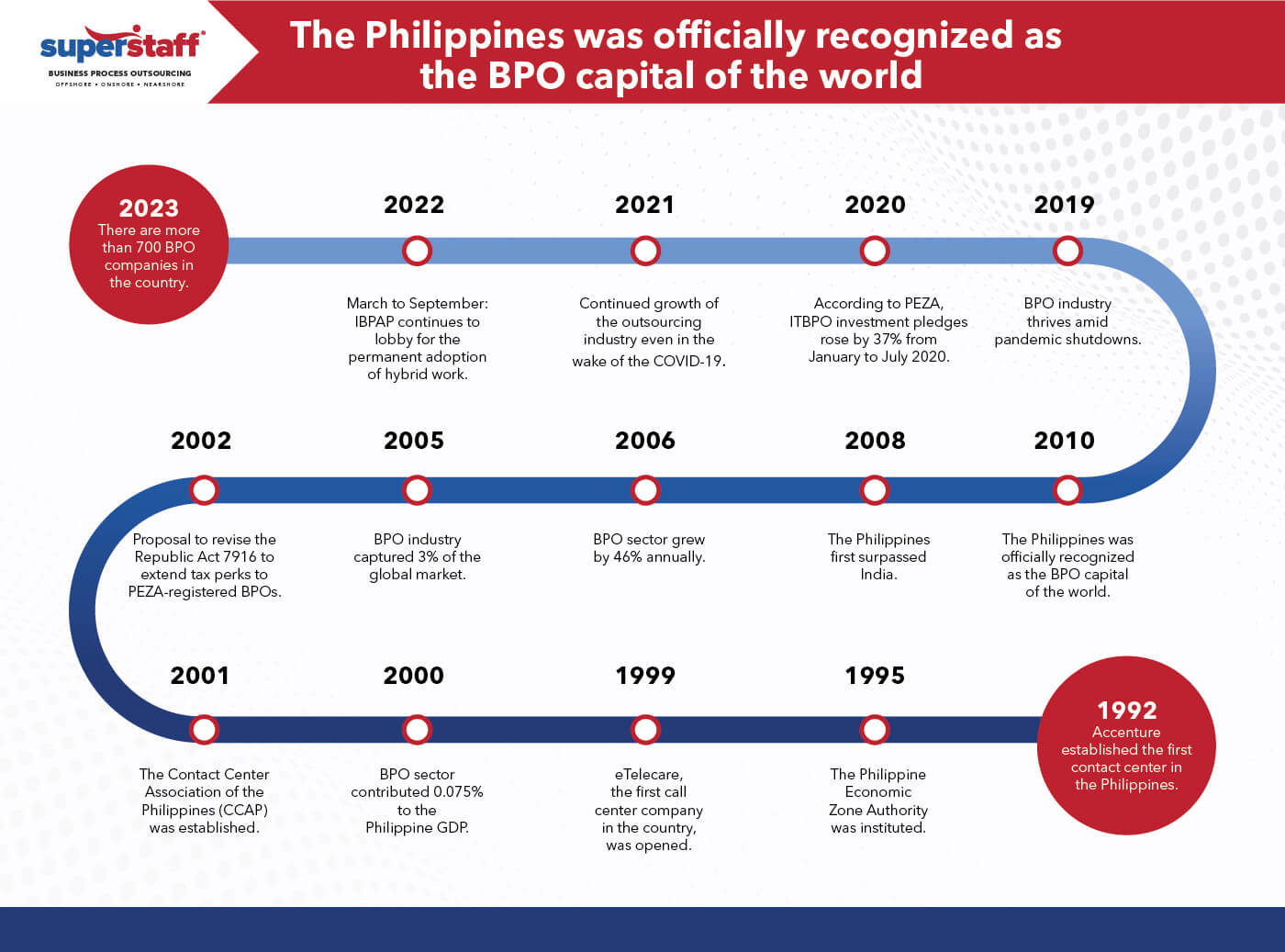

The Philippine outsourcing sector has significantly evolved since it first opened opportunities to global businesses in 1992. From providing limited business services to U.S.-based enterprises, BPO companies in the country now offer solutions for nearly all verticals and industries across continents.

As the world continues to power through unprecedented disruptions and marches towards an uncertain future, more businesses are finding success by leveraging the expanding clout of the Philippine BPO sector. Companies of all sizes no longer outsource to the Philippines merely to save costs but to gain a unique strategic advantage in the ever-evolving and increasingly globalized business landscape.

If you plan to outsource to the Philippines, this guide will equip you with everything you need to know to ensure a successful venture. Read on to gain a comprehensive knowledge of how the country’s BPO sector has started, matured, and evolved to remain as relevant as ever.

Read More: 5 Reasons to Choose Customer Service Outsourcing in the Philippines

A Brief Timeline of the Philippine Outsourcing Industry

Philippine BPO Industry at Present

Still a Strong and Resilient Economic Pillar

The outsourcing sector is indispensable in the Philippine economy. With more than 700 BPO companies in the country, the Philippines holds 10 to 15% of the global BPO market. BPO companies in the Philippines contributed $29.49 billion in service export revenue to the country’s economy in 2021, exceeding its expected growth of $29.1 billion by the end of 2022.

The outsourcing industry is also a primary employment driver in the Philippines. In 2021, the sector hired 120,000 additional full-time employees. This figure brings the county’s current headcount of BPO workers to 1.44 million — surpassing the forecasted 1.43 million by the end of 2022.

The government’s investor-friendly policies have played a big part in the continued growth of the outsourcing industry in the Philippines, even in the wake of the COVID-19 pandemic. BPO companies registered with the Philippine Economic Zone Authority (PEZA) enjoy tax incentives for driving economic activities in the ecozones.

When the country had to lock down in March 2020, BPO companies continued receiving tax perks, even as most of its workforce worked from home. However, this policy was only a temporary measure.

BPO Employees Return On-Site

In March 2022, the Fiscal Incentives Review Board (FIRB), the government body that grants tax incentives, announced a mandate requiring the full-time return of all BPO employees on-site effective April 1, 2022, to help boost economic activity and recovery. Failure to comply would mean losing tax incentives.

The IT & Business Process Association of the Philippines (IBPAP) appealed for the continuance of the WFH arrangement and asked for a revisit of the tax incentive guidelines, but the board refused. To allow ease of phased transitions, the FIRB, however, extended the implementation of the RTO mandate until September 2022.

Despite the setback, the IBPAP continues to lobby for legislation allowing the permanent adoption of remote and hybrid work for BPO companies. It is among the priorities outlined by the association in the Philippine IT-BPM Industry Roadmap 2028.

Philippine Outsourcing in the Wake of the COVID-19 Pandemic

The emergence of the COVD-19 pandemic in 2020 brought drastic changes to the Philippine outsourcing scene. Like almost all industries, BPO companies in the country experienced setbacks when the unprecedented lockdown happened in the second week of March. Thanks to the sector’s rapid transition to WFH arrangements, it managed to bounce back strongly.

According to PEZA, ITBPO investment pledges rose by 37% from January to July 2020. More opportunities also emerged, including increased demand for services requiring high-level skills. Among the fields that saw an acceleration of revenue growth rate are:

- Healthcare Information Management: from 7.3% in 2019 to 10.8% in 2020.

- Animation and Game Development: from 7.3% in 2019 to 12.3% in 2020.

- Information Technology (IT) and Software: from 3.2% in 2019 to 6.7% in 2020.

Pre-COVID-19 and Early Years

The outsourcing industry in the Philippines continued to record steady growth and surpassed forecasts and benchmarks since its establishment. Some of the most notable milestones are as follows:

- 2010: The Philippines was officially recognized as the BPO capital of the world after hiring 525,000 employees and hitting the $8.9 billion revenue mark.

- 2008: The Philippines first surpassed India, its top rival in the BPO market.

- 2006: The BPO sector started to grow by 46% annually.

- 2005: The Philippine BPO industry captured 3% of the global business process outsourcing market.

- 2002: Former Department of Trade and Industry Secretary Mar Roxas lobbied to revise the Republic Act 7916 to extend tax perks to BPO companies on PEZA-registered floors and buildings.

- 2001: The Contact Center Association of the Philippines (CCAP), an organization promoting the country’s global leadership in the IT-BPO industry, was established.

- 2000: The outsourcing sector contributed 0.075% to the Philippine GDP.

- 1999: eTelecare, the first call center company in the country, was opened.

- 1995: The Philippine Economic Zone Authority was instituted.

- 1992: Accenture established the first contact center in the Philippines.

Outsourcing to the Philippines: Current Trends and Insights

1. Growing Demand for Specialty Outsourcing Services

The Philippine outsourcing industry has come a long way. From starting with voice and non-voice processes, the country is now the destination for specialized and high-level outsourcing services.

Let’s take a look at some of the most in-demand specialty outsourcing services today:

Knowledge Process Outsourcing

These services involve information-related business activities in fields that require analytical and technical expertise, such as:

- Financial Services

- Programming

- Data And Business Analytics

- Cybersecurity

- Legal

- Healthcare

According to IBPAP, the Philippines’ deep pool of young, tech-savvy, and English-speaking talents is the greatest attraction for KPO clients. With the intense global talent war exacerbated by high industry turnover rates, more companies integrate offshoring and outsourcing into their strategic initiatives.

The agency is also optimistic that the demand for knowledge-intensive services will further grow, mainly as the IT-BPM Industry Roadmap 2028 includes digitization, infrastructure development, and country branding among the priorities over the next six years.

Legal Process Outsourcing

Legal process outsourcing (LPO) is one type of KPO solution that continues to grow in popularity among law firms and corporations, whether large or small. LPO involves assigning an external company to perform various non-core legal functions, such as:

- Legal Transcription

- Paralegal

- Legal Secretary

- Liaison Officer

- Litigation Support

- Contract Drafting

- E-Discovery

- Patent Support

Industry analysts foresee the global LPO market to reach $ 61.71 billion by 2027, at a CAGR of 30.50% from 2022 to 2027. Producing thousands of law graduates familiar with the U.S. legal system, the Philippines is among the countries expected to have a continued fair share of the expanding global LPO market.

Recruitment Process Outsourcing

As companies’ talent needs continue to intensify globally, recruitment process outsourcing (RPO) continues to be among the most popular outsourcing solutions in the Philippines and other parts of the world. By 2028, the global RPO market is forecasted to reach $25.4 billion at a CAGR of 17%.

RPO involves engaging a third-party service provider to take on various hiring and other human resource functions. Depending on your preference and business needs, you can outsource specific functions, such as sourcing and screening. You can also outsource the entire recruitment process cycle, including training and onboarding, to an outsourcing provider that offers end-to-end RPO solutions.

Specialty Healthcare Outsourcing

Even pre-pandemic, the Philippines has already had a headstart in the specialty healthcare outsourcing scene. Most of the often-outsourced healthcare services were back-end functions, such as:

- Medical Transcription

- Data Entry

- Medical Billing

- Customer Service

- Bookkeeping and Accounting

When COVID-19 emerged, the demand for the mentioned healthcare services increased further. The sector’s revenue growth rose to 5.3% in 2022 from 4.8% in 2020. Its headcount growth also rose from 4.01% to 4.5% in the said period.

Apart from the usual back-office functions, the need for higher-value remote healthcare services also increased. Filipino nurses and other healthcare workers were recognized and in demand globally long before the pandemic. Some of the sought-out higher levels of healthcare outsourcing services today are:

- Telemedicine

- Remote Patient Care and Management

- Virtual Mental Health Counseling and Psychological Services

Multilingual Customer Service

As a leading country in call center services with a global client base, the Philippines and its outsourcing sector stay abreast with the latest trends in customer experience. One of which is multilingual customer support. According to a survey of global consumers in 2020, 76% of online shoppers prefer buying products with information in their native language.

While English is the country’s most widely spoken second language, several BPO companies in the Philippines offer multilingual customer service. The Philippines leverages its status as a global recruitment process outsourcing provider to recruit professionals in different parts of the world fluent in the most popular languages, including:

- French

- German

- Spanish

- Japanese

- Korean

- Mandarin

- Cantonese

- Portuguese

- Russian

- Italian

Read More: Numbers Have Spoken: 38 Statistics Proving the Benefits of Multilingual Solutions for Businesses

Omnichannel Customer Support

The Philippine BPO sector has adapted cloud communication software and other modern digital technologies, allowing numerous offshoring partners to provide a seamless customer experience.

Consumers of today’s fast-paced global economy expect services on demand. As such, businesses must have the ability to provide omnichannel customer support. This service allows you to interact and respond to your customers across all possible touchpoints, including:

- Live Chat

With 85% of businesses wanting to implement a live chat feature on their websites in 2022, live chat is an in-demand customer communication channel today. There are two main reasons why.

First, live chat promotes efficiency and productivity. Unlike traditional phone customer service, a single agent can attend to more than one customer query in real time.

Live chat also drives better engagement, satisfaction, and sales conversion. According to a live chat usage analysis conducted by Tidio:

- 87% of customers found their live chat usage experience positive.

- Live chat users are 51% more likely to make a purchase.

- 43% of internet users chose live chat as their favorite means to reach out to businesses.

- AI Chatbots

To maximize ROI, 58% of businesses pair live chat support with AI chatbots. This strategy significantly minimizes wait time for customers and enables live chat and other customer support agents to focus on more complex customer concerns. About 43% of businesses also use AI chatbots to respond to frequently asked questions.

Despite the popularity of social media messaging and other similar apps, email is here to stay. Statista said global email users increased to 4 billion, while everyday email exchanges reached approximately 306 billion in 2020. Email is also the most preferred communication channel among businesses.

- Social Media

Social media customer support involves responding to concerns and inquiries made by customers, whether posted on social media pages or through messaging features. It is among the fastest-growing customer service channels preferred by customers, particularly among 18 to 34 years old.

With 4.70 billion social media users worldwide, it just makes perfect sense to use the platforms to connect with customers. A 2020 survey of U.S. consumers and executives found that:

- 85% of executives reported that social data would be a primary source of business intelligence for their brands.

- 78% of buyers would be willing to purchase from a brand following a positive social media experience.

- 77% of shoppers would choose a brand over another after a positive experience on social media.

- Phone

Inbound and outbound voice call center services remain the top driver of clients and jobs in the Philippines. Even as modern consumers appreciate the speed, efficiency, and overall experience of automated, self-service, and AI-powered solutions, they continue to crave authentic human interaction. As such, in-phone customer service outsourcing will continue to grow alongside other communication channels.

Read More: Why and How You Should Reinvent Your Telesales, Telemarketing, and Sales Support Strategies in 2022

2. Rise of Alternative BPO Destinations Outside Manila

One of the exciting developments in the Philippine outsourcing industry is the rise of BPO companies setting up locations in the countryside. For years, BPO investors in the country had focused on Metro Manila or the capital of the Philippines. As the Philippine BPO industry records exponential growth year after year, new opportunities open beyond the nation’s central business district.

Among the hottest outsourcing destinations outside the central capital of Manila is Pampanga. Located just right on the outskirts of Metro Manila, the province is the up-and-coming ICT and BPO hub. It boasts impressive technical, communication, and transportation infrastructures that make it an ideal location for foreign BPO investors, local workers, and international tourists. These infrastructures include:

- Built-In Fiber Optic Network

- Clark International Airport

- Entertainment and Recreational Getaways

- Beach Resorts, Leisure Parks, and Vacation Hotels

- Superhighways

Pampanga is becoming a center for commerce and innovation with continued government support. As part of a long-term and extensive plan to decongest the metro, the Philippine government, in partnership with the private sector, allocated ₱925 million for infrastructure projects in the province.

Another significant reason Pampanga is the ideal alternative location for establishing BPOs is its abundance of highly educated professionals familiar with Western culture. Known as the Gateway to the North, the province also allows strategic and convenient access to the rest of the country’s northern regions, where a wealth of quality talents also abound.

According to Matthew Narciso, Chief Executive Office of SuperStaff, one of the BPOs in the Philippines that got a headstart in establishing a presence in Pampanga:

“Pampanga was an attractive destination primarily for solid infrastructure and deep talent pools.

The Philippines is absolutely packed with talent from top to bottom. From Baguio City in the mountains, Clark in the Heartland, La Union on the coast, and down to Cebu and Mindanao.

We want Filipinos to stay with their families instead of having to travel hundreds of miles to work to provide for them.”

Read More: Why Choose Pampanga When Outsourcing to the Philippines

3. Shorter Recruitment Timeline

Speed has always mattered in recruitment. But given today’s talent supply chain deficit, quick turnaround time is imperative to establish employer branding, find quality talents, and prevent lost productivity.

Understanding this situation, forward-thinking BPO companies in the Philippines are moving fast to help businesses address “The Great Resignation” and the global labor shortage.

SuperStaff, for instance, employs an innovative sourcing and hiring approach that allows for a significantly shorter recruitment timeline, even for complex and hard-to-fill specialty outsourcing roles. Here’s the company’s average hiring timeline for a team of 5 to 20 heads:

- Tier 1 (Easy): 7 to 15 days

- Tier 2 (Moderate): 30 to 45 days

- Tier 3 (Hard): 60 to 90 days

The Future of the Philippine Outsourcing Industry

Time and again, the Philippine BPO sector has been among the most resilient in the world. And with all the exciting developments shaping the industry today, businesses that outsource to the Philippines can look forward to more rewarding opportunities.

Take advantage of what the Philippine outsourcing sector brings to the global business scene.